Rite Aid 2012 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2012 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Overview

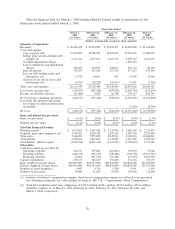

Net loss for fiscal 2012 was $368.6 million or $0.43 per basic and diluted share, compared to net

loss for fiscal 2011 of $555.4 million or $0.64 per basic and diluted share and a net loss for fiscal 2010

of $506.7 million or $0.59 per basic and diluted share. Our operating results are described in detail in

the Results of Operations section of this Item 7. Some of the key factors that impacted our results in

fiscal 2012, 2011 and 2010 are summarized as follows:

Sales Trends: Our revenue growth for fiscal 2012 was 3.6% compared to revenue declines of 1.8%

and 2.4% for fiscal 2011 and 2010, respectively.

Lease termination and impairment charges: We recorded lease terminations and impairment

charges of $100.1 million in fiscal 2012 compared to $210.9 million and $208.0 million in fiscal 2011

and 2010, respectively.

LIFO Charges: We record the value of our inventory on the Last-In, First-Out (LIFO) method.

We recorded non-cash LIFO charges of $188.7 million, $44.9 million and $88.5 million in fiscal 2012,

2011 and 2010, respectively. The higher LIFO charge this year is due to higher inflation on both

pharmacy and front end products.

Debt Refinancing: In fiscal 2012, we continued to take steps to extend the terms of our debt and

obtain more flexibility. In March 2011, we entered into a new $343.0 million Tranche 5 Term Loan

under our senior secured credit facility, the proceeds of which were used to repay and retire all

borrowings under our Tranche 3 Term Loans. In connection with the Tranche 3 Term Loan repayment

and retirement we recorded a loss on debt modification of $22.4 million during the first quarter of

fiscal 2012 due to the write off of debt issue costs of $2.7 million and unamortized original issuance

discount of $19.7 million.

In August 2011, we repurchased $41.0 million of our 8.625% senior notes due March 2015,

$5.0 million of our 9.375% senior notes due December 2015 and $4.5 million of our 6.875% senior

debentures due August 2013. These repurchases resulted in a gain in the second quarter of fiscal 2012

of $5.0 million.

In February 2012, we issued $481.0 million of our 9.25% senior notes due March 2020. These

notes are unsecured, unsubordinated obligations of Rite Aid Corporation and rank equally in right of

payment with all other unsubordinated indebtedness. Our obligations under the notes are fully and

unconditionally guaranteed, jointly and severally, on an unsecured unsubordinated basis, by all of our

subsidiaries that guarantee our obligations under our senior secured credit facility and our outstanding

8.00% senior secured notes due 2020, 9.75% senior secured notes due 2016, 10.375% senior secured

notes due 2016, 7.5% senior secured notes due 2017, 10.25% senior secured notes due 2019, 9.375%

senior notes due 2015 and 9.5% senior notes due 2017. The proceeds of the notes, together with

available cash, were used to repurchase and repay all of the outstanding 8.625% senior notes due

March 2015. In February 2012, we completed a tender offer for the 8.625% notes in which

$404.8 million aggregate principal amount of the outstanding 8.625% notes were tendered and

repurchased by us. In February 2012, we called for the redemption of the remaining 8.625% notes. We

redeemed the remaining 8.625% notes in March 2012 for $55.7 million which included the call

premium and interest through the call date. The refinancing resulted in a loss in the fourth quarter of

fiscal 2012 of $16.1 million.

These transactions are described in more detail in the ‘‘Liquidity and Capital Resources’’ section

below.

27