Tesco 2002 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2002 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TESCO PLC 19

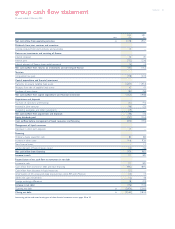

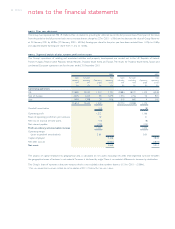

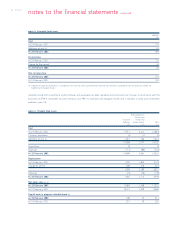

group cash flow statement

52 weeks ended 23 February 2002

2002 2001

note £m £m

Net cash inflow from operating activities 32 2,038 1,937

Dividends from joint ventures and associates

Income received from joint ventures and associates 15 –

Returns on investments and servicing of finance

Interest received 44 49

Interest paid (232) (206)

Interest element of finance lease rental payments (4) (4)

Net cash outflow from returns on investments and servicing of finance (192) (161)

Taxation

Corporation tax paid (378) (272)

Capital expenditure and financial investment

Payments to acquire tangible fixed assets (1,877) (1,953)

Receipts from sale of tangible fixed assets 42 43

Purchase of own shares (85) (58)

Net cash outflow from capital expenditure and financial investment (1,920) (1,968)

Acquisitions and disposals

Purchase of subsidiary undertakings (31) (41)

Invested in joint ventures (46) (35)

Invested in associates and other investments (19) –

Net cash outflow from acquisitions and disposals (96) (76)

Equity dividends paid (297) (254)

Cash outflow before management of liquid resources and financing (830) (794)

Management of liquid resources

Decrease in short-term deposits 27 –

Financing

Ordinary shares issued for cash 82 88

Increase in other loans 916 928

New finance leases –13

Capital element of finance leases repaid (24) (46)

Net cash inflow from financing 974 983

Increase in cash 171 189

Reconciliation of net cash flow to movement in net debt

Increase in cash 171 189

Cash inflow from increase in debt and lease financing (892) (895)

Cash inflow from decrease in liquid resources (27) –

Amortisation of 4% unsecured deep discount loan stock, RPI and LPI bonds (14) (7)

Other non-cash movements (12) (8)

Foreign exchange differences 18 (23)

Increase in net debt (756) (744)

Opening net debt 33 (2,804) (2,060)

Closing net debt 33 (3,560) (2,804)

Accounting policies and notes forming part of these financial statements are on pages 20 to 39.