TomTom 2008 Annual Report Download - page 58

Download and view the complete annual report

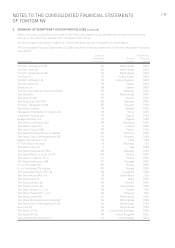

Please find page 58 of the 2008 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.56 / NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

OF TOMTOM NV

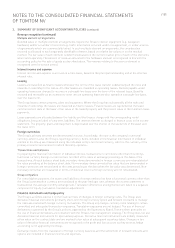

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Provisions

Provisions are recognised when the Group has a present obligation as a result of a past event and it is probable

that the Group will be required to settle that obligation. Provisions are measured at management’s best estimate

of the expenditure required to settle the obligation at the balance sheet date, and are discounted to present value

where the effect is material.

Provisions for warranty costs are recognised at the date of sale of the relevant products, at management’s best

estimate of the expenditure required to settle the Group’s obligation. Warranty costs are recorded within cost of sales.

Other provisions are recorded for probable liabilities that can be reasonably estimated. The provisions include

legal claims and tax risks for which it is probable that an outflow of resources will be required to settle the

obligation.

Borrowings

Borrowings are recognised initially at fair value, net of transaction costs incurred. Subsequently, amounts are

stated at amortised cost with the difference being recognised in the income statement over the period of the

borrowings using the effective interest rate method.

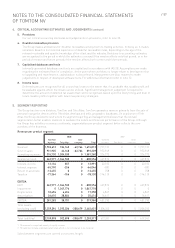

3. FINANCIAL RISK MANAGEMENT

The business risk report included on pages 38 to 39, contains auditable parts comprising ‘Trade Credit’,

‘Liquidity’, ‘Loan Covenants’, ‘Currencies’ and ‘Interest Rates’. Management policies have been established to

identify, analyse and monitor these risks, and to set appropriate risk limits and controls. Risk management is

carried out in accordance with the Treasury policy which has been approved by the Supervisory Board. The written

principles and policies are reviewed periodically to reflect changes in market conditions and the activities of the

business.

Further quantitative disclosures are included throughout these consolidated Financial Statements.

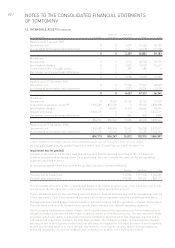

4. CRITICAL ACCOUNTING ESTIMATES AND JUDGEMENTS

The Group makes estimates and assumptions concerning the future. The resulting accounting estimates will, by

definition, seldom equal the related actual results. The estimates and assumptions that have a significant risk of

causing a material adjustment to the carrying amounts of assets and liabilities within the next financial year are

discussed below.

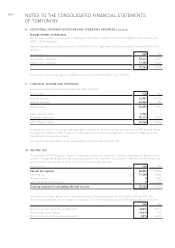

1. Revenue recognition

When returns are probable, an estimate is made of the expected financial impact of these returns. The

estimate is based upon historical data on the return rates and information on the inventory levels in the

distribution channel. The estimated probable returns are recorded as a direct deduction from revenue and

cost of sales.

The Group reduces revenue for estimates of sales incentives. We offer sales incentives, including channel

rebates and end-user rebates for our products. The estimate is based on our historical experience taking into

account future expectations on rebate payments.

If there is excess stock at retailers when a price reduction becomes effective, the Group will compensate its

customers on the price difference for their existing stock. Customers are eligible for compensation if certain

criteria are met. To reflect the costs related to known price reductions in the income statement, an accrual is

created against revenue.

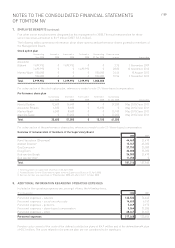

2. Business combinations

At acquisition all the identifiable assets and liabilities of Tele Atlas had to be recorded at fair value, this

required the Group to carry out a purchase price allocation (PPA). The valuation techniques applied in the

PPA are based on various assumptions. For additional information refer to note 29.

3. Impairment of non-financial assets

The Group reviews impairment of non-financial assets at least on an annual basis. This requires an

estimation of the fair value of the cash-generating units to which the non financial assets are allocated.

Estimating the fair value amount requires management to make an estimate of the expected future cash

flows from the cash-generating unit and also to determine a suitable discount rate in order to calculate the

present value of those cash flows. For additional information refer to note 12.

4. Stock compensation plan

In order to calculate the charge for share-based compensation as required by IFRS 2, the Group makes

estimates, principally relating to the assumptions used in its models to calculate the stock compensation

expenses as set out in note 21.