Occidental Petroleum 2006 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2006 Occidental Petroleum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

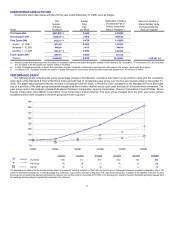

ITEM 6 SELECTED FINANCIAL DATA

Five-Year Summary of Selected Financial Data

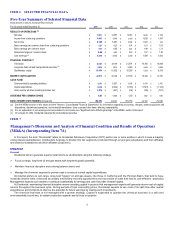

ITEM 7

Management’s Discussion and Analysis of Financial Condition and Results of Operations

(MD&A) (Incorporating Item 7A)

In this report, the term "Occidental" refers to Occidental Petroleum Corporation (OPC) and/or one or more entities in which it owns a majority

voting interest (subsidiaries). Occidental’s business is divided into two segments conducted through oil and gas subsidiaries and their affiliates

and chemical subsidiaries and their affiliates (OxyChem).

General

Occidental aims to generate superior total returns to stockholders using the following strategy:

ØFocus on large, long-lived oil and gas assets with long-term growth potential;

ØMaintain financial discipline and a strong balance sheet; and

ØManage the chemical segment to provide cash in excess of normal capital expenditures.

Occidental prefers to own large, long-lived "legacy" oil and gas assets, like those in California and the Permian Basin, that tend to have

moderate decline rates, enhanced secondary and tertiary recovery opportunities and economies of scale that lead to cost-effective production.

Management expects such assets to contribute substantially to earnings and cash flow after invested capital.

At Occidental, maintaining financial discipline means investing capital in projects that management expects will generate above-cost-of-capital

returns throughout the business cycle. During periods of high commodity prices, Occidental expects to use most of its cash flow after capital

expenditures and dividends to improve the potential for future earnings by making such investments.

The chemical business is not managed with a growth strategy. Capital is expended to operate the chemical business in a safe and

environmentally sound way, to sustain production capacity and to focus on projects

9