TomTom 2008 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2008 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

/ 39

Currencies

TomTom Group operates internationally and is exposed

to foreign exchange risk arising from various currency

exposures, primarily with respect to the US dollar and

the UK pound. Management has set up a policy to

manage and control this foreign exchange risk.

Foreign exchange risk is managed through the buying

and selling of options for forecast commitments and by

entering into forward contracts for actual commitments.

All such transactions are carried out within the

guidelines set by the financial risk management policy,

which has been approved by the Supervisory Board.

We are exposed to currency risk on our estimated

purchases and sales transactions that are denominated

in a currency other than the reporting currency of the

company – the euro (€). Foreign currency exposures are

based on invoices, orders and forecasted sales. We aim

to cover our currency exposure for nine months for both

purchases and sales.

We do not make use of natural hedges for anticipated

exposures, as these can prove ineffective in the event of

sharp increases or decreases in currency rates and are

therefore not considered best practice from a risk

management point of view. Foreign currency exposures

are grouped per currency to allow for more efficient

hedging. We hedge at least 80% of our anticipated and

committed foreign currency exposure, in respect of

forecast sales and purchases over the next nine months.

We use foreign exchange plain vanilla options and

foreign exchange forward contracts to hedge our

currency risk, all with a maturity of less than one year

from the reporting date.

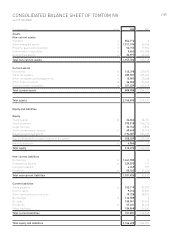

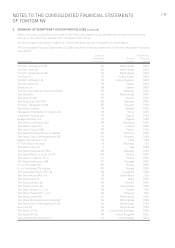

A 2.5% strengthening of the euro against the currencies

listed below on 31 December would have increased

(decreased) equity, and profit or loss, by the amounts

shown below. This analysis assumes that all other

variables remain constant. The analysis is performed on

the same basis for 2007.

2008 2007

Strengthen Weaken Strengthen Weaken

AUD

Net profit

after taxation -254,611 242,190 -247,000 247,000

Total capital

and reserves -138,611 127,190 -146,000 149,000

GBP

Net profit

after taxation -1,153,832 1,430,268 -933,000 933,000

Total capital

and reserves -792,832 1,068,268 -779,000 783,000

USD

Net profit

after taxation 1,728,546 -1,834,088 542,000 -542,000

Total capital

and reserves 2,065,546 -2,170,088 1,013,000 -1,011,000

Interest rates

TomTom’s interest rate risk arises from long-term

borrowings. The interest is based on Euribor with a

spread which depends on certain leverage covenants.

The Euribor element of the interest coupon is hedged

for the full term of the loan with cap instruments.

Market-related interest rates are received on the cash

balances. Cash balances are only held with counterparties

that have a credit risk rating of at least AA- as rated by

an acknowledged rating agency. It is our intention to

earn a reasonable interest rate whilst maintaining a

stable investment. The investment policy has been

approved by the Supervisory Board.