Polaris 2013 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2013 Polaris annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

But just as many of our customers value

performance and handling over paint schemes

and chassis designs, we pay as much attention

to developing efficient and effective business

processes as we do the resulting numbers.

We constantly strive to increase our products’

performance, and we are relentless about applying

that same focus to accelerate improvement across

every aspect of our rapidly diversifying business.

2013 was a good year for Polaris, but every one

of us knows that we must, and will, execute

muchbetter.

This report highlights the exciting progress

we’re making toward our strategic objectives,

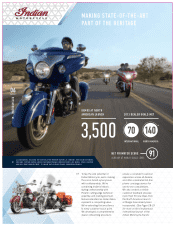

from launching the amazing RZR XP® 1000 and

the awesome Indian® Chieftain™ to expanding

our global footprint via the construction of new

assembly plants in India and Poland. However,

one simple number—10.1 percent—best

represents the progress we’ve made over the

past five years. In 2009, we set a goal to expand

net income margin from 6percent to 10percent

by 2018. With typical Polaris vigor, our teams

relentlessly pursued margin opportunities:

they moved plants and lowered product costs,

improved productivity and leveraged overhead,

value engineered vehicles, and capturedprice.

Achieving our net margin goal five years early, in

conjunction with our accelerated revenue growth,

coincides nicely with the exponential expansion

our market capitalization has undergone. While

we’re certainly pleased with our progress, there are

clear justifications for our intense motivation to be

better: wemust improve project execution, quality

and speed; lower inventories and warranty costs;

and generate significant returns on numerous

investments that have, in some cases, diluted our

margins over the pastfewyears.

Fundamental to our success is an unrelenting

focus on achieving our five strategic objectives.

(See Objectives on Page 5.) By most any measure,

Polaris’ performance has been outstanding over

the past four years. But as our business evolves,

our vision, strategy statements, guiding principles

and performance priorities also evolve, and

continue to provide the North Star that guides our

investment decisions and execution.

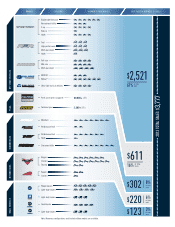

THE BEAUTY OF THE POLARIS VEHICLES GRACING THESE PAGES NICELY

COMPLEMENTS THE RECORD NUMBERS AND PROPERLY SLOPED GRAPHS THAT

ALSO REPRESENT OUR BUSINESS. FOR THE FOURTH CONSECUTIVE YEAR, OUR

TALENTED AND DEDICATED EMPLOYEES LEVERAGED INNOVATION AND PLAIN

HARD WORK TO GENERATE RECORD SALES AND EARNINGS GROWTH.

DEAR SHAREHOLDERS,

SCOTT W. WINE & BENNETT J. MORGAN

02

SHAREHOLDER LETTER