Red Lobster 1999 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 1999 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes

to Consolidated Financial Statements

32

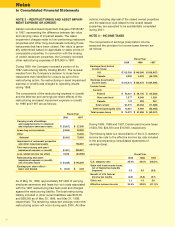

I. Income Taxes

The Company provides for federal and state income

taxes currently payable, as well as for those deferred

because of temporary differences between reporting

income and expenses for financial statement purposes

and income and expenses for tax purposes. Federal

income tax credits are recorded as a reduction of income

taxes. Deferred tax assets and liabilities are recognized

for the future tax consequences attributable to differ-

ences between the financial statement carrying amounts

of existing assets and liabilities and their respective tax

bases. Deferred tax assets and liabilities are measured

using enacted tax rates expected to apply to taxable

income in the years in which those temporary differences

are expected to be recovered or settled. The effect on

deferred tax assets and liabilities of a change in tax rates

is recognized in income in the period that includes the

enactment date.

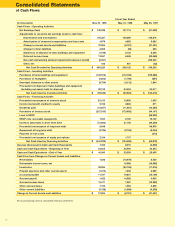

J. Statements of Cash Flows

For purposes of the consolidated statements of cash

flows, amounts receivable from credit card companies

and investments purchased with a maturity of three

months or less are considered cash equivalents.

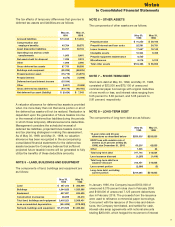

K. Net Earnings (Loss) Per Share

In February 1997, the Financial Accounting Standards

Board issued Statement of Financial Accounting

Standards No. 128 (SFAS 128), “Earnings Per Share,”

which requires presentation of basic and diluted earnings

per share. Basic earnings per share is computed by

dividing income available to common shareholders by

the weighted-average number of common shares

outstanding for the reporting period. Diluted earnings per

share reflects the potential dilution that could occur if

securities or other contracts to issue common stock

were exercised or converted into common stock. As

required, the Company adopted the provisions of

SFAS 128 during 1998. All prior year weighted-average

and per share information has been restated in accor-

dance with SFAS 128. Outstanding stock options issued

by the Company represent the only dilutive effect reflected

in diluted weighted-average shares.

Options to purchase 120,200 and 868,300 shares

of common stock were excluded from the calculation

of diluted earnings per share for the years ended

May 30, 1999, and May 31, 1998, respectively, because

their exercise prices exceeded the average market price

of common shares for the period. All options were

excluded from the calculation of diluted earnings per

share for the year ended May 25, 1997, because their

inclusion would have been anti-dilutive.

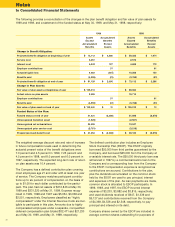

L. Derivative Financial and Commodity Instruments

On January 31, 1997, the Securities and Exchange

Commission (SEC) issued amended disclosure rules for

derivatives and exposures to market risk from derivative

and other financial and certain commodity instruments.

Enhanced accounting policy disclosures in accordance

with this SEC release follow.

The Company may, from time to time, use financial and

commodities derivatives in the management of interest

rate and commodities pricing risks that are inherent in

its business operations. The Company may also use

financial derivatives as part of its stock repurchase

program as described in Note 10. Such instruments are

not held or issued for trading or speculative purposes.

The Company may, from time to time, use interest-rate

swap and cap agreements in the management of interest

rate exposure. The interest rate differential to be paid or

received is normally accrued as interest rates change,

and is recognized as a component of interest expense

over the life of the agreements. If an agreement is termi-

nated prior to the maturity date and is characterized as a

hedge, any accrued rate differential would be deferred

and recognized as interest expense over the life of the

hedged item. The Company uses commodities hedging

instruments, including forwards, futures and options, to

reduce the risk of price fluctuations related to future raw

materials requirements for commodities such as coffee,

soybean oil and shrimp. The terms of such instruments

generally do not exceed 12 months, and depend on the

commodity and other market factors. Deferred gains and

losses are subsequently recorded as cost of products

sold in the statements of earnings (loss) when the

inventory is sold. If the inventory is not acquired and

the hedge is disposed of, the deferred gain or loss is

recognized immediately in cost of products sold. The

Company believes that it does not have material risk

from any of the above financial instruments, and the

Company does not anticipate any material losses from

the use of such instruments.

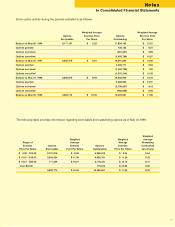

M. Use of Estimates

The preparation of financial statements in conformity

with generally accepted accounting principles requires

management to make estimates and assumptions that

affect the reported amounts of assets and liabilities and

disclosure of contingent assets and liabilities at the date

of the financial statements, and the reported amounts of

revenues and expenses during the reporting period.

Actual results could differ from those estimates.