United Healthcare 2004 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2004 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITEDHEALTH GROUP 55

10 Income Taxes

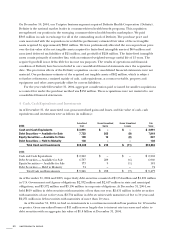

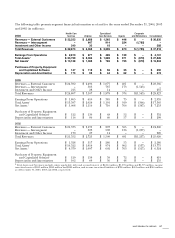

The components of the provision for income taxes are as follows:

Year Ended December 31, (in millions) 2004 2003 2002

Current Provision

Federal

$1,223

$932 $675

State and Local

78

46 57

Total Current Provision

1,301

978 732

Deferred Provision

85

37 12

Total Provision for Income Taxes

$1,386

$1,015 $744

The reconciliation of the tax provision at the U.S. Federal Statutory Rate to the provision for income taxes

is as follows:

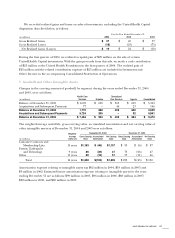

Year Ended December 31, (in millions) 2004 2003 2002

Tax Provision at the U.S. Federal Statutory Rate

$1,391

$994 $734

State Income Taxes, net of federal benefit

54

29 33

Tax-Exempt Investment Income

(33)

(30) (26)

Other, net

(26)

22 3

Provision for Income Taxes

$1,386

$1,015 $744

The components of deferred income tax assets and liabilities are as follows:

As of December 31, (in millions) 2004 2003

Deferred Income Tax Assets

Accrued Expenses and Allowances

$227

$161

Unearned Premiums

57

28

Medical Costs Payable and Other Policy Liabilities

85

83

Long-Term Liabilities

78

49

Net Operating Loss Carryforwards

123

86

Other

31

42

Subtotal

601

449

Less: Valuation Allowances

(28)

(43)

Total Deferred Income Tax Assets

573

406

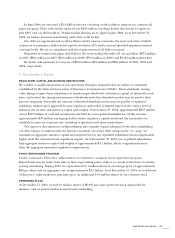

Deferred Income Tax Liabilities

Capitalized Software Development

(223)

(186)

Net Unrealized Gains on Investments

(72)

(82)

Intangible Assets

(406)

(50)

Property and Equipment

(63)

(58)

Other

(16)

–

Total Deferred Income Tax Liabilities

(780)

(376)

Net Deferred Income Tax Assets (Liabilities)

$(207)

$30

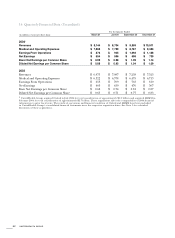

Valuation allowances are provided when it is considered more likely than not that deferred tax assets will

not be realized. The valuation allowances primarily relate to future tax benefits on certain federal and

state net operating loss carryforwards. Federal net operating loss carryforwards expire beginning in 2017

through 2023, and state net operating loss carryforwards expire beginning in 2005 through 2024.

We made cash payments for income taxes of $898 million in 2004, $783 million in 2003 and $458 million

in 2002. We increased additional paid-in capital and reduced income taxes payable by $358 million in

2004, $222 million in 2003, and by $133 million in 2002 to reflect the tax benefit we received upon the

exercise of non-qualified stock options.

Internal Revenue Service examinations for fiscal years 2000 through 2002 have been completed

and the resulting settlements have been included in our 2004 consolidated operating results.