TomTom 2006 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2006 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 TomTom Annual Report 2006Notes to the Financial Statements of TomTom NV

Interest income

Interest income is accrued on a time basis, based on the

principal outstanding and at the effective interest rate.

Leasing

Leases are classified as finance leases whenever the

terms of the lease substantially transfer all the risks and

rewards of ownership to the lessee. All other leases are

classified as operating leases. The Group has not entered

into any material finance leasing arrangements. Rentals

payable under operating leases are charged to income on

a straight-line basis over the term of the relevant lease.

Benefits received and receivable as an incentive to enter

into an operating lease are also spread on a straight-line

basis over the lease term.

Foreign currencies

The Company’s primary activities are denominated in

euros. Accordingly, the Company has chosen the euro

as its functional currency.

In preparing the financial statements of the individual

entities, transactions in currencies other than the

Company’s functional currency (foreign currencies) are

recorded at the rates of exchange prevailing at the dates

of the transactions. At each balance sheet date, monetary

items denominated in foreign currencies are retranslated

at the rates prevailing at the balance sheet date. Non-

monetary items carried at fair value that are denominated

in foreign currencies are retranslated at the rates prevailing

at the date when the fair value was determined. Non-

monetary items that are measured in terms of historical

cost in a foreign currency are not retranslated.

For consolidation purposes, the Company classifies its

subsidiaries as “foreign entities”. The assets and liabilities

are translated at the year end spot rate, whereas the

income statement is translated at the average monthly

exchange rate. Translation differences arising thereon are

taken to a separate component of shareholders’ equity

(cumulative translation adjustment).

In order to mitigate the risks to foreign currency exposures,

the Group enters into forward contracts and options

(see next paragraph for details of the Group’s accounting

policy in respect of financial instruments).

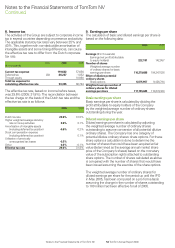

The principal exchange rates applied for the non-euro

currencies are:

Rate Rate

Average as at 31 Average as at 31

rate for December rate for December

2006 2006 2005 2005

Australian dollar 0.600 0.597 n/a n/a

US dollar 0.800 0.758 0.803 0.845

Great Britain pound sterling 1.446 1.485 1.462 1.453

New Taiwanese dollar 0.025 0.023 0.025 0.026

Chinese yuan 0.106 0.097 n/a n/a

Financial instruments and hedge policy

The Group’s activities expose it to the financial risks of

changes in foreign exchange rates. The Group uses

derivative financial instruments (primarily short-term foreign

currency forward contracts and options) to manage the

risks associated with foreign currency fluctuations relating

to certain committed and anticipated transaction exposures.

The use of financial derivatives is governed by the Group’s

policies approved by the Supervisory Board, which provide

written principles on the use of financial derivatives

consistent with the Group’s risk management strategy.

The Group does not use derivative financial instruments for

speculative purposes. Derivative financial instruments are

initially measured at fair value on the contract date, and are

marked again to fair value at subsequent reporting dates.

Changes in the fair value of derivative financial instruments

are recognised in the profit and loss account as they arise,

since hedge accounting is not applied by the Group.

Exchange results from the translation of foreign currency

balances and resulting from the settlement of forward

contracts and options are included in financial income and

expenses. Foreign exchange results related to currency

differences on trade invoices received in US dollars are

recognised in cost of sales.

Retirement benefit costs

Contributions to defined contribution retirement benefit

plans are recognised as an expense when employees

have rendered services entitling them to the contributions.

Payments made to state-managed retirement benefit

schemes are dealt with as payments to defined

contribution plans where the Group’s obligations under

the plans are equivalent to those arising in a defined

contribution retirement benefit plan.

Notes to the Financial Statements of TomTom NV

Continued