TJ Maxx 2000 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2000 TJ Maxx annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

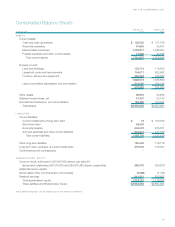

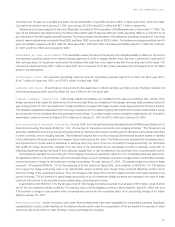

EARNINGS PER SHARE: The following schedule presents the calculation of basic and diluted earnings per share for income from

continuing operations:

Fiscal Year Ended

January 27, January 29, January 30,

Dollars In Thousands Except Per Share Amounts 2001 2000 1999

BASIC EARNINGS PER SHARE:

Income from continuing operations before

cumulative effect of accounting change $538,066 $526,822 $433,202

Less preferred stock dividends ––3,523

Income from continuing operations before cumulative effect of

accounting change available to common shareholders $538,066 $526,822 $429,679

Weighted average common stock outstanding

for basic earnings per share calculation 287,440,637 314,577,145 318,073,081

Basic earnings per share $1.87 $1.67 $1.35

DILUTED EARNINGS PER SHARE:

Income from continuing operations before cumulative effect of

accounting change available to common shareholders $538,066 $526,822 $429,679

Add preferred stock dividends ––3,523

Income from continuing operations before

cumulative effect of accounting change for diluted

earnings per share calculation $538,066 $526,822 $433,202

Weighted average common stock outstanding

for basic earnings per share calculation 287,440,637 314,577,145 318,073,081

Assumed conversion/exercise of:

Convertible preferred stock ––10,914,354

Stock options and awards 1,755,591 3,213,619 5,660,515

Weighted average common shares for

diluted earnings per share calculation 289,196,228 317,790,764 334,647,950

Diluted earnings per share $1.86 $1.66 $1.29

The weighted average common shares for the diluted earnings per share calculation exclude the incremental effect related to

outstanding stock options whose exercise price is in excess of the average price of TJX’s common stock. Such options are excluded

because they would have an antidilutive affect. These options amounted to 4.6 million as of January 27, 2001 and 3.1 million as of

January 29, 2000. There were 28,000 antidilutive options excluded from the calculation at January 30, 1999.

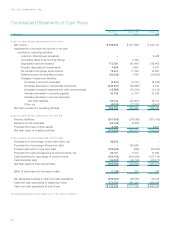

H. INCOME TAXES

The provision for income taxes includes the following:

Fiscal Year Ended

January 27, January 29, January 30,

In Thousands 2001 2000 1999

CURRENT:

Federal $272,075 $255,277 $231,811

State 51,217 49,836 45,117

Foreign 27,819 20,212 13,784

DEFERRED:

Federal (22,359) 3,885 (13,084)

State (2,269) 1,984 (2,306)

Foreign 393 (4,079) (4,512)

Provision for income taxes $326,876 $327,115 $270,810

THE TJX COMPANIES, INC.

29