TJ Maxx 2000 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2000 TJ Maxx annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

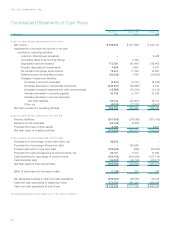

TJX had a net deferred tax asset as follows:

January 27, January 29,

In Thousands 2001 2000

DEFERRED TAX ASSETS:

Loss on investment in foreign subsidiary $ 7,013 $ –

Foreign net operating loss carryforward 17,998 30,107

Reserve for discontinued operations 10,129 10,900

Reserve for closed store and restructuring costs 6,443 11,569

Pension, postretirement and employee benefits 53,487 46,468

Leases 19,455 15,596

Other 29,111 28,234

Valuation allowance (3,396) (15,678)

Total deferred tax assets 140,240 127,196

DEFERRED TAX LIABILITIES:

Property, plant and equipment 17,211 19,240

Safe harbor leases 16,274 24,450

Tradename 44,140 45,408

Other 15,224 14,955

Total deferred tax liabilities 92,849 104,053

Net deferred tax asset $ 47,391 $ 23,143

TJX has elected to repatriate the earnings of its Canadian subsidiary after fiscal 1998. The majority of the fiscal 2001, 2000 and 1999

earnings from its Canadian subsidiary were repatriated and deferred foreign tax credits have been provided for on the undistributed

portions for these years. Earnings prior to fiscal 1999 of its Canadian subsidiary and all the earnings of TJX’s other foreign subsidiaries

are indefinitely reinvested and no deferred taxes have been provided for on those earnings.

TJX has a United Kingdom net operating loss carryforward of approximately $39 million for both tax and financial reporting purposes.

TJX recognized a deferred tax benefit of $7.0 million in fiscal 2001 due to the anticipated utilization of the balance of T.K. Maxx’s net oper-

ating loss carryforward. The United Kingdom net operating loss does not expire under current tax law. Due to TJX’s decision to close its

Netherlands operation, TJX does not expect to be able to utilize net operating losses of that operation. TJX, however, did recognize U.S.

tax benefits associated with the write-off of its total investment in the Netherlands operation. TJX also has a Puerto Rico net operating loss

carryforward of approximately $16 million, for tax and financial reporting purposes, which was acquired in the Marshalls acquisition and

expires in fiscal years 2002 through 2003. TJX recognized a deferred tax asset of $8.0 million and $3.4 million, in fiscal years 2000 and

1999, respectively, for the estimated future utilization of the Puerto Rico net operating loss carryforward. In fiscal 2001 a portion of the

deferred tax asset was reversed due to lower than anticipated earnings of the Puerto Rico operations. The valuation allowance relates to

TJX’s Puerto Rico net operating losses that have not yet been recognized or are likely to expire. Additional utilization of these net operating

loss carryforwards is dependent upon the level of future earnings in Puerto Rico.

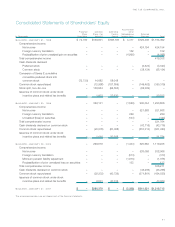

TJX’s worldwide effective income tax rate was 37.8% for the fiscal year ended January 27, 2001, 38.3% for the fiscal year ended

January 29, 2000, and 38.5% for the fiscal year ended January 30, 1999. The difference between the U.S. federal statutory income tax

rate and TJX’s worldwide effective income tax rate is reconciled below:

Fiscal Year Ended

January 27, January 29, January 30,

2001 2000 1999

U.S. federal statutory income tax rate 35.0% 35.0% 35.0%

Effective state income tax rate 4.0 4.2 4.1

Impact of foreign operations (1.0) (1.0) (.4)

All other (.2) .1 (.2)

Worldwide effective income tax rate 37.8% 38.3% 38.5%

THE TJX COMPANIES, INC.

30