Rite Aid 2012 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2012 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 3, 2012, February 26, 2011 and February 27, 2010

(In thousands, except per share amounts)

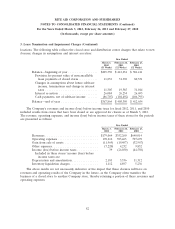

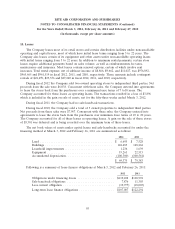

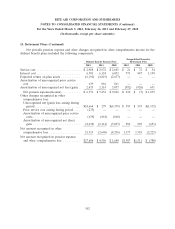

9. Indebtedness and Credit Agreement (Continued)

holder of such debt to accelerate the maturity or require the repurchase of such debt. The August 2010

amendments to the senior secured credit facility exclude the mandatory repurchase of the 8.5%

convertible notes due 2015 from this event of default.

Substantially all of Rite Aid Corporation’s 100 percent owned subsidiaries guarantee the

obligations under the senior secured credit facility. The subsidiary guarantees of the senior secured

credit facility; the 9.75% senior secured notes due 2016 and the 8.00% senior secured notes due 2020

are secured by a senior lien on, among other things, accounts receivable, inventory and prescription

files of the subsidiary guarantors. Rite Aid Corporation is a holding company with no direct operations

and is dependent upon dividends, distributions and other payments from its subsidiaries to service

payments due under the senior secured credit facility. The Company’s 10.375% senior secured notes

due 2016, the 7.5% senior secured notes due 2017 and the 10.25% senior secured notes due 2019 are

secured on a second priority basis by the same collateral that secures the senior secured credit facility,

the 9.75% senior secured notes due 2016 and the 8.00% senior secured notes due 2020. The 8.625%

senior notes due 2015, the 9.375% senior notes due 2015 and the 9.5% senior notes due 2017 are

guaranteed by substantially all of the Company’s 100 percent owned subsidiaries on an unsecured basis.

The subsidiary guarantees related to the Company’s senior secured credit facility and secured

guaranteed notes and, on an unsecured basis, the unsecured guaranteed notes are full and

unconditional and joint and several, and there are no restrictions on the ability of the Company to

obtain funds from its subsidiaries. Also, the Company has no independent assets or operations, and

subsidiaries not guaranteeing the credit facility and applicable notes are minor. Accordingly, condensed

consolidating financial information for the Company and subsidiaries is not presented.

The indentures that govern the Company’s secured and guaranteed unsecured notes contain

restrictions on the amount of additional secured and unsecured debt that can be incurred by the

Company. As of March 3, 2012, the amount of additional secured and unsecured debt that could be

incurred under these indentures was $1,006,200 (which does not include the ability to enter into certain

sale and leaseback transactions.) However, the Company could not incur any additional secured debt

assuming a fully drawn revolver and the outstanding letters of credit. The ability to issue additional

unsecured debt under these indentures is governed by an interest coverage ratio test.

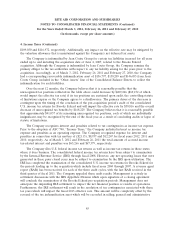

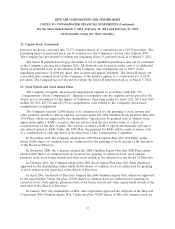

Other 2012 Transactions

On February 14, 2012, the Company issued $481,000 of its 9.25% senior notes due March 2020.

These notes are unsecured, unsubordinated obligations of Rite Aid Corporation and rank equally in

right of payment with all other unsubordinated indebtedness. The Company’s obligations under the

notes are fully and unconditionally guaranteed, jointly and severally, on an unsubordinated basis, by all

of its subsidiaries that guarantee our obligations under its senior secured credit facility and its

unsecured outstanding 8.00% senior secured notes due 2020, 9.75% senior secured notes due 2016,

10.375% senior secured notes due 2016, 7.5% senior secured notes due 2017, 10.25% senior secured

notes due 2019, 9.375% senior notes due 2015 and 9.5% senior notes due 2017. The proceeds of the

notes, together with available cash, were used to repurchase and repay the 8.625% senior notes due

March 2015. In February 2012, the Company completed a tender offer for the 8.625% notes in which

92