Omron 2001 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2001 Omron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 Omron Corporation

To Our Shareholders

Consolidated net sales increased 7.0 percent year-on-year to ¥594.3 billion.

Profits were affected by negative factors including temporary expenses associated

with the consolidation of offices, asset impairment costs resulting from the weak

domestic stock market, and exchange rate changes. Despite these factors, the

increase in net sales and a lower cost-of-sales margin led to a 90.3 percent increase

in consolidated income before income taxes and minority interests to ¥40.0 billion

and a 92.9 percent gain in net income to ¥22.3 billion, both up significantly over the

previous fiscal year. Return on equity improved from 3.5 percent to 6.7 percent.

This increase in earnings was driven by several factors. First, we realized the

benefits from our shift to a more customer-oriented approach by emphasizing the

solutions-providing business, particularly in the Industrial Automation Company.

Additional factors included a turnaround in the domestic economy led by IT-related

investment; a continuation of the strong economic climate overseas, particularly in

the United States; and increased sales for the Industrial Automation Company and

the Electronic Components Company. Moreover, the internal company system

introduced in April 1999 has resulted in even greater enthusiasm for achieving

performance objectives, because it spurs each internal company to reach its profit

and cash flow targets and engenders a stronger sense of competition among the

companies.

YOSHIO TATEISI

Representative Director and

Chief Executive Officer

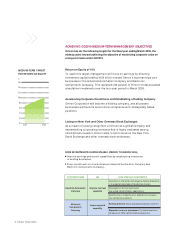

PERFORMANCE:

SIGNIFICANT GAIN IN PROFITS

A core objective for Omron in the year ended March 31, 2001, the first year of our Eighth Medium-Term Management

Plan, was accelerating the transformation of the Company. Accordingly, we worked toward market expansion and

stronger competitiveness to establish a platform for sustained earnings growth. Under the internal company system

introduced in April 1999, each internal company worked to improve its performance through measures such as

strengthening business development in overseas markets, reinforcing business tie-ups with other companies, and

boosting productivity both in and outside Japan. In addition, we invested in new and expanding business fields to

establish the foundation for Omron’s future growth. On the strength of these measures and a strong global economy

that continued through the first half of the period, we achieved record net income in the past fiscal year.