Suzuki 2004 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2004 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUZUKI MOTOR CORPORATION

Management policy

1. Business operations basic policy

Ever since establishment, the Suzuki group has maintained a basic policy of making "value-packed products" to give

our customers satisfaction. The opening paragraph of our company's mission promises that we will "develop products of

superior quality by focusing on the customer". Of course, the value of a product varies with the times as well as in

different countries and lifestyles. By keeping on top of the dynamic changes in the market that occur over time, we strive

to create products of real value, products that are always designed to win our customers' approval.

We are committed to making positive efforts in the production of small and subcompact vehicles, to develop vehicles

that are environmentally benign and to develop vehicles that are in tune with our customers' demands. Under our "Small

Cars for a Big Future" program, we are working to ensure our operations run in an efficient, well-coordinated and well-

balanced manner.

2. Profit sharing basic policy

The Company's basic profit sharing policy is focused on maintaining a continuous and stable payout of

dividends. At the same time, however, from a middle- and long-term perspective, we are always looking how to

improve our performance, how to increase the dividend payout ratio and how internal reserves can be improved

as a basis for enhancing our corporate structure to allow us to expand our business operations in the future.

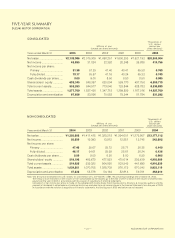

The increase in consolidated net sales for the current fiscal year was largely due to the increase in overseas

sales that resulted from an increase in production at our overseas manufacturing subsidiaries in developing

countries. At the same time, we also saw a decrease in non-consolidated net sales and we could face a similarly

tough situation in the coming fiscal year and thereafter. As previously stated, the Suzuki group has a structure in

which profits are highly dependent on overseas manufacturing plants, mainly located in developing countries,

and therefore are subject to exchange rates fluctuations. Furthermore we have plans to actively move ahead

and increase our investment in these overseas manufacturing bases. For stable growth, we need to further

enhance our corporate structure and to prepare for unforeseen circumstances.

Dividends for the current fiscal year are approved to be 8.00 yen per share as annual dividends (including

interim dividends of 4.00 yen). In addition, special dividends of 1.00 yen are to be paid. Therefore, total

dividends are 9.00 yen per share. As a result, the dividend payout ratio for the current fiscal year is 19.0% and

the dividend rate of shareholders' equity is 0.9%.

3. Perspectives and policy for lowering investment unit of shares

The Company recognizes improvement in share liquidity and increasing the number of individual

shareholders as significant issues to achieve a fair price for our shares. Therefore in September last year, we

decided to improve the market environment for investors by lowering the investment unit from 1,000 down to 100

to facilitate the easier purchasing of shares. Furthermore, we will continue to take into consideration factors such

as maximization of shareholders' interests, expansion of the number of individual investors, and improvement of

share liquidity.

4. Medium-term management strategy

A new business target was put in place in May, 2002 in order for the Suzuki group to survive in drastically

changing and tough business environment. The conditions upon which "Suzuki medium-term 3-year plan" was

formulated have been subject to change, but each and every member of our business has been working as a

team to achieve the goals.

5. Outstanding issues

An increase in the export market has brought about some signs of improvement in Suzuki group's business

environment in the domestic market. The effect of factors such as the appreciation of the yen on foreign

exchange markets and the slow recovery of the employment market mean the situation remains unstable. In

addition, in overseas markets, uncertainties regarding the chaotic situation in Iraq also cloud positive sentiment

for the future.

In order to cope in such difficult circumstances, we are striving to pursue the following motto to represent our

basic policy: "In order to survive, let us stop acting in a self-styled manner and get back to basics". By which we

intend to make positive efforts to strengthen our management structure by reviewing our practices in every area

of our business.

In our motorcycle operations for the domestic market, we will promote sales increases of the domestic-made

"Choinori"- the driving force in recent improvements in our market share - as well as push sales of our large-size

models. In overseas markets, we will try to boost sales of small-size models in Asia and large-size models in the

European and North American markets. In this way, we intend to establish a highly profitable motorcycle

16