Red Lobster 1999 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 1999 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes

to Consolidated Financial Statements

40

be issued under this plan, and all options have an exer-

cise price equal to the fair market value of the shares at

the date of grant. The Darden Restaurants Compensation

Plan for Non-Employee Directors provides that non-

employee directors may elect to receive their annual

retainer and meeting fees in cash, deferred cash or

shares of common stock. The common stock issuable

under the plan shall have a fair market value equivalent

to the value of the foregone retainer and meeting fees.

Fifty thousand shares of common stock are authorized

for issuance under the plan.

The per share weighted-average fair value of stock

options granted during 1999, 1998 and 1997 was

$10.21, $8.03 and $2.88, respectively. These amounts

were determined using the Black Scholes option-pricing

mode,l which values options based on the stock price

at the grant date, the expected life of the option, the

estimated volatility of the stock, expected dividend pay-

ments, and the risk-free interest rate over the expected

life of the option. The dividend yield was calculated by

dividing the current annualized dividend by the option

price for each grant. The expected volatility was deter-

mined considering stock prices for the fiscal year the

grant occurred and prior fiscal years, as well as consid-

ering industry volatility data. The risk-free interest rate

was the rate available on zero-coupon U.S. government

issues with a term equal to the remaining term for each

grant. The expected life of the option was estimated

based on the exercise history from previous grants.

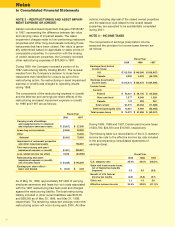

The assumptions used in the Black Scholes model were

as follows:

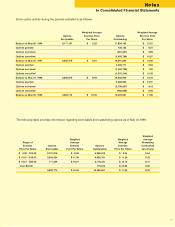

Stock Options

Granted in Fiscal Year

1999 1998 1997

Risk-free interest rate 5.60% 6.25% 6.70%

Expected volatility of stock 30.0% 25.0% 22.5%

Dividend yield 0.1% 0.1% 0.1%

Expected option life 6.0 years 5.0 years 6.5 years

The expected option-life decrease from 1997 to 1998

resulted principally from a change in the vesting period

of Company options from five years to four years. The

expected option-life increase from 1998 to 1999 resulted

principally from the expectation that employees will hold

their options longer because of a recent history of

consistent Company stock price increases. Since the

Company is a relatively new public company, the

expected option life may continue to vary as the

Company builds a history of employee exercise habits.

The Company applies APB 25 in accounting for its stock

option plans and, accordingly, no compensation cost has

been recognized for its stock options in the Company’s

financial statements for stock options granted under

any of its stock plans. Had the Company determined

compensation cost based on the fair value at the

grant date for its stock options under SFAS 123, the

Company’s net earnings (loss) and net earnings (loss)

per share would have been reduced to the pro forma

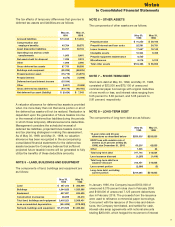

amounts indicated below:

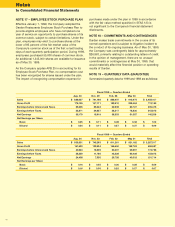

Fiscal Year

1999 1998 1997

Net earnings (loss)

As reported $ 140,538 $ 101,714 $ (91,029)

Pro forma $ 134,527 $ 98,047 $ (93,154)

Basic net earnings

(loss) per share

As reported $ 1.02 $ 0.69 $ (0.59)

Pro forma $ 0.98 $ 0.66 $ (0.60)

Diluted net earnings

(loss) per share

As reported $ 0.99 $ 0.67 $ (0.59)

Pro forma $ 0.95 $ 0.65 $ (0.60)

Under SFAS 123, stock options granted prior to 1996

are not required to be included as compensation in

determining pro forma net earnings (loss). To determine

pro forma net earnings (loss), reported net earnings (loss)

have been adjusted for compensation costs associated

with stock options granted during 1999, 1998 and 1997

that are expected to eventually vest.