Telus 2005 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2005 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

market by approximately 7.5 million people as of the end of 2005, while allowing TELUS to

avoid estimated capital expenditures of approximately $800 million over the 10-year term of the

agreements. In 2002 and in 2005, these Roaming/Resale Agreements were amended to include

roaming for 1X and EVDO, respectively. At the end of 2005, TELUS’ national digital networks

combined with coverage provided by the Roaming/Resale Agreements reached approximately

30.6 million Canadians.

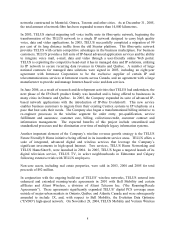

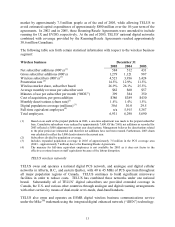

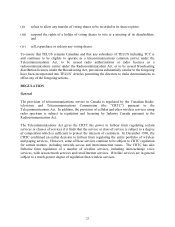

The following table sets forth certain statistical information with respect to the wireless business

segment:

Wireless business December 31

2005 2004 2003

Net subscriber additions (000’s) (1) 584 512 431

Gross subscriber additions (000’s) 1,279 1,121 987

Wireless subscribers (000’s) (1) 4,521 3,936 3,424

Penetration rate (2) 14.5% 12.9% 11.5%

Wireless market share, subscriber based 26.9% 26.1% 25.5%

Average monthly revenue per subscriber unit $62 $60 $57

Minutes of use per subscriber per month (“MOU”) 399 384 350

Cost of acquisition, per gross addition $386 $389 $430

Monthly deactivations (churn rate)(1) 1.4% 1.4% 1.5%

Digital population coverage (millions) (3) 30.6 30.0 29.5

Full-time equivalent employees(4) n/a 5,915 5,387

Total employees 6,931 6,298 5,690

(1) Based on an audit of the prepaid platform in 2003, a one-time adjustment was made to the prepaid subscriber

base. Cumulative subscribers were reduced by approximately 7,600. Of the 7,600, net additions as recorded for

2003 reflected a 5,000 adjustment for current year deactivations. Management believes the deactivations related

to the prior period are immaterial and therefore net additions have not been restated. Furthermore, 2003 churn

was calculated to reflect the 5,000 deactivations in the current year.

(2) Subscribers divided by population coverage.

(3) Includes expanded population coverage in 2005 of approximately 7.5 million in the PCS coverage area

(2003 – approximately 7 million) due to the Roaming/Resale Agreements.

(4) The measure for full-time equivalent employees is not available for 2005 as it does not factor in the

effective overtime hours on staff equivalents because of the labour disruption.

TELUS wireless networks

TELUS owns and operates a national digital PCS network, and analogue and digital cellular

networks in Alberta, B.C., and eastern Québec, with 40 to 45 MHz of PCS spectrum throughout

all major population regions of Canada. TELUS continues to build significant microwave

facilities in order to reduce costs. TELUS has combined these networks under one national

brand. Substantially all of TELUS’ digital subscribers are provided extended coverage in

Canada, the U.S. and various other countries through analogue and digital roaming arrangements

with other carriers by means of dual-mode or tri-mode, dual-band handsets.

TELUS also owns and operates an ESMR digital wireless business communications service

under the MikeTM trademark using the integrated digital enhanced network (“iDEN”) technology.