Shutterfly 2011 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2011 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6.7 Successors and Assigns . The rights and benefits of this Agreement shall inure to the benefit of

.

, and be

enforceable by, the Company’

s successors and assigns. The rights and obligations of Participant under this Agreement may only be assigned

with the prior written consent of the Company.

6.8 U.S. Tax Consequences

. Upon vesting of Shares, Participant will include in taxable income the difference between

the fair market value of the vesting Shares, as determined on the date of their vesting, and the price paid for the Shares. This will be treated as

ordinary income by Participant and will be subject to withholding by the Company when required by applicable law. In the absence of an

Election (defined below) the Company shall withhold a number of vesting Shares with a fair market value (determined on the date of their

vesting) equal to the amount the Company is required to withhold for income and employment taxes. If Participant makes an Election, then

Participant must, prior to making the Election, pay in cash (or check) to the Company an amount equal to the amount the Company is required to

withhold for income and employment taxes.

7. Section 83(b) Election

. Participant hereby acknowledges that he or she has been informed that, with respect to the purchase

of the Shares, an election may be filed by the Participant with the Internal Revenue Service, within 30 days of the purchase of the Shares,

electing pursuant to Section 83(b) of the Code to be taxed currently on any difference between the purchase price of the Shares and their Fair

Market Value on the date of purchase (the “ Election ”).

Making the Election will result in recognition of taxable income to the Participant on

the date of purchase, measured by the excess, if any, of the Fair Market Value of the Shares over the purchase price for the Shares. Absent such

an Election, taxable income will be measured and recognized by Participant at the time or times on which the Company’

s Repurchase Right

lapses. Participant is strongly encouraged to seek the advice of his or her own tax consultants in connection with the purchase of the Shares and

the advisability of filing of the Election. PARTICIPANT ACKNOWLEDGES THAT IT IS SOLELY PARTICIPANT’

S RESPONSIBILITY,

AND NOT THE COMPANY’

S RESPONSIBILITY, TO TIMELY FILE THE ELECTION UNDER SECTION 83(b) OF THE CODE, EVEN

IF PARTICIPANT REQUESTS THE COMPANY, OR ITS REPRESENTATIVE, TO MAKE THIS FILING ON PARTICIPANT’S BEHALF.

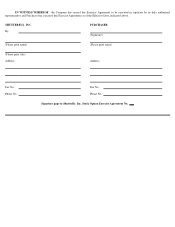

The parties have executed this Agreement as of the date first set forth above.

SHUTTERFLY, INC.

By:

Its:

RECIPIENT:

Signature

Please Print

Name