Sallie Mae 2003 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2003 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

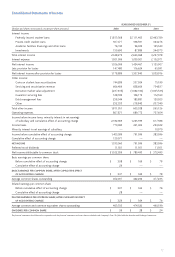

Consolidated Statements of Income

YEARS ENDED DECEMBER 31,

(Dollars and shares in thousands, except per share amounts) 2003 2002 2001

Interest income:

Federally insured student loans $1,813,368 $2,111,463 $2,463,789

Private credit student loans 307,477 338,591 324,276

Academic facilities financings and other loans 76,740 96,025 125,540

Investments 150,690 87,889 344,373

Total interest income 2,348,275 2,633,968 3,257,978

Interest expense 1,021,906 1,209,501 2,132,071

Net interest income 1,326,369 1,424,467 1,125,907

Less: provision for losses 147,480 116,624 65,991

Net interest income after provision for losses 1,178,889 1,307,843 1,059,916

Other income:

Gains on student loan securitizations 744,289 337,924 75,199

Servicing and securitization revenue 666,409 838,609 754,837

Derivative market value adjustment (237,815) (1,082,100) (1,005,533)

Guarantor servicing fees 128,189 106,172 112,160

Debt management fees 258,544 185,881 120,923

Other 252,335 218,842 207,540

Total other income 1,811,951 605,328 265,126

Operating expenses 807,871 689,772 707,654

Income before income taxes, minority interest in net earnings

of subsidiary and cumulative effect of accounting change 2,182,969 1,223,399 617,388

Income taxes 779,380 431,403 223,322

Minority interest in net earnings of subsidiary — — 10,070

Income before cumulative effect of accounting change 1,403,589 791,996 383,996

Cumulative effect of accounting change 129,971 — —

NET INCOME 1,533,560 791,996 383,996

Preferred stock dividends 11,501 11,501 11,501

Net income attributable to common stock $1,522,059 $ 780,495 $ 372,495

Basic earnings per common share:

Before cumulative effect of accounting change $ 3.08 $ 1.69 $ .78

Cumulative effect of accounting change .29 — —

BASIC EARNINGS PER COMMON SHARE, AFTER CUMULATIVE EFFECT

OF ACCOUNTING CHANGE $ 3.37 $ 1.69 $ .78

Average common shares outstanding 452,037 462,294 477,233

Diluted earnings per common share:

Before cumulative effect of accounting change $ 3.01 $ 1.64 $ .76

Cumulative effect of accounting change .28 — —

DILUTED EARNINGS PER COMMON SHARE, AFTER CUMULATIVE EFFECT

OF ACCOUNTING CHANGE $ 3.29 $ 1.64 $ .76

Average common and common equivalent shares outstanding 463,335 474,520 490,199

DIVIDENDS PER COMMON SHARE $ .59 $ .28 $ .24

The financial statements should be read in conjunction with the financial statements and notes thereto included in the Company’s Form 10-K filed with the Securities and Exchange Commission.