Red Lobster 1999 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 1999 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes

to Consolidated Financial Statements

31

(Dollar amounts in thousands, except per share data)

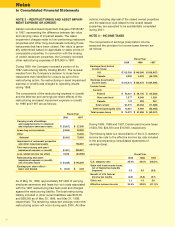

NOTE 1 – SUMMARY OF SIGNIFICANT

ACCOUNTING POLICIES

A. Principles of Consolidation

The accompanying 1999, 1998 and 1997 consolidated

financial statements include the operations of Darden

Restaurants, Inc. and its wholly owned subsidiaries

(Darden or the Company). All significant intercompany

balances and transactions have been eliminated in

consolidation. Prior to 1996, the Company was a wholly-

owned subsidiary of General Mills, Inc. (General Mills).

The common shares of Darden were distributed by

General Mills to its stockholders as of May 28, 1995.

Darden’s fiscal year ends on the last Sunday in May.

Fiscal years 1999 and 1997 each consisted of 52 weeks.

Fiscal year 1998 consisted of 53 weeks.

B. Inventories

Inventories are valued at the lower of cost or market

value, using the “weighted average cost” method.

C. Land, Buildings and Equipment

All land, buildings and equipment are recorded at cost.

Building components are depreciated over estimated

useful lives ranging from seven to 40 years using the

straight-line method. Equipment is depreciated over esti-

mated useful lives ranging from three to ten years also

using the straight-line method. Accelerated depreciation

methods are generally used for income tax purposes.

In accordance with Statement of Financial Accounting

Standards No. 121, “Accounting for the Impairment of

Long-Lived Assets and for Long-Lived Assets to Be

Disposed Of,” the Company periodically reviews restau-

rant sites and certain identifiable intangibles for impair-

ment whenever events or changes in circumstances

indicate that the carrying amount of an asset may not

be recoverable. Recoverability of assets to be held and

used is measured by a comparison of the carrying

amount of an asset to future net cash flows expected to

be generated by the asset. If such assets are considered

to be impaired, the impairment to be recognized is

measured by the amount by which the carrying amount

of the assets exceed the fair value of the assets.

Restaurant sites and certain identifiable intangibles to

be disposed of are reported at the lower of the carrying

amount or fair value, less estimated costs to sell.

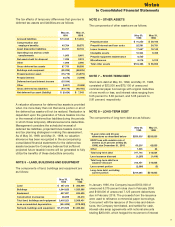

D. Intangible Assets

The cost of intangible assets at May 30, 1999, and

May 31, 1998, amounted to $14,851 and $14,594,

respectively. These costs are being amortized using the

straight-line method over their estimated useful lives

ranging from five to 40 years. Costs capitalized principally

represent the purchase costs of leases with favorable

rent terms. Accumulated amortization on intangible

assets as of May 30, 1999, and May 31, 1998, amounted

to $4,347 and $5,135, respectively. The Audit Committee

of the Board of Directors annually reviews intangible

assets. At its meeting on June 21, 1999, the Board of

Directors affirmed that the carrying amounts of these

assets have continuing value.

E. Liquor Licenses

The costs of obtaining non-transferable liquor licenses

that are directly issued by local government agencies for

nominal fees are expensed in the year incurred. The

costs of purchasing transferable liquor licenses through

open markets in jurisdictions with a limited number of

authorized liquor licenses for fees in excess of nominal

amounts are capitalized. If there is permanent impairment

in the value of a liquor license due to market changes,

the asset is written down to its net realizable value.

Annual liquor license renewal fees are expensed.

F. Foreign Currency Translation

The Canadian dollar is the functional currency for the

Canadian restaurant operations. Assets and liabilities

are translated using the exchange rates in effect at the

balance sheet date. Results of operations are translated

using the average exchange rates prevailing throughout

the period. Translation gains and losses are accumulated

in a cumulative foreign currency adjustment account

included within other comprehensive income as a sepa-

rate component of stockholders’ equity. Gains and losses

from foreign currency transactions are generally included

in the consolidated statements of earnings (loss) for

each period.

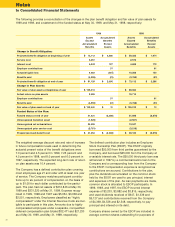

G. Pre-Opening Costs

Prior to 1998, the Company capitalized the direct and

incremental costs associated with the opening of new

restaurants. These costs were amortized over a one-

year period from the restaurant opening date. During

1998, the Company adopted the accounting practice

of expensing these costs as incurred. This change in

accounting method did not have a significant impact on

the Company’s financial position or results of operations.

H. Advertising

Production costs of commercials and programming are

charged to operations in the year the advertising is first

aired. The costs of other advertising, promotion and mar-

keting programs are charged to operations in the year

incurred. Advertising expense was $180,563, $186,261

and $204,321, in 1999, 1998 and 1997, respectively.