TomTom 2006 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2006 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

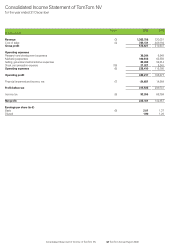

36 TomTom Annual Report 2006

Gross profit

The gross profit in 2006 increased to 579 million,

an increase of 86% over 2005 (2005: 311 million).

Despite the 27% reduction in the average selling price

for PNDs the gross profit margin continued to be strong

at 42%, only one percentage point lower than in 2005

(2005: 43%). Effective cost engineering on the new GO

and ONE devices and continued reductions in the costs of

components delivered substantial cost savings in our bills

of material and contributed to the strength of our gross

margin. On average the US dollar rate weakened by 0.5%

against the euro year on year and had a negligible impact

on the gross margin.

Operating expenses

Operating expenses consist of research and

development costs, marketing expenditures, selling,

general and administrative expenses and stock

compensation expenses. Operating expenses (excluding

stock compensation expenses) increased as a percentage

of revenue to 15.9% in 2006 from 15.3% in 2005. In

absolute terms operating expenses (excluding stock

compensation expenses) increased by 107 million, from

110 million in 2005 to 217 million in 2006. Most of the

increase resulted from additional marketing and personnel

expenses to support the growth of the business.

2006 % revenue 2005 % revenue

(in millions)

Research and development 36.3 2.7% 8.9 1.2%

Marketing 100.8 7.4% 63.6 8.8%

Selling, general and

administrative 80.0 5.9% 38.0 5.3%

Total operating expenses 217.1 15.9% 110.5 15.3%

Research and development costs include the payroll

expenses of our research and development teams,

third-party software costs, patent creation costs and the

depreciation of research and development-related tangible

fixed assets and amortisation of acquired technologies.

The costs of third-party manufacturing design activities

are also included within research and development

expenditures. We now have research and development

teams in Amsterdam, London, Taipei, Leipzig, Berlin and

Edinburgh. Research and development costs increased

more than fourfold from 8.9 million in 2005 to 36.3

million in 2006. The majority of the increase was the result

of the increase in the numbers of development staff and

higher amortisation and depreciation expenses, which

grew from 2.2 million in 2005 to 15.5 million in 2006.

The increased amortisation and depreciation charges were

mainly the result of the full-year impact of the acquired

technologies purchased from Datafactory and Applied

Generics. As a percentage of revenue research and

development expenses increased to 2.7%, up from 1.2%

in 2005.

We invested 101 million in advertising and marketing

expenditure in 2006 (2005: 64 million). This represented

7.4% of revenue (2005: 8.8%) and an increase of 37

million over 2005. We were able to achieve leverage in

these costs as a percentage of revenue while consolidating

our European market leadership position and at the same

time making good progress in building our market position

in North America.

Selling, general and administrative expenses include

personnel expenses for our selling and administrative staff,

office expenses and other general expenses. SG&A costs

increased to 80 million in 2006, an increase of 111%

compared to 2005. As a percentage of revenue SG&A

expenses increased slightly from 5.3% in 2005 to 5.9%

in 2006. The key driver was the increase in sales staff

and general and administrative staff, together with higher

fees for professional services, most importantly for legal

services in connection with IP litigation matters.

Our head count (excluding temporary employees) almost

doubled to 818 at the end of 2006 from 435 at the end

of 2005.

Stock compensation charges

This expense is a non-cash accounting charge required by

IFRS 2 “Share-based Payments”, and it relates to the grant

of share options. This charge is calculated under the

requirements of the IFRS and recognised evenly over the

vesting period of the share options. In 2006 we recognised

a charge of 21 million (2005: 5 million) of which 2.5

million was related to new share options granted in 2006.

Financial income and expenses

We recorded a net charge of 25 million in 2006,

compared to a net gain of 15 million in 2005. The

reversed trend in the US dollar-euro exchange rate in

2006 compared to 2005 resulted in declining values of

our US dollar hedge cover which had a negative effect

on our financial income and expense line. Exchange rate

results switched from a gain of 12.3 million in 2005 to

a loss of 32.3 million in 2006. This loss arose mainly from

foreign exchange contracts to purchase US dollars in order

to pay our most significant contract manufacturers. We

revalue all forward contracts to market value at the end of

each period whether or not they have matured, as well as

cash and other assets and liabilities denominated in foreign

currencies. The loss therefore consisted of both realised

and unrealised losses. Net interest income increased to

7.6 million, up from 2.4 million in 2005.

Financial Review

Financial Review

Continued