Shutterfly 2011 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2011 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

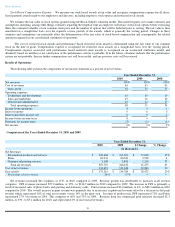

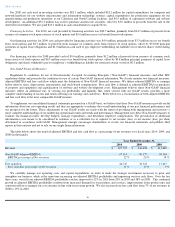

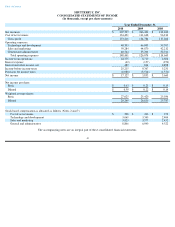

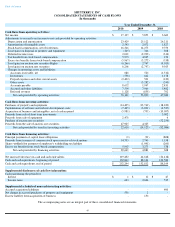

The following is a reconciliation of adjusted EBITDA and free cash flow to the most comparable GAAP measure for the years ended

December 31, 2010, 2009 and 2008 (in thousands):

Free cash flow has limitations due to the fact that it does not represent the residual cash flow for discretionary expenditures. For example,

free cash flow does not incorporate payments made on capital lease obligations or cash requirements to comply with debt covenants. Therefore,

we believe that it is important to view free cash flow as a compliment to our consolidated financial statements as reported.

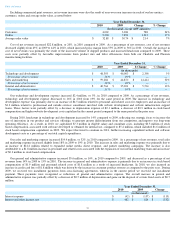

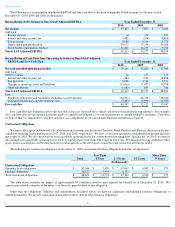

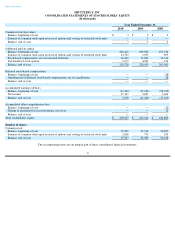

Contractual Obligations

We lease office space in Redwood City, California and a production facility in Charlotte, North Carolina and Phoenix, Arizona under non-

cancelable operating leases that expire in 2017, 2014, and 2016, respectively. We have co-location agreements with third-

party hosting facilities

that expire in 2013. We also have various non-

cancellable operating leases for certain production equipment. Specifically, in 2010, we entered

into multiple non-

cancellable operating leases for new digital presses with terms that expire in five years. We anticipate leasing additional office

space, production facilities and hosting facilities in future periods as the need arises, consistent with our historical business model.

