Rite Aid 2012 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2012 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 3, 2012, February 26, 2011 and February 27, 2010

(In thousands, except per share amounts)

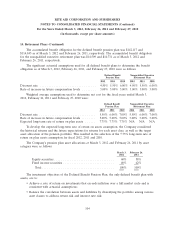

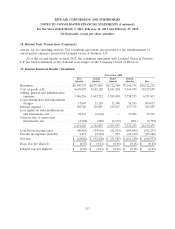

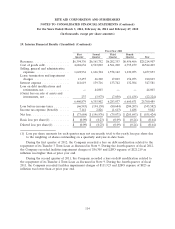

19. Interim Financial Results (Unaudited) (Continued)

Fiscal Year 2011

First Second Third Fourth

Quarter Quarter Quarter Quarter Year

Revenues ..................... $6,394,336 $6,161,752 $6,202,353 $6,456,466 $25,214,907

Cost of goods sold .............. 4,682,632 4,523,092 4,561,200 4,755,479 18,522,403

Selling, general and administrative

expenses ................... 1,622,934 1,626,704 1,578,142 1,630,053 6,457,833

Lease termination and impairment

charges .................... 13,457 26,360 17,003 154,073 210,893

Interest expense ................ 141,619 139,716 133,742 132,504 547,581

Loss on debt modifications and

retirements, net .............. — 44,003 — — 44,003

(Gain) loss on sale of assets and

investments, net .............. 237 (3,973) (7,050) (11,438) (22,224)

6,460,879 6,355,902 6,283,037 6,660,671 25,760,489

Loss before income taxes ......... (66,543) (194,150) (80,684) (204,205) (545,582)

Income tax expense (benefit) ...... 7,141 2,826 (1,613) 1,488 9,842

Net loss ...................... $ (73,684) $ (196,976) $ (79,071) $ (205,693) $ (555,424)

Basic loss per share(1) ........... $ (0.09) $ (0.23) $ (0.09) $ (0.24) $ (0.64)

Diluted loss per share(1) ......... $ (0.09) $ (0.23) $ (0.09) $ (0.24) $ (0.64)

(1) Loss per share amounts for each quarter may not necessarily total to the yearly loss per share due

to the weighting of shares outstanding on a quarterly and year-to-date basis.

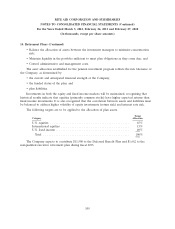

During the first quarter of 2012, the Company recorded a loss on debt modification related to the

repayment of its Tranche 3 Term Loan as discussed in Note 9. During the fourth quarter of fiscal 2012,

the Company recorded facilities impairment charges of $56,305 and LIFO expense of $121,219 as

inflation was higher than at prior year end.

During the second quarter of 2011, the Company recorded a loss on debt modification related to

the repayment of its Tranche 4 Term Loan as discussed in Note 9. During the fourth quarter of fiscal

2011, the Company recorded facilities impairment charges of $111,923 and LIFO expense of $825 as

inflation was lower than at prior year end.

114