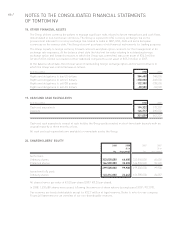

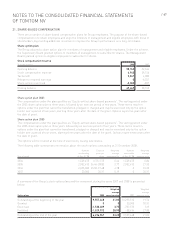

TomTom 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

/ 69

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

OF TOMTOM NV

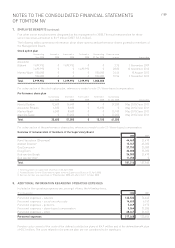

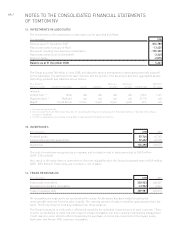

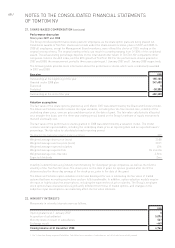

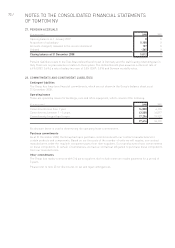

23. BORROWINGS

Borrowings (€ in thousands) 2008 2007

Non-current 1,241,900 0

Current1146,588 0

Total borrowings 1,388,488 0

1 €158,5m (10%) of the loan amount will be repaid in December 2009. The full amount payable on the loan is reduced by the netting off of the

loan negotiation costs which are built back up over the period of the loan through an interest charge.

The Group negotiated a syndicated loan facility consisting of a €1,585 million term loan and a €175 million

revolving credit facility to fund the Tele Atlas acquisition. Transaction costs related to the facility amounted to

€44.7 million. The facility terminates on 31 December 2012 and has an annual repayment schedule. The interest

is in line with market conditions and based on Euribor with a spread that depends on certain leverage covenants.

The Group’s borrowings are subject to covenant clauses whereby the Group is required to meet certain

performance indicators with regard to our financial condition. The performance indicators relate to interest cover

and leverage. In case of a breach of these covenants the banks are contractually entitled to request early

repayment of the outstanding amount. The carrying amount of the Group’s borrowings is denominated in euro’s.

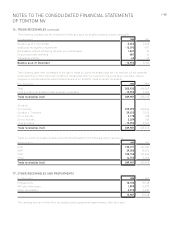

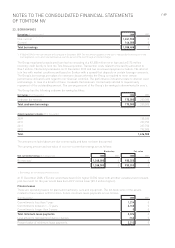

The Group has the following undrawn borrowing facilities:

Borrowings (€ in thousands) 2008 2007

Undrawn borrowings 175,000 200,000

Total undrawn borrowings 175,000 200,000

Annual repayment schedule (€ in thousands)

2009 158,500

2010 237,750

2011 237,750

2012 792,500

Total 1,426,500

The amounts included above are due contractually and have not been discounted.

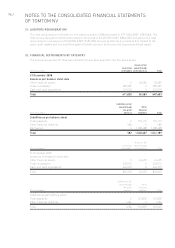

The carrying amount and fair value of our non-current borrowings are as follows:

Book value Fair value

Non current borrowings (€ in thousands) 2008 2007 2008 2007

Borrowings11,268,000 0930,355 0

1,268,000 0930,355 0

1 Borrowings do not include amortised costs.

At 31 December 2008, if Euribor would have been 0.5% higher (0.5%) lower with all other variables held constant,

post tax result for the year would have been €2.2 million lower (€3.3 million higher).

Finance leases

These are operating leases for plant and machinery, cars and equipment. The net book value of the assets

related to these leases is €3.2 million. Future minimum lease payments are as follows.

(€ in thousands) 2008 2007

Commitments less than 1 year 1,214 0

Commitments between 1 – 5 years 2,160 0

Commitments longer than 5 years 00

Total minimum lease payments 3,374 0

Less amounts representing finance charges -162 0

Present value of minimum lease payments 3,212 0