Sallie Mae 2003 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2003 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

Letter from the CEO & President

will help offset this squeeze and

allow us to deliver on our 2004 EPS

growth expectations.

Margin pressures notwithstanding,

we will continue to push hard to

accelerate our final privatization

efforts. Led by Jack Remondi, our

finance team delivered huge funding

volume in 2003 at better-than-

expected spreads. Our post-GSE

market access and capital adequacy

questions were clearly answered by

that performance. As shareholders

you have absorbed these refinancing

costs as the price for earnings diver-

sification and better control of our

destiny. We believe that our new

freedom will improve long-term

results and produce valuations more

closely related to the economics of

the higher education marketplace

that we serve.

And we love the higher education

market dynamics. Today, the average

value of a bachelor’s degree is about

$1.5 million higher than a high

school diploma, a differential that is

growing as rapidly as today’s tuition

costs. The American economy places

so high a value on education that its

cost is each citizen’s most rewarding

investment. As involved Americans,

we, too, fret about the sizeable finan-

cial obligations undertaken by some

of our young adults. Yet it is clear:

borrowing to attend college is a wiser

choice than being debt free without

an education.

After 20 years of no growth in

America’s college-age population,

that group will grow 13 percent just

in this decade. These new students

will join and compete with the rap-

idly growing mid-career adult popula-

tion returning to school. Growing

demand has pushed prices upward

and spawned particularly explosive

growth in the for-profit sector of

higher education, which provides

much-needed seats and focused edu-

cation to working and “transitioning”

adults. We have worked closely with

this segment of the market, which is

fueling both our FFELP and private

credit loan originations.

Today, our nearly 8,000 employees

deliver service to schools and students.

Our 300-person sales force connects

us with as many as 1,500 schools per

week. Campus presence combined

with our products and delivery system

make up our franchise. We are now

the leading player in loan origination,

loan servicing, guarantee servicing,

and student loan collection. While we

experience robust competition in each

segment, we also see potential for

ample share growth. This, combined

with the market’s expansion, underlies

our long-term optimism.

It is a rare shareholder conversa-

tion for us that omits discussion of

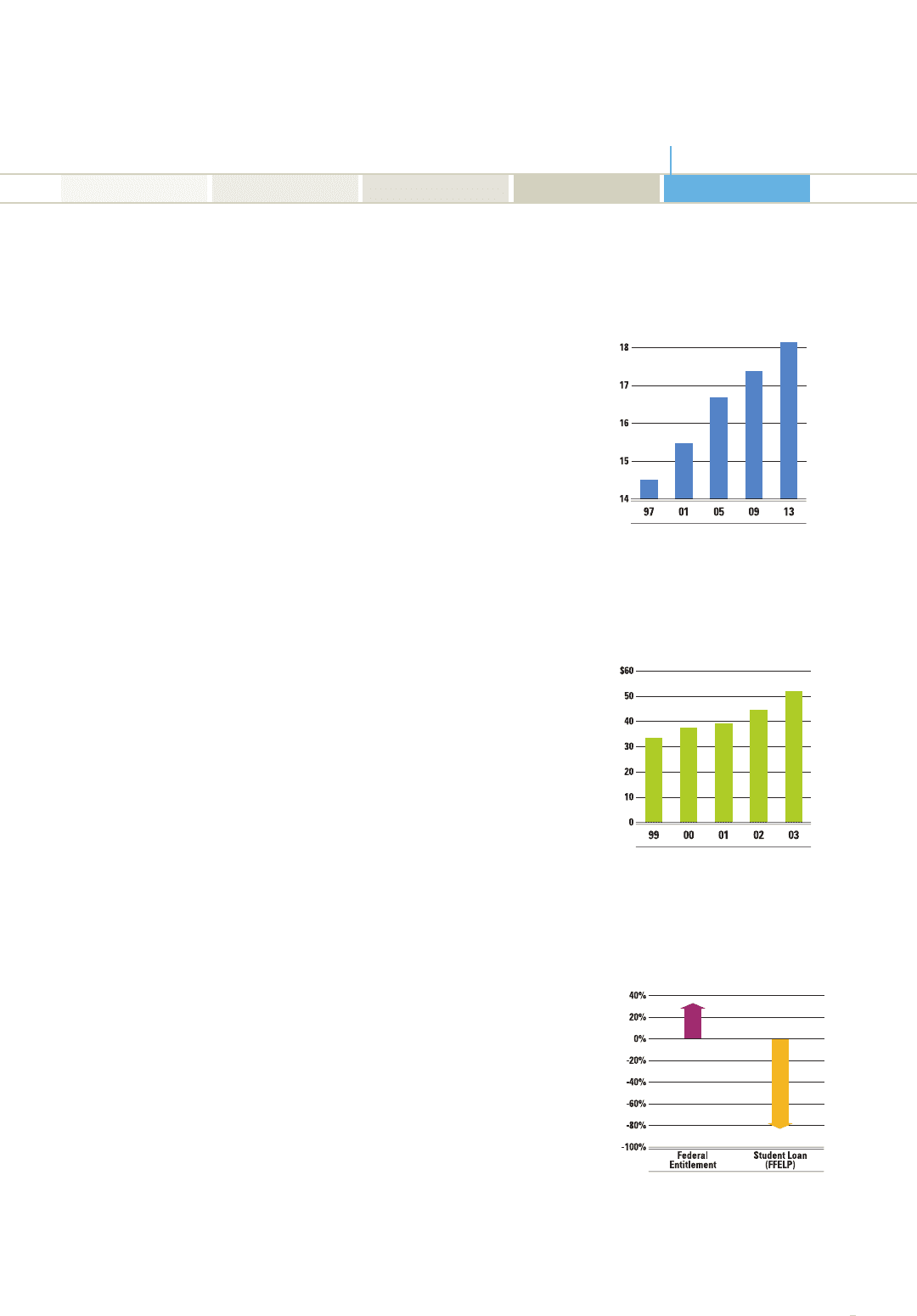

Projected Enrollment Trends

(in millions)

Federal Student Loan Originations

(in billions)

Source: U.S. Department of Education, “Projections of

Education Statistics to 2013,” Table 10, p. 57.

Federal Entitlement Spending

(% change in constant $, 1991 to 2001)

Source: U.S. Department of Education, “Federal Student Loan

Program Databook,” FY1997–FY2000, Table 1 adjusted to

constant dollars; Historical Tables, President’s Budget FY2004.

Source: U.S. Department of Education, “Federal Student

Financial Assistance Programs Loan Value Updates.”