Sallie Mae 2003 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2003 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

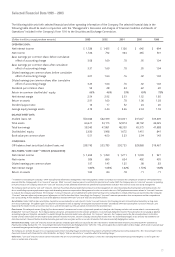

Selected Financial Data 1999 – 2003

The following table sets forth selected financial and other operating information of the Company. The selected financial data in the

following table should be read in conjunction with the “Management’s Discussion and Analysis of Financial Condition and Results of

Operations” included in the Company’s Form 10-K to the Securities and Exchange Commission.

(Dollars in millions, except per share amounts) 2003 2002 2001 2000 1999

OPERATING DATA:

Net interest income $ 1,326 $ 1,425 $ 1,126 $ 642 $ 694

Net income 1,534 792 384 465 501

Basic earnings per common share, before cumulative

effect of accounting change 3.08 1.69 .78 .95 1.04

Basic earnings per common share, after cumulative

effect of accounting change 3.37 1.69 .78 .95 1.04

Diluted earnings per common share, before cumulative

effect of accounting change 3.01 1.64 .76 .92 1.02

Diluted earnings per common share, after cumulative

effect of accounting change 3.29 1.64 .76 .92 1.02

Dividends per common share .59 .28 .24 .22 .20

Return on common stockholders’ equity 66% 46% 30% 49% 78%

Net interest margin 2.54 2.92 2.33 1.52 1.85

Return on assets 2.91 1.60 .78 1.06 1.28

Dividend payout ratio 18 17 32 24 20

Average equity/average assets 4.19 3.44 2.66 2.34 1.59

BALANCE SHEET DATA:

Student loans, net $50,048 $42,339 $41,001 $37,647 $33,809

Total assets 64,611 53,175 52,874 48,792 44,025

Total borrowings 58,543 47,861 48,350 45,375 41,988

Stockholders’ equity 2,630 1,998 1,672 1,415 841

Book value per common share 5.51 4.00 3.23 2.54 1.43

OTHER DATA:

Off-balance sheet securitized student loans, net $38,742 $35,785 $30,725 $29,868 $19,467

PRO-FORMA “CORE CASH”(1) RESULTS (UNAUDITED):

Net interest income $ 1,652 $ 1,359 $ 1,271 $ 1,039 $ 927

Net income 926 690 624 492 405

Diluted earnings per common share 1.97 1.43 1.25 .98 .83

Net interest margin 1.80% 1.68% 1.62% 1.53% 1.68%

Return on assets 1.00 .84 .78 .71 .71

(1) In addition to evaluating the Company’s GAAP-based financial information, management, credit rating agencies, lenders and analysts also evaluate the Company on certain non-GAAP performance

measures that the Company refers to as “core cash” measures.While “core cash” measures are not a substitute for reported results under GAAP, the Company relies on “core cash” measures in operating

its business because the Company believes the “core cash” measures provide additional information on operational and performance indicators that are most closely assessed by management.

The Company reports pro forma “core cash” measures, which are the primary financial performance measure used by management not only in developing the financial plans and tracking results, but

also in establishing corporate performance targets and determining incentive compensation. Management also relies on several other non-GAAP performance measures related to “core cash” measures

to evaluate the Company’s performance. The Company’s “core cash” measures are not defined terms within GAAP and may not be comparable to similarly titled measures reported by other companies.

“Core cash” measures reflect only current period adjustments to GAAP as described below. Accordingly, the Company’s “core cash” measures presentation does not represent another comprehensive

basis of accounting. A more detailed discussion of the differences between GAAP and “core cash” measures calculations follows.

Securitization: Under GAAP, certain securitization transactions are accounted for as sales of assets. Under “core cash”measures, the Company presents all securitization transactions as long-term

non-recourse financings. The upfront “gains” on sale from securitization as well as ongoing “servicing and securitization revenue” presented by GAAP are excluded from “core cash” measures, and

replaced by the interest income, provision for loan losses, and interest expense as they are earned or incurred on the securitized loans.

Floor Income: The timing and amount (if any) of floor income earned is uncertain and in excess of expected spreads and, therefore, the Company excludes such income when it is not economically

hedged from “core cash” measures. The Company employs derivatives, primarily floor income contracts and futures, to economically hedge floor income. These derivatives do not qualify as effective

accounting hedges and, therefore, are marked-to-market through the derivative market value adjustment. For “core cash” measures, the Company reverses the fair value adjustments on the floor

income contracts and includes the amortization of net premiums received in income. Since the Company excludes floor income that is not economically hedged, it also excludes net settlements on

derivative contracts, the amortization of certain derivative gains and losses and gains and losses on sales of securities that were economically hedging floor income.

Derivative Accounting: “Core cash” measures exclude the periodic unrealized gains and losses caused by the one-sided mark-to-market derivative valuations prescribed by GAAP’s Statement of

Financial Accounting Standard No. 133, “Accounting for Derivative Instruments and Hedging Activities” (SFAS No. 133), and recognize the economic effect of these hedges, which results in any cash paid

or received being recognized ratably as an expense or revenue over the hedged item’s life.

The Company also excludes the gain or loss on equity forward contracts including the gain recorded upon the adoption of Statement of Financial Accounting Standard No. 150,“Accounting for Certain

Financial Instruments with Characteristics of both Liabilities and Equity,” that was recorded as a “cumulative effect of accounting change.”

Other items: “Core cash” measures exclude certain transactions that are not considered part of the Company’s core business including the amortization of acquired intangibles, as well as gains and

losses on certain sales of securities.