Shutterfly 2011 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2011 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company’

s policy is to recognize interest and /or penalties related to all tax positions in income tax expense. To the extent that accrued

interest and penalties do not ultimately become payable, amounts accrued will be reduced and reflected as a reduction of the overall income tax

provision in the period that such determination is made. No interest and penalties were accrued as of December 31, 2009 and 2010.

The Company is subject to taxation in the United States, California and fourteen other jurisdictions in the United States.

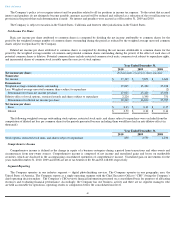

Net Income Per Share

Basic net income per share attributed to common shares is computed by dividing the net income attributable to common shares for the

period by the weighted average number of common shares outstanding during the period as reduced by the weighted average unvested common

shares subject to repurchase by the Company.

Diluted net income per share attributed to common shares is computed by dividing the net income attributable to common shares for the

period by the weighted average number of common and potential common shares outstanding during the period, if the effect of each class of

potential common shares is dilutive. Potential common shares include restricted common stock units, common stock subject to repurchase rights,

and incremental shares of common stock issuable upon the exercise of stock options.

The following weighted-average outstanding stock options, restricted stock units, and shares subject to repurchase were excluded from the

computation of diluted net loss per common share for the periods presented because including them would have had an anti-dilutive effect (in

thousands):

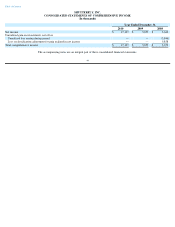

Comprehensive Income

Comprehensive income is defined as the change in equity of a business enterprise during a period from transactions and other events and

circumstances from non-

owner sources. Comprehensive income is composed of net income and unrealized gains and losses on marketable

securities, which are disclosed in the accompanying consolidated statements of comprehensive income. Unrealized gain on investments for the

years ended December 31, 2010, 2009 and 2008 are net of tax benefit of $0, $0 and $3,148,000 respectively.

Segment Reporting

The Company operates in one industry segment —

digital photofinishing services. The Company operates in one geographic area, the

United States of America. The Company reports as a single operating segment with the Chief Executive Officer (“CEO”) being the Company’

s

chief operating decision maker. The Company’

s CEO reviews financial information presented on a consolidated basis for purposes of allocating

resources and evaluating financial performance. Accordingly, the Company has one business activity and there are no segment managers who

are held accountable for operations, operating results or components below the consolidated unit level.

Table of Contents

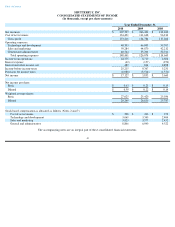

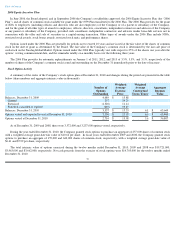

Year Ended December 31,

2010

2009

2008

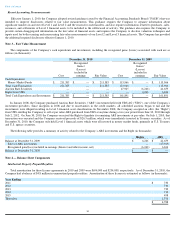

Net income per share:

In thousands, except per share amounts

Numerator

Net income

$

17,127

$

5,853

$

3,660

Denominator

Weighted

-

average common shares outstanding

27,025

25,420

25,038

Less: Weighted

-

average unvested common shares subject to repurchase

-

-

(2

)

Denominator for basic net income per share

27,025

25,420

25,036

Dilutive effect of stock options, restricted awards and shares subject to repurchase

2,224

1,390

751

Denominator for diluted net income per share

29,249

26,810

25,787

Net income per share

Basic

$

0.63

$

0.23

$

0.15

Diluted

$

0.59

$

0.22

$

0.14

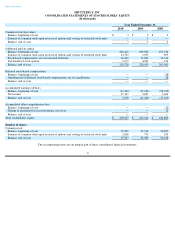

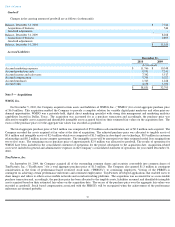

Year Ended December 31,

2010

2009

2008

Stock options, restricted stock units, and shares subject to repurchase

830

2,559

4,230

49