TomTom 2006 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2006 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

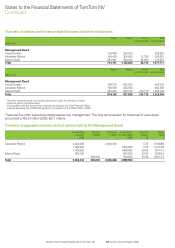

61 TomTom Annual Report 2006Notes to the Financial Statements of TomTom NV

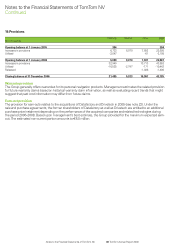

Other provision

The Group formed a provision for potential legal and tax

risks in various jurisdictions. The legal matters mainly

consist of intellectual property infringement issues.

In the normal course of business the Group receives

claims relating to allegations that TomTom has infringed

intellectual property assets and the companies making

the claims seek payments which may take the form of

licences and/or damages. Some of these claims may be

resisted, some are likely to be settled by negotiation and

others are expected to result in litigation.

The cases and claims against the Group often raise difficult

and complex factual and legal issues which are subject to

many uncertainties and complexities, including but not

limited to the facts and circumstances of each particular

case and claim, the jurisdiction in which each

suit is brought and the differences in applicable law. In the

normal course of business, management consults with

legal counsel and certain other experts on matters related

to litigation. The Group accrues a liability when it is

determined that an adverse outcome is more likely

than not and the amount of the loss can be reasonably

estimated. If either the likelihood of an adverse outcome

is reasonably possible or an estimate is not determinable,

the matter is disclosed provided it is material. The directors

are of the opinion that the provision is adequate to resolve

these claims.

The methodology used to determine the level of liability

requires significant judgements and estimates regarding

the costs of settling asserted claims. Due to the fact that

there is limited historical data available the estimated

liability cannot be based upon recent settlement

experience for similar types of claims.

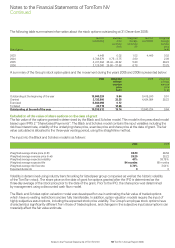

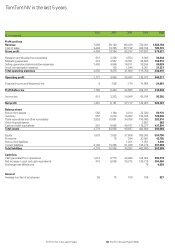

2006 2005

(in thousands)

Non-current 9,682 9,777

Current134,103 11,204

Total 43,785 20,981

1The warranty provision is classified as a current liability.

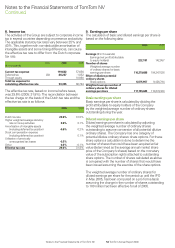

20. Deferred income tax

As at 31 December 2006 the Group had an estimated

deferred tax liability of 1.0 million (2005: 0.8 million).

A deferred tax asset has been recorded amounting

to 12.1 million (2005: 1.3 million). The deferred tax asset

and tax liability result from timing differences between the

tax and accounting treatment of granted share options,

amortisation of intangible assets and several provisions.

2006 2005

(in thousands)

Deferred tax assets:

To be recovered after more than 12 months 6,927 1,307

To be recovered within 12 months 5,134

12,061 1,307

Deferred tax liabilities:

To be recovered after more than 12 months 86 287

To be recovered within 12 months 876 469

962 756

The movement of the deferred tax assets is as follows:

Stock Intangible Provisions Total

compensation assets

expense

(in thousands)

Balance as at

31 December 2004

Charged to income 1,011 296 1,307

Balance as at

31 December 2005 1,011 296 1,307

Charged to income 5,361 555 4,838 10,754

Balance as at

31 December 2006 6,372 555 5,134 12,061

A deferred tax asset is recognised for the stock

compensation expense related to the share option

plan 2005.

Notes to the Financial Statements of TomTom NV

Continued