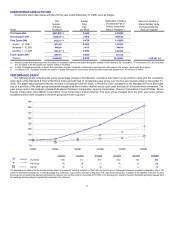

Occidental Petroleum 2006 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2006 Occidental Petroleum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In 2006, Occidental added reserves of 141 million BOE through improved recovery. In the United States, improved recovery additions were 43

million BOE in the Permian Basin and 28 million BOE in the Elk Hills field. Foreign additions included 23 million BOE in Argentina and 11

million BOE in Colombia. The Elk Hills operations employ infill drilling and both gas flood and water flood techniques. In the Permian Basin, the

increased reserves were primarily attributable to enhanced recovery techniques, such as drilling additional CO 2 flood and water flood wells.

Occidental obtains reserve additions from extensions and discoveries, which are dependent on successful exploitation programs. In 2006, as a

result of such programs, Occidental added reserves of 34 million BOE, consisting of 13 million BOE in the United States, 14 million BOE in the

Middle East/North Africa and 7 million BOE in Argentina. In western Colorado, Occidental added approximately 4 million BOE from the extension

of gas reserves, most of which will require additional development capital.

The success of improved recovery, extension and discovery projects depends on reservoir characteristics and technology improvements, as well

as oil and gas prices, capital costs and operating costs. Many of these factors are outside of management's control, and will affect whether or not

these historical sources of reserve additions continue at similar levels.

In 2006, Occidental purchased reserves of 326 million BOE, of which 143 million BOE were in the United States and 178 million BOE were in

Latin America. The Vintage acquisition added proved reserves of 160 million BOE in Argentina and 8 million BOE in Bolivia with the remainder in

the United States and Yemen, of which 66 percent were proved developed reserves. Occidental continues to add reserves through acquisitions

when properties are available at reasonable prices. Acquisitions are dependent on successful bidding and negotiating of oil and gas contracts at

attractive terms. As market conditions change, the available supply of properties may increase or decrease accordingly.

Proved Undeveloped Reserves

Occidental had proved undeveloped reserve additions of 207 million BOE resulting from improved recovery, extensions and discoveries and

purchases, primarily in Argentina, the Permian Basin and the Elk Hills field. Argentina provided 46 percent of this increase. These proved

undeveloped reserve additions were offset by reserve transfers of 275 million BOE to the proved developed category as a result of 2006

development programs. The Dolphin Project transferred 133 million BOE to the proved developed category during 2006. This transfer, along with

other revisions, reduced the Dolphin Project's proved undeveloped reserves to 132 million BOE at December 31, 2006 from 250 million BOE at

December 31, 2005. Overall, Occidental's proved undeveloped reserves decreased by 47 million BOE in 2006.

Industry Outlook

The petroleum industry is highly competitive and subject to significant volatility due to numerous market forces. Crude oil and natural gas

prices are affected by market fundamentals such as weather, inventory levels, competing fuel prices, overall demand and the availability of

supply.

Worldwide oil prices in 2006 remained at or near historical highs during the first three quarters of the year, but fell in the fourth quarter.

Continued economic growth, resulting in increased demand, and concerns about supply availability, could result in continued high prices. A lower

demand growth rate could result in lower crude oil prices.

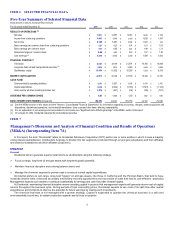

Oil prices have significantly affected profitability and returns for Occidental and other upstream producers. Oil prices cannot be predicted with

any certainty. The WTI price has averaged approximately $33 per barrel over the past ten years. However, the industry has historically

experienced wide fluctuations in prices. During 2006, Occidental experienced an increase in its price differential of the average WTI price over

Occidental's realized prices. See the "Oil and Gas Segment — Business Environment" section above for further information.

While local supply/demand fundamentals are a decisive factor affecting domestic natural gas prices over the long term, day-to-day prices may

be more volatile in the futures markets, such as on the NYMEX and other exchanges, making it difficult to forecast prices with any degree of

confidence. Over the last ten years, the NYMEX gas price has averaged approximately $4.60 per Mcf.

Business Environment

The chemical segment results improved in 2006 due to better margins despite higher feedstock costs. OxyChem also benefited from the mid-

year 2005 acquisition of two basic chemical manufacturing facilities from Vulcan Materials Company (Vulcan) and realized substantial synergies

and higher sales volumes.

Business Review

Basic Chemicals

During 2006, demand and pricing for basic chemical products generally remained strong while energy costs fell, which enabled OxyChem to

realize above average margins. OxyChem’s chlor-alkali operating rate for 2006 was 91 percent, just slightly above the industry average operating

rate of 90 percent. Industry demand for liquid caustic soda in 2006 was virtually flat compared to the prior year. Demand increased in the refining

industry but was offset by reduced demand primarily in the organics and inorganics chemical market segments. Industry pricing for caustic soda

started the year strong, but subsequently softened throughout the first three quarters of 2006. Caustic soda supply tightened in the fourth quarter

due to lower chlorine demand resulting from a weakening vinyls sector and lower imports of caustic soda. This led to caustic soda price stabilization

in the fourth quarter.

16