Red Lobster 1999 Annual Report Download

Download and view the complete annual report

Please find the complete 1999 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

Darden Restaurants, Inc. (Darden or the Company) was

created as an independent, publicly held company in

May 1995 through the spin-off of all of General Mills’

restaurant operations to its shareholders. Darden

operates 1,139 Red Lobster, Olive Garden and Bahama

Breeze restaurants in the U.S. and Canada and licenses

38 restaurants in Japan. All of the restaurants in the

U.S. and Canada are operated by the Company with

no franchising.

This discussion should be read in conjunction with the

business information and the consolidated financial

statements and related notes found elsewhere in this

report. Darden’s fiscal year ends on the last Sunday

in May.

REVENUES

Total revenues in 1999 (52 weeks) were $3.46 billion,

a five percent increase from 1998 (53 weeks). Total

revenues in 1998 were $3.29 billion, a four percent

increase from 1997.

COSTS AND EXPENSES

Food and beverage costs for 1999 were 32.8 percent

of sales, a decrease of 0.2 percentage points from 1998

and a decrease of 1.2 percentage points from 1997. The

higher level of food and beverage costs for 1997, as a

percentage of sales, primarily resulted from the reposi-

tioning strategy at Red Lobster, initiated in 1997’s sec-

ond quarter, that lowered check averages and improved

food by providing larger portions and enhancing food

quality and presentation. Profit margins increased during

1999 and 1998 primarily as a result of increased sales,

higher margin food items and favorable food costs.

Restaurant labor was comparable year to year at

32.3 percent of sales in 1999 against 32.3 percent in

1998 and 32.1 percent in 1997.

Restaurant expenses (primarily lease expenses, property

taxes, utilities and workers’ compensation costs)

decreased in 1999 to 14.3 percent of sales compared

to 14.7 percent in 1998 and 15.2 percent in 1997. The

1999 and 1998 decreases resulted primarily from

increased sales levels.

Selling, general and administrative expenses declined in

1999 to 10.4 percent of sales compared to 10.9 percent

in 1998 and 11.4 percent in 1997. The 1999 and 1998

declines resulted from an overall decrease in marketing

costs each year and increased sales levels.

Depreciation and amortization expense of 3.6 percent of

sales in 1999 decreased from 3.8 percent in 1998 and

4.3 percent in 1997. The 1999 and 1998 decreases

resulted from increased sales levels, restaurant closings

and asset impairment write-downs that occurred during

1997’s fourth quarter. Interest expense of 0.6 percent of

sales in 1999 and 1998 decreased from 0.7 percent in 1997.

INCOME FROM OPERATIONS

Pre-tax earnings before restructuring credit increased

by 35 percent in 1999 to $207.4 million, compared to

$153.7 million in 1998 and $75.4 million before restruc-

turing and asset impairment charges in 1997. The

increase in 1999 was mainly attributable to annual

same-restaurant sales increases in the U.S. for both

Red Lobster and Olive Garden totaling 7.4 percent and

9.0 percent, respectively. Red Lobster and Olive Garden

have enjoyed six and 19 consecutive quarters of

same-restaurant sales increases, respectively. The

increase in 1998 was mainly attributable to substantially

higher earnings at Red Lobster resulting from actions

beginning in the second quarter of 1997 intended to

enhance long-term performance through new menu

items, bolder

flavors, more choices at lower prices and

service

improvements. Olive Garden also posted a solid

increase in earnings in 1998. Fiscal 1998 same-restaurant

sales increases in the U.S. for Red Lobster and Olive

Garden totaled 2.5 percent and 8.3 percent, respectively.

PROVISION FOR INCOME TAXES

The effective tax rate for 1999 before restructuring credit

was 34.8 percent compared to 33.8 percent in 1998 and

27.9 percent before restructuring and asset impairment

charges in 1997. The higher effective tax rate in 1999

resulted from higher pre-tax earnings. The 34.9 percent

rate in 1999, after restructuring credit, compared to

1998’s 33.8 percent rate and to 1997’s 41.1 percent

benefit after restructuring and asset impairment charges.

The unusual effective rate in 1997 resulted from operating

losses combined with federal income tax credits, both of

which created an income tax benefit.

NET EARNINGS AND NET EARNINGS PER

SHARE BEFORE RESTRUCTURING AND ASSET

IMPAIRMENT EXPENSE OR (CREDIT)

Net earnings before restructuring credit for 1999 of

$135.3 million or 96 cents per diluted share increased

33 percent, compared to 1998 net earnings of

$101.7 million or 67 cents per diluted share. 1998 net

earnings increased 87 percent, compared to net earnings

before restructuring and asset impairment charges for

1997 of $54.3 million or 35 cents per diluted share.

