Omron 2001 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2001 Omron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6 Omron Corporation

Return on Equity of 10%

To reach this target, management will focus on earnings by directing

investment capital totaling ¥120 billion toward Omron’s high-earnings core

businesses in the Industrial Automation Company and Electronic

Components Company. This represents 60 percent of Omron’s total projected

cumulative investments over the four-year period to March 2005.

Accelerating Corporate Divestitures and Establishing a Holding Company

Omron Corporation will become a holding company, and all present

businesses will become autonomous companies with strategically based

positions.

Listing on New York and Other Overseas Stock Exchanges

As a means of raising recognition of Omron as a global company and

implementing corporate governance that is highly evaluated among

international investors, Omron aims to list its stock on the New York

Stock Exchange and other overseas stock exchanges.

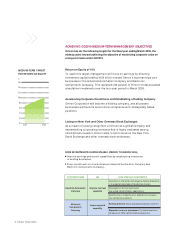

ACHIEVING GD2010 MEDIUM-TERM MANAGEMENT OBJECTIVES

Omron has set the following targets for the fiscal year ending March 2005, the

midway point toward achieving the objective of maximizing corporate value on

a long-term basis under GD2010.

MEDIUM-TERM TARGET

FOR RETURN ON EQUITY

%

0

2

4

6

8

10

12

14

16

3/01 3/05

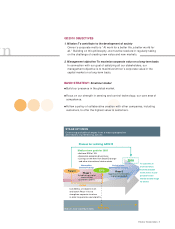

CORE INVESTMENTS DURING PHASE I (PERIOD TO MARCH 2005)

●Improve earnings and growth capabilities by emphasizing investment

in existing businesses.

●Focus investments on core businesses (Industrial Automation Company and

Electronic Components Company).

INVESTMENT AREA AIM CORE STRATEGIC INVESTMENTS

Investment in information technology to improve productivity

in management/development /production divisions

Industrial Automation Improve earnings Development of new businesses

Company capability Advanced sensors/Safety applications

Build business model by user segments to increase

the number of customers

Electronic Improve growth Existing business: Build up global production systems

Components capability

Company Expansion into new businesses: IT-related electronic

components (fiber optics/mobile equipment)