Shutterfly 2011 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2011 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

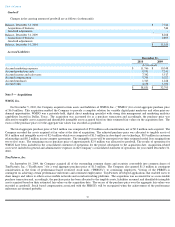

The total aggregate purchase price of $1.3 million was comprised of $1.0 million in cash consideration and $0.3 million in assumed working

capital deficit. Of the purchase price, $0.1 million was allocated to in-

process research and development having an indefinite life and $51,000

was allocated to core technology and user base which will be amortized over their estimated useful lives of one to three years. The Company

also recorded a deferred tax asset of $0.6 million which relates to the net operating loss carry-

forwards from TinyPictures. The remaining excess

purchase price of approximately $0.5 million was allocated to goodwill which represents the knowledge and experience of the assembled

workforce and future technology. The results of operations for TinyPictures have been included in the consolidated statement of operations for

the period subsequent to the acquisition date. Acquisition-related costs were included in general and administrative expenses in the Company’

s

consolidated statement of operations for year ended December 31, 2009.

Nexo Systems, Inc .

On January 4, 2008, the Company acquired all of the outstanding shares of Nexo Systems, Inc. ("Nexo") for total aggregate cash purchase

price of $10.1 million, including $0.1 million in fees; and $4.0 million in restricted stock. Nexo had developed and launched an internet-

based

platform, whereby groups can create customized, content-rich personal and group websites. The acquisition was accounted for as a non-

taxable

purchase transaction and, accordingly, the purchase price has been allocated to the tangible assets, liabilities assumed, and identifiable intangible

assets acquired based on their estimated fair values on the acquisition date. The excess of the purchase price over the aggregate fair values was

recorded as goodwill. The restricted stock award was granted to the Nexo founders contingent upon their continued employment for a period of

two years. As a result, $4.0 million will be recognized as stock-based compensation over the two year service period.

Of the total purchase price, $5.1 million was allocated to developed technology and is being amortized over an estimated useful life of five

years, and $0.1 million was allocated to all other assets and liabilities acquired. No amount was allocated to in

-

process research and

development. The remaining excess purchase price of approximately $4.9 million was allocated to goodwill. In addition, $2.0 million was

recorded as a deferred tax liability representing the difference between the assigned values of the assets acquired and the tax basis of those

assets, with the offset recorded as additional goodwill. The results of operations for the acquired business have been included in the consolidated

statement of operations for the period subsequent to the Company's acquisition of Nexo. Nexo's results of operations for periods prior to this

acquisition were not material to the consolidated statement of operations and, accordingly, pro forma financial information has not been

presented.

Note 6 — Commitments and Contingencies

Leases

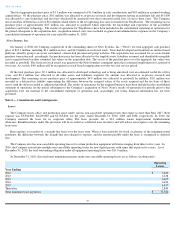

The Company leases office and production space under various non-

cancelable operating leases that expire no later than May 2017. Rent

expense was $3,964,000, $4,609,000 and $2,786,000, for the years ended December 31, 2010, 2009 and 2008, respectively. In 2010, the

Company renewed the lease for its corporate office. The lease provides for a $2.1 million tenant improvement reimbursement

allowance. Reimbursements under this provision will be recorded as a deferred lease incentive and will reduce rent expense over the remaining

lease term.

Rent expense is recorded on a straight-

line basis over the lease term. When a lease provides for fixed escalations of the minimum rental

payments, the difference between the straight-

line rent charged to expense, and the amount payable under the lease is recognized as deferred

rent.

The Company also has non-cancelable operating leases for certain production equipment with terms ranging from three to five years. In

2010, the Company entered into multiple non-cancellable operating leases for new digital presses with terms that expire in five years. As of

December 31, 2010, the total outstanding obligation under all equipment operating leases was $11.0 million.

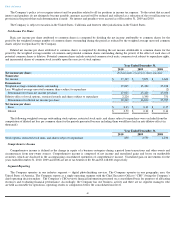

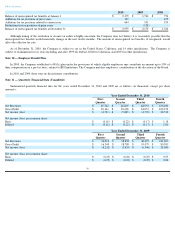

At December 31, 2010, the total future minimum payments under non-cancelable operating leases are as follows (in thousands):

Table of Contents

Operating

Leases

Year Ending:

2011

$

5,820

2012

6,238

2013

6,405

2014

6,426

2015

4,817

Thereafter

2,840

Total minimum lease payments

$

32,546

53