NET EARNINGS (LOSS) AND NET EARNINGS

(LOSS) PER SHARE

Net earnings after restructuring credit for 1999 of

$140.5 million (99 cents per diluted share) compared

with 1998’s net earnings of $101.7 million (67 cents per

diluted share) and 1997’s net loss after restructuring and

asset impairment charges of $(91.0) million (59 cents per

diluted share).

Management’s Discussion

of Results of Operations and Financial Condition

Table of contents

-

Page 1

...Results of Operations and Financial Condition Darden Restaurants, Inc. (Darden or the Company) was created as an independent, publicly held company in May 1995 through the spin-off of all of General Mills' restaurant operations to its shareholders. Darden operates 1,139 Red Lobster, Olive Garden and... -

Page 2

... of buildings and equipment prior to their disposal, lease buy-out provisions, employee severance and other costs. Cash required to carry out these activities is being provided by operations and the sale of closed properties (see Note 3 of Notes to Consolidated Financial Statements). During 1999, an... -

Page 3

... of Operations and Financial Condition In 1999, the Company declared eight cents per share in annual dividends paid in two installments. In December 1998, the Company's Board approved an additional authorization for the ongoing stock buy-back plan whereby the Company may purchase on the open market... -

Page 4

... the Year 2000 readiness of suppliers, banks, vendors and others having a direct or indirect business relationship with the Company. Report of Management Responsibilities The management of Darden Restaurants, Inc. is responsible for the fairness and accuracy of the consolidated financial statements... -

Page 5

... sheets of Darden Restaurants, Inc. and subsidiaries as of May 30, 1999, and May 31, 1998, and the related consolidated statements of earnings (loss), changes in stockholders' equity, and cash flows for each of the years in the three-year period ended May 30, 1999. These consolidated financial... -

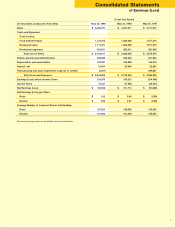

Page 6

...expense or (credit) Total Costs and Expenses Earnings (Loss) before Income Taxes Income Taxes Net Earnings (Loss) Net Earnings (Loss) per Share: Basic Diluted Average Number of Common Shares Outstanding: Basic Diluted See accompanying notes to consolidated financial statements. May 30, 1999 $ 3,458... -

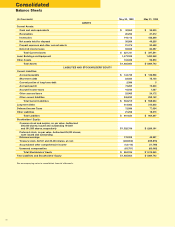

Page 7

... issued and outstanding Retained earnings Treasury stock, 32,541 and 20,434 shares, at cost Accumulated other comprehensive income Unearned compensation Total Stockholders' Equity Total Liabilities and Stockholders' Equity See accompanying notes to consolidated financial statements. May 30, 1999... -

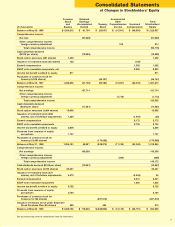

Page 8

... benefit credited to equity Proceeds from issuance of equity put options Purchases of common stock for treasury (12,162 shares) Issuance of treasury stock under Employee Stock Purchase Plan (55 shares) Balance at May 30, 1999 $1,328,796 See accompanying notes to consolidated financial statements... -

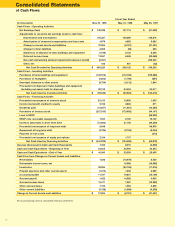

Page 9

...Change in other liabilities (Gain) loss on disposal of land, buildings and equipment Deferred income taxes Non-cash restructuring and asset impairment expense or (credit) Other, net Net Cash Provided by Operating Activities Cash Flows - Investing Activities Purchases of land, buildings and equipment... -

Page 10

... the restaurant opening date. During 1998, the Company adopted the accounting practice of expensing these costs as incurred. This change in accounting method did not have a significant impact on the Company's financial position or results of operations. H. Advertising Production costs of commercials... -

Page 11

...this SEC release follow. The Company may, from time to time, use financial and commodities derivatives in the management of interest rate and commodities pricing risks that are inherent in its business operations. The Company may also use financial derivatives as part of its stock repurchase program... -

Page 12

... for reporting information about a company's operating segments. It also establishes standards for related disclosures about products and services, geographic areas and major customers. As of May 30, 1999, the Company operated 1,139 Red Lobster, Olive Garden and Bahama Breeze restaurants in... -

