TJ Maxx 2000 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2000 TJ Maxx annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

I. PENSION PLANS AND OTHER RETIREMENT BENEFITS

TJX has a non–contributory defined benefit retirement plan covering the majority of its full–time U.S. employees. Employees who have

attained twenty–one years of age and have completed one year of service are covered under the plan. Benefits are based on compen-

sation earned in each year of service. TJX also has an unfunded supplemental retirement plan which covers key employees of TJX and

provides additional retirement benefits based on average compensation; and an unfunded postretirement medical plan which provides

limited postretirement medical and life insurance benefits to associates who participate in TJX’s retirement plan and who retire at age

fifty–five or older with ten or more years of service.

Presented below is financial information relating to TJX’s retirement plans for the fiscal years indicated:

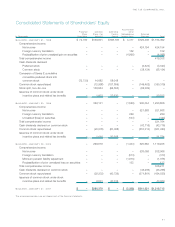

Pension Postretirement Medical

Fiscal Year Ended Fiscal Year Ended

January 27, January 29, January 27, January 29,

Dollars In Thousands 2001 2000 2001 2000

CHANGE IN BENEFIT OBLIGATION:

Benefit obligation at beginning of year $140,010 $152,047 $18,529 $24,992

Service cost 10,734 11,781 1,353 1,366

Interest cost 11,560 10,768 1,624 1,430

Participants’ contributions ––42 14

Amendments 1,080 –––

Actuarial (gains) losses 22,564 (20,393) 4,376 (8,165)

Settlement (1,141) (7,434) ––

Benefits paid (6,616) (6,039) (1,162) (1,108)

Expenses paid (830) (720) ––

Benefit obligation at end of year $177,361 $140,010 $24,762 $18,529

CHANGE IN PLAN ASSETS:

Fair value of plan assets at beginning of year $140,191 $123,191 $ – $ –

Actual return on plan assets 1,665 15,024 ––

Employer contribution 15,532 8,735 1,120 1,094

Participants’ contributions ––42 14

Benefits paid (6,616) (6,039) (1,162) (1,108)

Expenses paid (830) (720) ––

Fair value of plan assets at end of year $149,942 $140,191 $ – $ –

RECONCILIATION OF FUNDED STATUS:

Benefit obligation at end of year $177,361 $140,010 $24,762 $18,529

Fair value of plan assets at end of year 149,942 140,191 ––

Funded status – excess (assets) obligations 27,419 (181) 24,762 18,529

Unrecognized transition obligation –447 ––

Unrecognized prior service cost 218 685 946 1,278

Unrecognized actuarial (gains) losses 11,554 (21,282) 394 (4,167)

Net amount recognized $ 15,647 $ 19,969 $23,422 $21,418

AMOUNT RECOGNIZED IN THE STATEMENT OF

FINANCIAL POSITION CONSISTS OF:

Net accrued liability $ 12,215 $ 19,969 $23,422 $21,418

Intangible asset 1,757 –––

Reduction to accumulated other comprehensive income 1,675 –––

Net amount recognized $ 15,647 $ 19,969 $23,422 $21,418

WEIGHTED AVERAGE ASSUMPTIONS:

Discount rate 7.41% 7.66% 7.50% 7.75%

Expected return on plan assets 9.00% 9.00% N/A N/A

Rate of compensation increase 4.00% 4.00% 4.00% 4.00%

THE TJX COMPANIES, INC.

31