United Healthcare 2004 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2004 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITEDHEALTH GROUP 57

Pursuant to our agreement, AARP assets under management are managed separately from our general

investment portfolio and are used to pay costs associated with the AARP program. These assets are invested at

our discretion, within investment guidelines approved by AARP. We do not guarantee any rates of investment

return on these investments and, upon transfer of the AARP contract to another entity, we would transfer

cash equal in amount to the fair value of these investments at the date of transfer to that entity. Interest

earnings and realized investment gains and losses on these assets accrue to the overall benefit of the AARP

policyholders through the RSF. As such, they are not included in our earnings. Interest income and realized

gains and losses related to assets under management are recorded as an increase to the AARP RSF and were

$103 million, $101 million and $102 million in 2004, 2003 and 2002, respectively. Assets under management

are reported at their fair market value, and unrealized gains and losses are included directly in the RSF

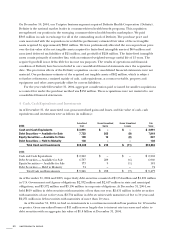

associated with the AARP program. As of December 31, 2004 and 2003, the amortized cost, gross unrealized

gains and losses, and fair value of cash, cash equivalents and investments associated with the AARP insurance

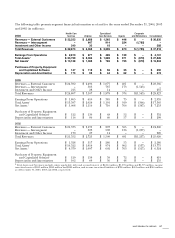

program, included in Assets Under Management, were as follows (in millions):

Amortized Gross Unrealized Gross Unrealized Fair

2004 Cost Gains Losses Value

Cash and Cash Equivalents $ 184 $ – $ – $ 184

Debt Securities — Available for Sale 1,664 37 (2) 1,699

Total Cash and Investments $1,848 $ 37 $ (2) $ 1,883

2003

Cash and Cash Equivalents $218 $–$–$218

Debt Securities — Available for Sale 1,655 86 – 1,741

Total Cash and Investments $1,873 $86 $–$1,959

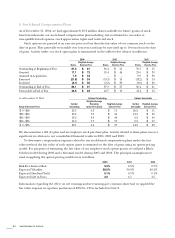

As of December 31, 2004 and 2003, respectively, debt securities consisted of $809 million and $711 million

in U.S. Government and Agency obligations, $20 million and $16 million in state and municipal obligations

and $870 million and $1,014 million in corporate obligations. At December 31, 2004, the AARP assets under

management included debt securities of $99 million with maturities of less than one year, $813 million with

maturities of one to five years, $464 million with maturities of five to 10 years and $323 million with

maturities of more than 10 years.