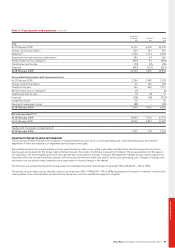

Tesco 2010 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2010 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial statements

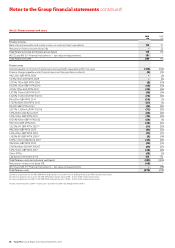

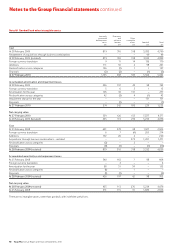

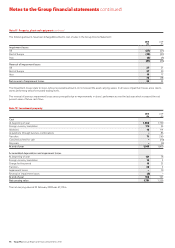

Note 6 Taxation

Recognised in the Group Income Statement

2010 2009

Restated

£m £m

Current tax expense

UK corporation tax 566 673

Foreign tax 128 88

Adjustments in respect of prior years (91) (164)

603 597

Deferred tax expense

Origination and reversal of temporary differences 110 110

Adjustments in respect of prior years 124 97

Change in tax rate 3 (25)

237 182

Total income tax expense 840 779

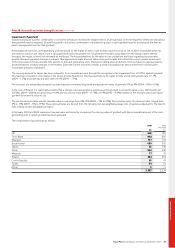

UK corporation tax is calculated at 28.0% (2009 – 28.2%) of the estimated assessable profit for the year. Taxation in other jurisdictions is calculated at

the rates prevailing in the respective jurisdictions.

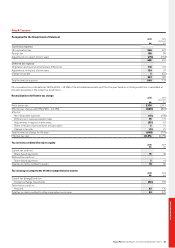

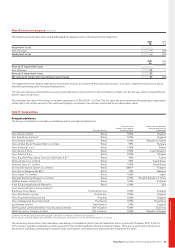

Reconciliation of effective tax charge

2010 2009

Restated

£m £m

Profit before tax 3,176 2,917

Effective tax charge at 28.0% (2009 – 28.2%) (889) (823)

Effect of:

Non-deductible expenses (13) (190)

Differences in overseas taxation rates 93 111

Adjustments in respect of prior years (33) 67

Share of results of joint ventures and associates 5 31

Change in tax rate (3) 25

Total income tax charge for the year (840) (779)

Effective tax rate 26.4% 26.7%

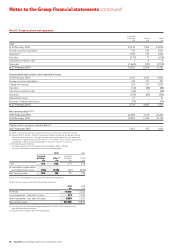

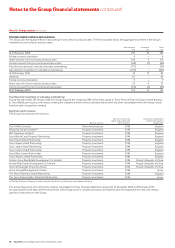

Tax on items credited directly to equity

2010 2009

£m £m

Current tax credit on:

Share-based payments 15 46

Deferred tax credit on:

Share-based payments 3 14

Total tax on items credited to equity 18 60

Tax relating to components of other comprehensive income

2010 2009

£m £m

Current tax (charge)/credit on:

Foreign exchange movements (33) 199

Deferred tax credit on:

Pensions 87 176

Total tax on items credited to other comprehensive income 54 375

Tesco PLC Annual Report and Financial Statements 2010 87