Shutterfly 2011 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2011 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

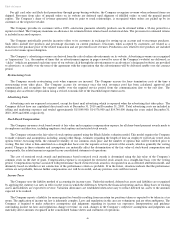

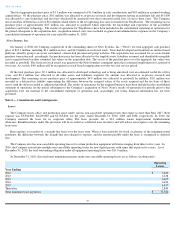

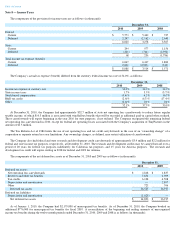

Property and Equipment

Property and equipment includes $35,000 and $1,212,000 of equipment under capital leases at December 31, 2010 and 2009, respectively.

Accumulated depreciation of assets under capital leases totaled $31,000 and $1,199,000 at December 31, 2010 and 2009, respectively.

Depreciation and amortization expense for the years ended December 31, 2010, 2009 and 2008 was $23,429,000, $25,122,000 and

$24,211,000, respectively.

Total capitalized software and website development costs, net of accumulated amortization totaled $11,588,000 and $8,629,000 at

December 31, 2010 and 2009, respectively. These amounts included $1,846,000 and $1,571,000 of stock based compensation expense at

December 31, 2010 and 2009, respectively. Amortization of capitalized costs totaled approximately $4,207,000, $3,314,000 and $2,456,000 for

the years ended December 31, 2010, 2009 and 2008, respectively.

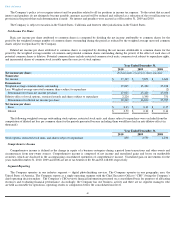

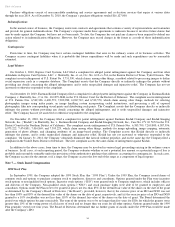

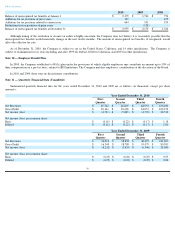

Intangible Assets

Intangible assets are comprised of the following at December 31:

Purchased technology is amortized over a period ranging from two to sixteen years. Customer relationships are amortized over a period

ranging from one to three years. Licenses and other is amortized over a period ranging from two to five years.

Intangible asset amortization expense for the years ended December 31, 2010, 2009 and 2008 was $1,849,000, $1,838,000 and $1,827,000,

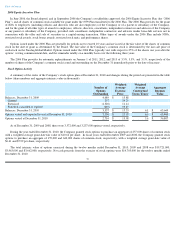

respectively. Amortization of existing intangible assets is estimated to be as follows (in thousands):

Table of Contents

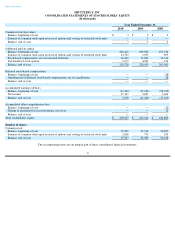

December 31,

2010

2009

In thousands

Computer and other equipment

$

87,531

$

84,754

Software

9,124

7,122

Leasehold improvements

7,133

6,848

Furniture and fixtures

3,006

2,956

Capitalized software and website development costs

25,173

17,494

131,967

119,174

Less: Accumulated depreciation and amortization

(92,241

)

(77,329

)

Net property and equipment

$

39,726

$

41,845

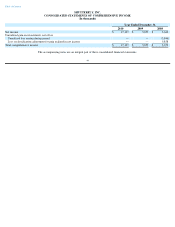

Weighted Average

Useful Life

December 31,

2010

2009

In thousands

Purchased technology

7 Years

$

9,878

$

8,578

Less: accumulated amortization

(5,228

)

(3,734

)

4,650

4,844

Customer relationships

3 Years

1,935

1,015

Less: accumulated amortization

(1,065

)

(777

)

870

238

Licenses and other

3 Years

416

256

Less: accumulated amortization

(264

)

(200

)

152

56

Total

$

5,672

$

5,138

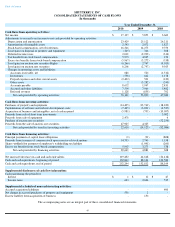

Year Ending:

2011

$

2,104

2012

1,951

2013

644

2014

388

2015

345

Thereafter

240

$

5,672

51