TomTom 2008 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2008 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

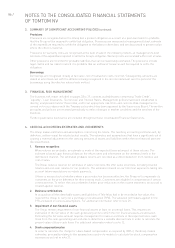

60 / NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

OF TOMTOM NV

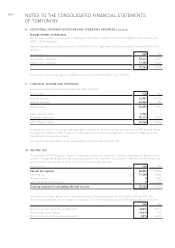

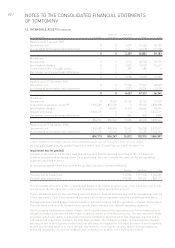

8. ADDITIONAL INFORMATION REGARDING OPERATING EXPENSES (continued)

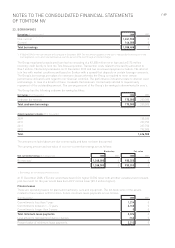

Average number of employees

The average number of employees in 2008 was 2,703 (2007: 1,078). At 31 December 2008, the Group had 3,498

(2007: 1,337) employees.

Operating expenses include an amount of €72.8 million for depreciation and amortisation expenses (2007: €23.5

million).

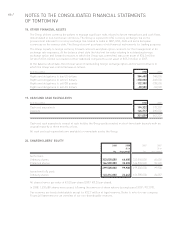

(€ in thousands) 2008 2007

Amortisation expenses 55,414 16,611

Depreciation expenses 17,350 6,867

72,764 23,478

The costs for operating leases in 2008 amounted to €17.4 million (2007: €2.7 million).

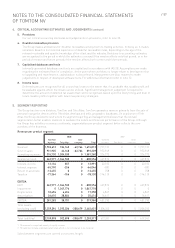

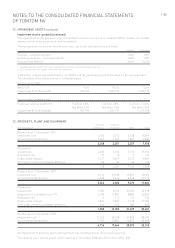

9. FINANCIAL INCOME AND EXPENSES

Financial income and expenses include the following items.

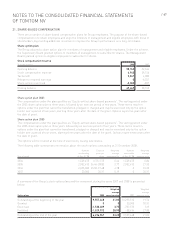

(€ in thousands) 2008 2007

Interest income 13,991 20,102

Interest expense -66,046 -981

Interest result -52,055 19,121

Other financial result -3,966 0

Exchange rate result 76,114 -16,330

Other financial result 72,148 -16,330

A substantial part of the foreign exchange gain is related to results on hedge contracts to sell GB pounds and to

purchase US dollars in order to pay our most significant contract manufacturers. This gain is made up of both

realised and unrealised amounts.

The interest expense relates to interest paid on our borrowings (see note 23).

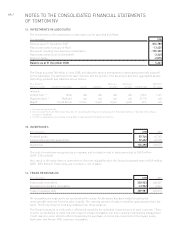

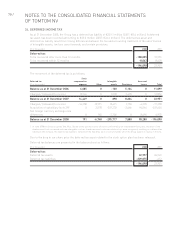

10. INCOME TAX

The activities of the Group are subject to corporate income tax in several countries, depending on presence and

activity. The applicable statutory tax rates vary between 25% and 40%. This, together with timing differences, can

cause the effective tax rate to differ from the Dutch corporate tax rate.

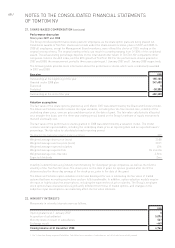

(€ in thousands) Note 2008 2007

Current tax expense 60,832 118,804

Deferred tax 24 17,298 -12,852

Through equity 05,822

Other permanent differences 02,345

Total tax expense for calculating effective tax rate 78,130 114,119

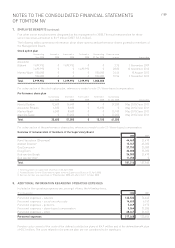

The effective tax rate, based on income before taxes, excluding impairment, was 30.8% (2007: 26.5%). The

reconciliation between the tax charge on the basis of the Dutch tax rate and the effective tax rate is as follows:

2008 2007

Effective tax rate (excluding impairment) 30.8% 26.5%

Effect impairment charge -40.6% 0.0%

Effective tax rate (including impairment) -9.8% 26.5%