Red Lobster 1999 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 1999 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes

to Consolidated Financial Statements

37

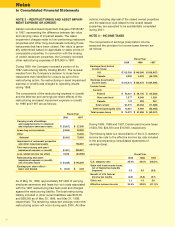

The components of interest, net are as follows:

Fiscal Year

1999 1998 1997

Interest expense $ 21,015)$ 21,527)$ 23,336)

Capitalized interest (593) (1,018) (739)

Interest income (882) (425) (306)

Interest, net $ 19,540)$ 20,084)$ 22,291)

NOTE 13 – LEASES

An analysis of rent expense by property leased (all

of which are accounted for as operating leases) is

as follows:

Fiscal Year

1999 1998 1997

Restaurant minimum rent $ 38,866 $ 39,140)$ 40,616

Restaurant percentage rent 1,853 1,707)1,649

Restaurant equipment

minimum rent 8,511 3,465)

Restaurant rent

averaging expense 13 (121) 595

Transportation equipment 1,856 2,169)1,951

Office equipment 1,012 990)915

Office space 505 436)406

Warehouse space 215 217)235

Total rent expense $ 52,831 $ 48,003)$ 46,367

Minimum rental obligations are accounted for on a

straight-line basis over the term of the lease. Percentage

rent expense is generally based on sales levels or

changes in the Consumer Price Index. Most leases

require payment of property taxes, insurance and

maintenance costs in addition to the rent payments.

The annual non-cancelable future lease commitments

for each of the five years subsequent to May 30, 1999,

and thereafter are: $51,035 in 2000; $47,518 in 2001;

$43,940 in 2002; $36,981 in 2003; $24,729 in 2004; and

$89,869 thereafter, for a cumulative total of $294,072.

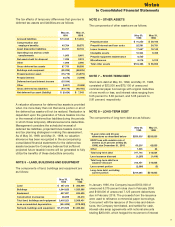

NOTE 14 – RETIREMENT PLANS

The Company has a defined benefit plan covering most

salaried employees and a group of hourly employees

with a frozen level of benefits. Benefits for salaried

employees are based on length of service and final

average compensation. The hourly plan provides a

monthly amount for each year of credited service. The

Company’s funding policy is consistent with the funding

requirements of federal law and regulations. Plan assets

consist principally of listed equity securities, corporate

obligations and U.S. government securities.

Components of net periodic benefit cost (income) are

as follows:

Fiscal Year

1999 1998 1997

Service cost $ 3,251)$ 2,576)$ 3,250)

Interest cost 5,243)4,699)4,686)

Expected return on

plan assets (10,247) (8,865) (8,318)

Amortization of unrecognized

transition asset (642) (642) (642)

Amortization of unrecognized

prior service cost (456) (456)

Recognized net actuarial loss 1,088)1,164)1,864)

Net periodic benefit

cost (income) $ (1,763) $ (1,524) $ 840)