Page 13

...,672 Fiscal Year 1999 Carrying costs of buildings and equipment prior to disposal and employee severance costs Lease buy-out provisions Other Subtotal Impairment of restaurant properties and other long-lived assets Total restructuring and asset impairment expense or (credit) Less related income tax... -

Page 14

... financial statements for the deferred tax assets because the Company believes that sufficient projected future taxable income will be generated to fully utilize the benefits of these deductible amounts. NOTE 8 - LONG-TERM DEBT The components of long-term debt are as follows: May 30, 1999 10-year... -

Page 15

...May 30, 1999, no equity put options were outstanding. NOTE 11 - STOCKHOLDERS' RIGHTS PLAN The Company has a stockholders' rights plan that entitles each holder of Company common stock to purchase one-hundredth of one share of Darden preferred stock for each common share owned at a purchase price of... -

Page 16

... employees with a frozen level of benefits. Benefits for salaried employees are based on length of service and final average compensation. The hourly plan provides a monthly amount for each year of credited service. The Company's funding policy is consistent with the funding requirements of federal... -

Page 17

... 1998, and a statement of the funded status at May 30, 1999, and May 31, 1998, respectively: 1999 Assets Exceed Accumulated Benefits Change in Benefit Obligation: Projected benefit obligation at beginning of year Service cost Interest cost Employer contributions Actuarial (gain) loss Benefits paid... -

Page 18

... based on years of service. Components of net periodic post-retirement benefit cost are as follows: NOTE 16 - STOCK PLANS The Darden Restaurants Stock Option and Long-Term Incentive Plan of 1995 provides for the granting of stock options to key employees at a price equal to the fair market value of... -

Page 19

Notes to Consolidated Financial Statements be issued under this plan, and all options have an exercise price equal to the fair market value of the shares at the date of grant. The Darden Restaurants Compensation Plan for Non-Employee Directors provides that nonemployee directors may elect to receive... -

Page 20

...37 9.12 9.36 11.35 The following table provides information regarding exercisable and outstanding options as of May 30,1999: Range of Exercise Price Per Share $ 5.00 - $10.00 Options Exercisable 2,121,916 3,534,524 177,334 Weighted Average Exercise Price Per Share $ 8.69 $ 11.39 $ 15.61 Options... -

Page 21

Notes to Consolidated Financial Statements NOTE 17 - EMPLOYEE STOCK PURCHASE PLAN Effective January 1, 1999, the Company adopted the Darden Restaurants Employee Stock Purchase Plan to provide eligible employees who have completed one year of service an opportunity to purchase shares of its common ... -

Page 22

...and Equipment Working Capital (deficit) Long-term Debt Stockholders' Equity Stockholders' Equity per Share Other Statistics Cash Flow from Operations Capital Expenditures Dividends Paid Dividends Paid per Share Advertising Expense Number of Employees Number of Restaurants Stock Price: High Low Close... -

Page 23

...sports cars in American LeMans Series Championship races around the nation. When the series held a race in Atlanta this spring, for instance, Olive Garden donated a 24-foot refrigerated truck and 500 cases of food to the Atlanta Community Food Bank, and provided more than 200 meals to needy families... -

Page 24

... year in a row, rated PACE number one out of 491 such agencies in Florida). Darden Restaurants Foundation has been a long-time supporter of this uniquely successful program. Dennis Franz (second from right), Emmy-award winning actor and star of ABC-TV's NYPD Blue and Red Lobster's EVP of Marketing... -

Page 25

... (PEC) The nation's oldest incorporated African-American community, Eatonville, Florida, is located near Darden's Restaurant Support Center in Orlando. To help preserve and promote the area's rich heritage, both the Foundation and Corporation support the Association to Preserve the Eatonville... -

Page 26

... Sports Authority, Inc. Blaine Sweatt, III President, New Business Development and Executive Vice President, Darden Restaurants, Inc. *Retiring 9/23/99 ** Effective 6/21/99 Corporate Officers Linda J. Dimopoulos Senior Vice President, Corporate Controller and Business Information Systems Gary... -

Page 27

... Annual Meeting of Shareholders will be held at 4 p.m. Eastern Daylight Time, Thursday, September 23, 1999, at the Orlando Science Center's Darden Adventure Theater, 777 East Princeton Street, Orlando, Florida. MARKETS New York Stock Exchange Stock Exchange Symbol: DRI WEB SITE ADDRESSES www.darden... -

Page 28