Occidental Petroleum 2006 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2006 Occidental Petroleum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

designed to lower manufacturing costs. Asset acquisitions may be pursued when they are expected to enhance the existing core chlor-alkali and

PVC businesses. Historically, the chemical segment has generated cash flow exceeding its normal capital expenditure requirements. Occidental

intends to invest this cash mainly in strategically attractive assets.

Oil and Gas

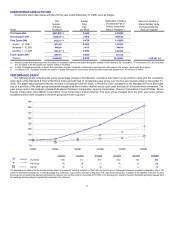

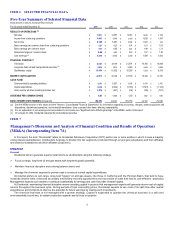

Segment Income

The oil and gas business seeks to add new oil and natural gas reserves at a pace ahead of production while keeping costs incurred for finding

and development among the lowest in the industry. The oil and gas business implements this strategy within the limits of the overall corporate

strategy primarily by:

ØContinuing to add commercial reserves through a combination of focused exploration and development programs conducted in and around

Occidental’s core areas, which are the United States, the Middle East/North Africa and Latin America;

ØPursuing commercial opportunities in core areas to enhance the development of mature fields with large volumes of remaining oil by applying

appropriate technology and advanced reservoir-management practices; and

ØMaintaining a disciplined approach in buying and selling assets at attractive prices.

Over the past several years, Occidental has strengthened its asset base within each of the core areas. Occidental has invested in, and

disposed of, assets with the goal of raising the average performance and potential of its assets. See "Oil and Gas Segment — Business Review"

for a discussion of these changes.

In addition, Occidental has continued to make capital contributions and investments in the Dolphin Project in Qatar and the UAE and in

Libya, and assumed operations in the Mukhaizna field in Oman for future growth opportunities, not for current production.

In 2006, Occidental acquired Vintage Petroleum, Inc. (Vintage) which it expects to provide growth in production, primarily from the Vintage

Argentina assets.

Occidental’s overall performance during the past several years reflects the successful implementation of its strategy to enhance the

development of mature fields, beginning with the acquisition of the Elk Hills oil and gas field in California, followed by a series of purchases in the

Permian Basin in west Texas and New Mexico and the integration of the Vintage and Plains Exploration and Production Company (Plains)

operations acquired in 2006.

At the end of 2006, the Elk Hills and Permian assets made up 64 percent of Occidental’s consolidated proven oil reserves and 43 percent of its

consolidated proven gas reserves. On a barrels of oil equivalent (BOE) basis, they accounted for 59 percent of Occidental’s consolidated reserves.

In 2006, the combined production from these assets averaged approximately 290,000 BOE per day.

Chemical

Segment Income

OxyChem’s strategy is to be a low-cost producer so that it can maximize its cash flow generation. OxyChem concentrates on the chlorovinyls

chain beginning with chlorine, which is coproduced with caustic soda, and then chlorine and ethylene are converted, through a series of

intermediate products, into polyvinyl chloride (PVC). OxyChem's focus on chlorovinyls permits it to take advantage of economies of scale.

Key Performance Indicators