Tesco 2002 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2002 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

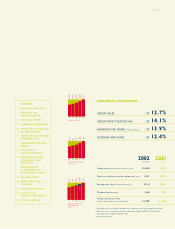

TESCO SHARE PRICE OVER LAST 3 YEARS pence

253.50

168.75

Feb 99 Feb 00 Feb 01 Feb 02

GROUP SUMMARY

2002 2001 Change

£m £m %

Group sales

(including value added tax) 25,654 22,773 12.7

Group operating profit

(prior to goodwill amortisation) 1,332 1,174 13.5

Profit on ordinary activities

before tax†1,221 1,070 14.1

Adjusted diluted earnings

per share†12.14p 10.66p‡13.9

Dividend per share 5.60p 4.98p 12.4

UK PERFORMANCE

2002 2001 Change

£m £m %

Sales

(including value added tax) 21,685 19,884 9.1

Operating profit 1,213 1,100 10.3

REST OF EUROPE PERFORMANCE

2002 2001 Change

£m £m %

Sales

(including value added tax) 2,475 1,970 25.6

Operating profit 90 70 28.6

ASIA PERFORMANCE

2002 2001 Change

£m £m %

Sales

(including value added tax) 1,494 919 62.6

Operating profit 29 4 625.0

†Excluding net loss on disposal of fixed assets and goodwill

amortisation.

‡Restated due to the adoption of FRS 19, ‘Deferred Tax’.

* 52 weeks pro forma.

2TESCO PLC operating and financial review

This operating and financial review analyses the performance of the Tesco Group in

the financial year ended 23 February 2002. It also explains other aspects of the

Group’s results and operations including taxation and treasury management.

GROUP PERFORMANCE

Group sales including VAT increased by 12.7% to

£25,654m (2001 – £22,773m).

Group profit on ordinary activities before tax

(excluding net loss on disposal of fixed assets

and goodwill amortisation) increased by 14.1% to

£1,221m.

Group capital expenditure was £2,027m

(2001 – £1,944m) including £219m for lease

buybacks and freehold purchases. UK capital

expenditure was £1,276m, including £498m on

new stores, £219m for lease buybacks and

freehold purchases and £270m on extensions

and refits. Total international capital expenditure

was £751m including £426m in Asia. In the year

ahead we forecast Group capital expenditure to

be £2.0bn.

Group net debt in the year increased by

£756m to £3,560m (2001 – £2,804m), with

gearing increasing to 64% (2001 – 56%‡).

GROUP INTEREST AND TAXATION

Net interest payable was £153m (2001 – £125m).

This increase resulted from additional borrowings

to fund our investment plans.

Ta x has been charged at an effective rate of

30.9% (2001 – 31.6%‡). Prior to accounting for

the net loss on disposal of fixed assets and

goodwill amortisation, our underlying tax rate was

30.4% (2001 – 31.1%‡).

SHAREHOLDER RETURNS AND DIVIDENDS

Adjusted diluted earnings per share (excluding

net loss on disposal of fixed assets and goodwill

amortisation) increased by 13.9% to 12.14p

(2001 – 10.66p‡).

The Board has proposed a final dividend of

3.93p (2001 – 3.50p) giving a total dividend for

the year of 5.60p (2001 – 4.98p).This represents

an increase of 12.4% and a dividend cover of

2.17 times.

Shareholders’ funds, before minority interests,

increased by £552m. This was due to retained

profits of £440m, new shares issued less expenses

of £100m, and gains on foreign currency

translation of £12m. As a result, return on

shareholders’ funds was 23.2%.

98 99 00 0201

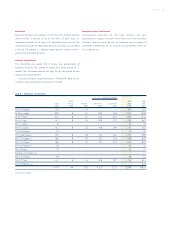

GROUP PERFORMANCE £m

25,654

22,773

20,358

18,546

17,447*

21,685

19,884

18,334

17,091

15,818*

GROUP SALES

UK SALES

98 99 00 0201

CAPITAL EXPENDITURE £m

2,027

1,944

1,488

1,067

841

1,276

1,206

989

848

757

GROUP

UK

1 year 3 years 5 years

TOTAL SHAREHOLDER RETURN

RELATIVE TO THE FTSE 100 %

14.0

17.7

11.6

98 99 00 0201

UK SALES GROWTH %

9.1

8.5

7.4

8.0

12.7*

6.2

4.8

4.2

4.0

6.1*

TOTAL

LIKE FOR LIKE