Rite Aid 2012 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2012 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.RITE AID CORPORATION AND SUBSIDIARIES

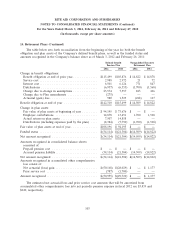

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 3, 2012, February 26, 2011 and February 27, 2010

(In thousands, except per share amounts)

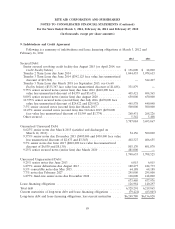

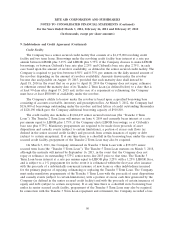

9. Indebtedness and Credit Agreement (Continued)

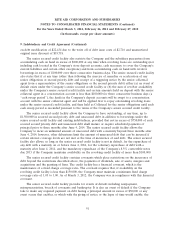

$404,844 aggregate principal amount of the outstanding 8.625% notes were tendered and repurchased

by the Company. In February 2012, the Company called for the redemption of the remaining 8.625%

notes. The Company satisfied and discharged the remaining 8.625% notes on March 14, 2012 for

$55,644, which included the call premium and interest through the call date. The refinancing resulted in

a loss for the period of $16,066.

During August 2011, the Company repurchased $41,000 of its 8.625% senior notes due March

2015, $5,000 of its 9.375% senior notes due December 2015 and $4,496 of its 6.875% senior debentures

due August 2013. These repurchases resulted in a gain for the period of $4,924.

On March 1, 2011, the Company was notified by the NYSE that, as of March 1, 2011, it had

regained compliance with the NYSE minimum share price listing requirement. The Company is now in

compliance with all NYSE listing rules, and has actively been taking steps to maintain its listing and

expects its efforts to maintain its NYSE listing will be successful. However, there can be no assurance

that the Company will maintain compliance with the NYSE minimum share price rule or other

continued listing requirements. In the event of a delisting, all holders of its $64,188 of outstanding

8.5% Convertible Notes due May 2015 (‘‘Convertible Notes’’) would be entitled to require the

Company to repurchase its Convertible Notes. The Company’s senior secured credit facility permits the

Company to make such a repurchase of the Convertible Notes; provided that, before and after such

transaction, no default or event of default shall have occurred and be continuing under the senior

secured credit facility and the Company has at least $100,000 of availability under its revolving credit

facility. The Company’s ability to pay cash to holders of the Convertible Notes may be limited by its

financial resources at the time of such repurchase. The Company cannot assure you that sufficient

financing will be available on terms acceptable to it if necessary to make any required repurchase of

the Convertible Notes.

2011 Transactions

In August 2010, the Company issued $650,000 of 8.00% senior secured notes due August 15, 2020.

These notes are unsecured, unsubordinated obligations of Rite Aid Corporation and rank equally in

right of payment with all other unsubordinated indebtedness. The Company’s obligations under these

notes are guaranteed, subject to certain limitations, by the same subsidiaries that guarantee the

obligations under the senior secured credit facility and the 9.75% senior secured notes due 2016. These

guarantees are shared, on a senior basis, with debt outstanding under the senior secured credit facility

and the 9.75% senior secured notes due 2016. The indenture that governs the 8.00% notes contains

covenant provisions that, among other things, allow the holders of the notes to participate along with

the term loan holders and holders of the 9.75% senior secured notes due 2016 in the mandatory

prepayments resulting from the proceeds of certain asset dispositions (at the option of the noteholder)

and include limitations on the Company’s ability to pay dividends, make investments or other restricted

payments, incur debt, grant liens, sell assets and enter into sale-leaseback transactions.

In July 2010, the Company repurchased $93,812 of its $158,000 outstanding 8.5% convertible notes.

The Company’s remaining 8.5% convertible notes require that the Company maintains a listing on the

NYSE or certain other exchanges. In the event of a NYSE delisting, holders of these notes could

93