TJ Maxx 2000 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2000 TJ Maxx annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

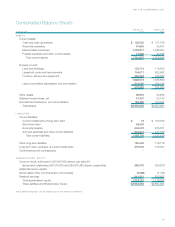

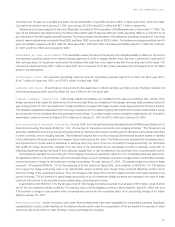

The aggregate maturities of long–term debt, exclusive of current installments, at January 27, 2001 are as follows:

General

Corporate

In Thousands Debt

Fiscal Year

2003 $ –

2004 15,000

2005 5,000

2006 99,939

Later years 199,433

Aggregate maturities of long–term debt, exclusive of current installments $319,372

In December 1999, TJX issued $200 million of 7.45% ten–year notes. The proceeds were used for general corporate purposes,

including TJX’s ongoing stock repurchase program.

TJX periodically enters into financial instruments to manage its cost of borrowing. In December 1999, TJX entered into a rate–lock agree-

ment to hedge the underlying treasury rate of the $200 million ten–year notes, prior to their issuance. The cost of this agreement has been

deferred and is being amortized to interest expense over the term of the notes and results in an effective rate of 7.60% on the debt.

In September 1997, TJX entered into a five–year $500 million revolving credit facility. In addition, in July 2000, TJX entered into a $250

million, 364–day revolving credit agreement. The agreements have similar terms which include certain financial covenants requiring that TJX

maintain specified fixed charge coverage and leverage ratios. The revolving credit facilities are used as backup to TJX’s commercial paper

program. As of January 27, 2001, $711 million of the revolving credit facilities were available for use. Interest is payable on borrowings at

rates equal to or less than prime. The maximum amount of TJX’s U.S. short–term borrowings was $330 million in fiscal 2001 and $108

million in fiscal 2000, with no borrowings during fiscal 1999. The weighted average interest rate on TJX’s U.S. short–term borrowings was

6.82% in fiscal 2001 and 6.06% in fiscal 2000. TJX does not have any compensating balance requirements under these arrangements.

TJX also has C$40 million of credit lines for its Canadian subsidiary, all of which were available as of January 27, 2001. The maximum

amount outstanding under TJX’s Canadian credit lines was C$15.2 million during fiscal 2001, C$19.2 million in fiscal 2000 and C$15.6

million during fiscal 1999.

In February 2001, TJX raised gross proceeds of $347.6 million through the issuance of twenty–year zero coupon convertible

subordinated notes. See Note O to the consolidated financial statements for further information.

D. FINANCIAL INSTRUMENTS

TJX periodically enters into forward foreign currency exchange contracts to hedge firm U.S. dollar and Euro merchandise purchase

commitments made by its foreign subsidiaries. As of January 27, 2001, TJX had $26.6 million of such contracts outstanding for its

Canadian subsidiary and $5.6 million and ¤4.8 million Euro for its subsidiary in the United Kingdom. The contracts cover certain commit-

ments for the first quarter of fiscal 2002. Through January 27, 2001 gains and losses on such contracts were included as a component

of the item being hedged.

TJX also has entered into several foreign currency swap and forward contracts in both Canadian dollars and British pounds sterling.

Both the swap and forward agreements are accounted for as a hedge against TJX’s investment in its foreign subsidiaries. Foreign

exchange gains and losses on the agreements are recognized in shareholders’ equity, thereby offsetting translation adjustments asso-

ciated with TJX’s investment in its foreign subsidiaries.

The Canadian swap and forward agreements will require TJX to pay C$94.3 million in exchange for $65.9 million in U.S. currency

between January 2002 and January 2005. The British pounds sterling swap and forward agreements will require TJX to pay £75.0 million

between January 2002 and January 2003 in exchange for $117.5 million in U.S. currency.

The agreements contain rights of offset which minimize TJX’s exposure to credit loss in the event of nonperformance by one of the

counterparties. The interest rates payable on the foreign currency swap agreements are slightly higher than the interest rates receivable

on the currency exchanged, resulting in deferred interest costs which are being amortized to interest expense over the term of the related

agreements. The premium costs or discounts associated with the forward contracts are being amortized over the term of the related

agreements and are included with the gains or losses of the hedging instrument. The unamortized balance of the net deferred costs

was $1.5 million and $2.1 million as of January 27, 2001 and January 29, 2000, respectively.

The counterparties to the forward exchange contracts and swap agreements are major international financial institutions. TJX

periodically monitors its position and the credit ratings of the counterparties and does not anticipate losses resulting from the nonper-

formance of these institutions.

THE TJX COMPANIES, INC.

25