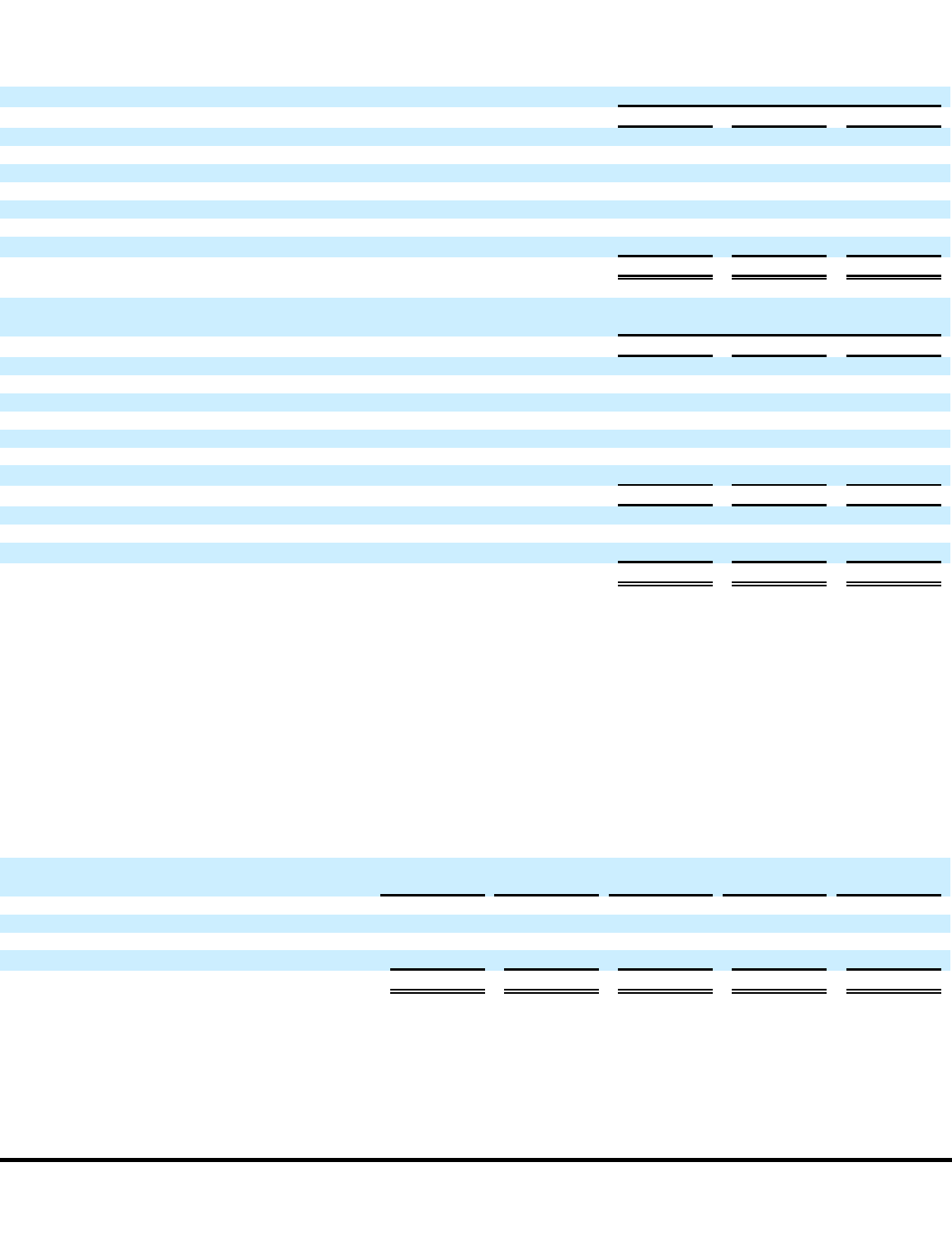

The following are contractual obligations at December 31, 2010, associated with lease obligations and other arrangements:

The table above excludes the impact of approximately $3.0 million related to unrecognized tax benefits as of December 31, 2010. We

cannot make reliable estimates of the future cash flows by period related to this obligation.

Other than the obligations, liabilities and commitments described above, we have no significant unconditional purchase obligations or

similar instruments. We are not a guarantor of any other entities’ debt or other financial obligations.

Table of Contents

Reconciliation of Net Income to Non

-

GAAP Adjusted EBITDA

Year Ended December 31,

2010

2009

2008

Net income

$

17,127

$

5,853

$

3,660

Add back:

Interest expense

42

157

273

Interest and other income, net

(482

)

(814

)

(2,898

)

Tax provision

8,088

3,514

1,571

Depreciation and amortization

25,972

27,194

26,038

Stock-based compensation expense

16,366

14,273

9,750

Non

-

GAAP Adjusted EBITDA

$

67,113

$

50,177

$

38,394

Reconciliation of Cash Flow from Operating Activities to Non

-

GAAP Adjusted

EBITDA and Free Cash Flow

Year Ended December 31,

2010

2009

2008

Net cash provided operating activities

$

76,161

$

53,890

$

47,040

Add back:

Interest expense

42

157

273

Interest and other income, net

(482

)

(814

)

(2,898

)

Tax provision

8,088

3,514

1,571

Changes in operating assets and liabilities

(15,014

)

(7,435

)

(7,978

)

Other adjustments

(1,682

)

865

386

Non

-

GAAP Adjusted EBITDA

$

67,113

$

50,177

$

38,394

Less:

Purchases of property and equipment, including accrued amounts

(14,961

)

(13,764

)

(18,220

)

Capitalized technology and development costs

(7,405

)

(3,891

)

(4,527

)

Free cash flow

$

44,747

$

32,522

$

15,647

Total

Less Than

1 Year

1

-

3 Years

3

-

5 Years

More Than

5 Years

(In thousands)

Contractual Obligations

Operating lease obligations

$

32,546

$

5,820

$

19,069

$

6,902

$

755

Purchase obligations

16,127

7,954

8,173

—

—

Total contractual obligations

$

48,673

$

13,774

$

27,242

$

6,902

$

755

37