Rite Aid 2012 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2012 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 3, 2012, February 26, 2011 and February 27, 2010

(In thousands, except per share amounts)

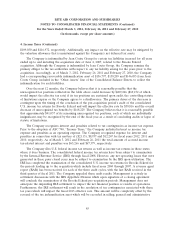

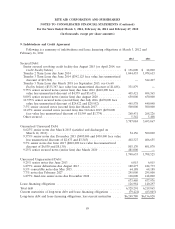

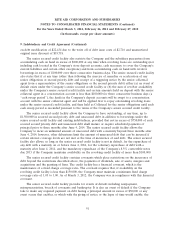

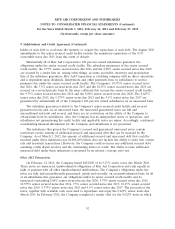

9. Indebtedness and Credit Agreement (Continued)

require the Company to repurchase them, which the Company has the ability to do under the terms of

our senior credit facility. On July 30, 2010, the Company received a notice of non-compliance from the

NYSE because the price of its common stock had fallen below the NYSE’s minimum share price rule.

The Company’s common stock continued to trade as usual on the NYSE and on March 1, 2011, the

Company received notice that it had regained compliance with the NYSE’s minimum share price listing

requirement. The Company is currently in compliance with all NYSE listing rules.

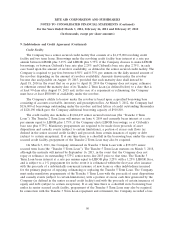

2010 Transactions

In October 2009, the Company issued $270,000 of 10.25% senior secured notes due October 15,

2019. These notes are unsecured, unsubordinated obligations of Rite Aid Corporation and rank equally

in right of payment with all other unsubordinated indebtedness. The Company’s obligations under these

notes are guaranteed, subject to certain limitations, by the same subsidiaries that guarantee the

obligations under the senior secured credit facility and the 9.75% senior secured notes due 2016. The

guarantees are secured by shared second priority liens with holders of the 10.375% senior secured

notes due 2016 and 7.5% senior secured notes due 2017. The indenture that governs the 10.25% notes

contains covenant provisions that, among other things, include limitations on the Company’s ability to

pay dividends, make investments or other restricted payments, incur debt, grant liens, sell assets and

enter into sale-leaseback transactions. The 10.25% senior secured notes due October 2019 were issued

at 99.2% of par.

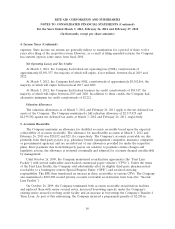

In June 2009, the Company issued $410,000 of 9.75% senior secured notes due June 12, 2016.

These notes are unsecured, unsubordinated obligations of Rite Aid Corporation and rank equally in

right of payment with all other unsubordinated indebtedness. The Company’s obligations under these

notes are guaranteed, subject to certain limitations, by the same subsidiaries that guarantee the

obligations under the senior secured credit facility and its 8.00% senior secured notes due 2020. These

guarantees are shared, on a senior basis, with debt outstanding under the senior secured credit facility

and its 8.00% senior secured notes due 2020. The indenture that governs the 9.75% notes and its

8.00% senior secured notes due 2020 contains covenant provisions that, among other things, allow the

holders of the notes to participate along with the holders of the 8.00% senior secured notes due 2020

in the mandatory prepayments resulting from the proceeds of certain asset dispositions (at the option

of the noteholder) and include limitations on the Company’s ability to pay dividends, make investments

or other restricted payments, incur debt, grant liens, sell assets and enter into sale-leaseback

transactions. The 9.75% senior secured notes due June 2016 were issued at 98.2% of par.

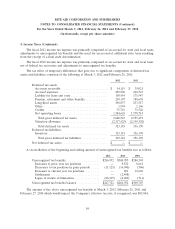

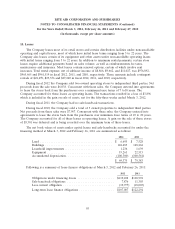

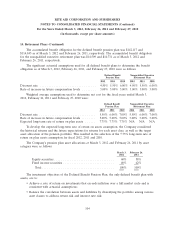

Interest Rates and Maturities

The annual weighted average interest rate on the Company’s indebtedness was 7.4%, 7.5%, and

6.8% for fiscal 2012, 2011, and 2010, respectively.

The aggregate annual principal payments of long-term debt for the five succeeding fiscal years are

as follows: 2013—$59,445; 2014—$189,316; 2015—$1,044,692; 2016—$608,617 and $4,340,708 in 2017

and thereafter.

94