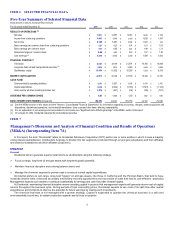

Occidental Petroleum 2006 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2006 Occidental Petroleum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Vinyls

The PVC industry realized record level pricing and margins for 2006. Ethylene cost increases of 9 percent were partially offset by lower natural

gas prices. Total PVC industry-wide demand in 2006 was 3 percent lower as compared with 2005. OxyChem operated its PVC facilities at an

average operating rate of 82 percent for 2006, compared to the North American industry average of 87 percent.

Industry Outlook

In 2006, Occidental's chemical business core earnings increased by 16 percent compared to 2005, primarily due to the continued strong

United States economy, higher sales volumes, largely due to the full year impact of the Vulcan operating assets, and improving margins.

Future performance will depend on global economic activity, the competitiveness of the United States in the world economy, feedstock and

energy pricing, and the impact of additional production capacity entering the market place.

Basic Chemicals

Forecasts of a slowing economy offset by a stabilizing residential construction market in 2007 are expected to result in demand levels similar to

average 2006 levels. Despite first quarter pressure on pricing from a weak vinyls market, margins in 2007 are expected to remain strong, but

could weaken in the fourth quarter due to the anticipated impact of capacity additions in late 2007.

Vinyls

Industry-wide PVC operating rates are expected to be lower in 2007 as a result of weak demand in the first quarter coupled with the start-up of

new capacity later in the year.

Lower cost Far East Asian PVC production has resulted in a significant increase in imports of PVC and finished goods into the Western

Hemisphere.

Corporate and Other includes the investments in Lyondell Chemical Company (Lyondell) and Premcor, Inc., (Premcor), a leased cogeneration

facility in Taft, Louisiana and a 1,300-mile oil pipeline and gathering system located in the Permian Basin, which is used in corporate-directed oil

and gas marketing and trading operations. It also includes a cogeneration facility at Ingleside, Texas, in which Occidental held a 50-percent

interest, and acquired the remaining 50-percent interest in October 2006. The Premcor investment was sold in 2005.

Since December 31, 2006, Occidental has resolved certain legal disputes that it expects will result in a gain of approximately $108 million in

the first quarter of 2007.

On August 1, 2006, Occidental effected a two-for-one stock split in the form of a stock dividend to shareholders of record as of that date with

distribution of the shares on August 15, 2006. All share and per share amounts discussed and disclosed in this Annual Report on Form 10-K reflect

the effect of the stock split.

Lyondell

In May 2006, Occidental lost significant influence over Lyondell and classified its Lyondell shares as an available-for-sale investment. In

October 2006, Occidental sold 10 million shares of Lyondell's common stock in a registered public offering for a pre-tax gain of $90 million and gross

proceeds of $250 million. At December 31, 2006, Occidental owned 20.3 million Lyondell shares of common stock (8-percent ownership), with a

carrying value of $519 million, and warrants to purchase an additional five million shares of Lyondell common stock. In February 2007, Occidental

exercised these warrants and received approximately 700,000 shares of Lyondell stock. Following this transaction, Occidental owned

approximately 21 million shares of Lyondell common stock.

Premcor

Valero Energy Corp.’s (Valero) acquisition of Premcor resulted in a $704 million pre-tax gain and the subsequent sale of all of the Valero shares

received resulted in an additional $22 million pre-tax gain in 2005.

The following discussion of Occidental’s two operating segments and corporate items should be read in conjunction with Note 15 to the

Consolidated Financial Statements.

Segment earnings generally exclude income taxes, interest income, interest expense, environmental remediation expenses, unallocated

corporate expenses, discontinued operations and the cumulative effect of changes in accounting principles, but include gains and losses from

dispositions of segment assets and results and other earnings from the segments' equity investments.

17