Telus 2005 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2005 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 6

By combining its wireline and wireless businesses into a single operation in the wireline-wireless

merger, which included the 2006 legal restructure, TELUS expects to be better able to leverage

the ongoing convergence between wireline and wireless communications technology, more

effectively compete with telecom and cable TV operators, differentiate its business from those of

its competitors by having TCC provide wireline and wireless services to customers, and provide

new services to customers regardless of the physical medium used to deliver the service. The

combining of the wireline and wireless businesses in TCC should also improve operating

effectiveness and efficiency. TELUS will continue to report financial results separately for the

wireless and wireline segments.

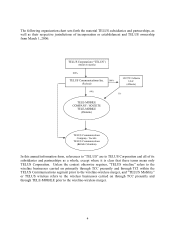

During the three years ended December 31, 2005, the corporate structure of the Company

underwent other changes. On July 1, 2004, through an internal reorganization, TCI acquired

substantially all of the assets and the wireline operations of TELUS Communications (Québec)

Inc. (“TELUS Communications (Québec)”). TCI assumed substantially all the liabilities of

TELUS Communications (Québec) including $30 million principal amount of First Mortgage

Bonds and $70 million principal amount of Medium Term Notes, which were the publicly held

debt of TELUS Communications (Québec). By combining in a single entity ownership of the

network assets in Québec with those outside of Québec, TELUS expects to be able, over the

long-run, to build common systems and processes that otherwise would have been more difficult

to build due to regulatory requirements. These changes should allow TELUS to better serve

customers whose service requirements span Canada.

On November 30, 2004, Verizon Communications Inc. (“Verizon”) and the Company entered into an

agreement pursuant to which the independent members of the Board of Directors of TELUS agreed

to accommodate Verizon’s desire to divest all of its 20.5 per cent equity investment in the Company.

Such divestiture was effected by a public secondary offering of Verizon’s entire equity interest in the

Company. Post divestiture, Verizon and the Company are no longer related parties (the “Verizon

Sale”). Concurrently with the divestiture, Verizon and the Company further adjusted their business

relationships to reflect changes in their business requirements since the alliance was first established.

See section “Alliances” on page 17 of this annual information form for further information.

On December 30, 2004, through an internal reorganization, a subsidiary of TELUS, TELUS

Solutions Holdings Inc., was wound up into TCI. Upon this wind up, TELUS Services

Partnership ceased to exist and its business was transferred by operation of law to TCI.

Amendments to Charter Documents

TELUS’ charter documents, the Notice of Articles and the Articles of the Company, were

amended in 2005 with the requisite approval of its shareholders. In particular, these

amendments:

• decreased the minimum number of directors from 12 to 10;

• replaced the then existing Articles with a new form of Articles which conformed with the

New BC Act;

• reduced the threshold for a special resolution and a special separate resolution from 3/4 to

2/3;