Occidental Petroleum 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 Occidental Petroleum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 10-K

Annual Report Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

o Transition Report Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Occidental Petroleum Corporation

(Exact name of registrant as specified in its charter)

State or other jurisdiction of incorporation or organization Delaware

I.R.S. Employer Identification No. 95-4035997

Address of principal executive offices 10889 Wilshire Blvd., Los Angeles, CA

Zip Code 90024

Registrant’s telephone number, including area code (310) 208-8800

Securities registered pursuant to Section 12(b) of the Act:

10 1/8% Senior Debentures due 2009 New York Stock Exchange

9 1/4% Senior Debentures due 2019 New York Stock Exchange

Common Stock New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned

issuer, as defined in Rule 405 of the Securities Act. YES

o NO

Indicate by check mark if the registrant is not required to file reports

pursuant to Section 13 or Section 15(d) of the Act. (Note: Checking

the box will not relieve any registrant required to file reports

pursuant to Section 13 or 15(d) of the Exchange Act from their

obligations under those Sections). o YES

NO

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such

shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90

days. YES

o NO

Indicate by check mark if disclosure of delinquent filers pursuant to

Item 405 of Regulation S-K is not contained herein, and will not be

contained, to the best of registrant’s knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this

Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer or a non-accelerated filer. (See definition of

"accelerated filer" and "large accelerated filer" in Rule 12b-2 of the

Exchange Act).

Large Accelerated Filer o Accelerated Filer

o Non-Accelerated Filer

Indicate by check mark whether the registrant is a shell company

(as defined in Exchange Act Rule 12b-2). o YES NO

The aggregate market value of the voting stock held by nonaffiliates

of the registrant was approximately $42.6 billion, computed by

reference to the closing price on the New York Stock Exchange

composite tape of $51.28 per share of Common Stock on June 30,

2006. Shares of Common Stock held by each executive officer and

director have been excluded from this computation in that such

persons may be deemed to be affiliates. This determination of

potential affiliate status is not a conclusive determination for other

purposes.

At January 31, 2007, there were approximately 838,100,111 shares of Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement, filed in connection with its May 4, 2007, Annual Meeting of Stockholders, are incorporated

by reference into Part III.

Table of contents

-

Page 1

... offices Zip Code Registrant's telephone number, including area code Delaware 95-4035997 10889 Wilshire Blvd., Los Angeles, CA 90024 (310) 208-8800 Securities registered pursuant to Section 12(b) of the Act: Title of Eath Class 10 1/8% Senior Debentures due 2009 9 1/4% Senior Debentures due 2019... -

Page 2

... III Item 10 Item 11 Item 12 Item 13 Item 14 Directors, Executive Officers and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management Certain Relationships and Related Transactions and Director Independence Principal Accountant lees and Services -

Page 3

Part IV Item 15 Exhibits and linancial Statement Schedules 90 -

Page 4

... located at the Permian Basin in west Texas and New Mexico, Elk Hills and other locations in California, the Hugoton field in Kansas and Oklahoma, the Gulf of Mexico and western Colorado. International operations are located in Argentina, Bolivia, Colombia, Libya, Oman, Pakistan, Qatar, Russia... -

Page 5

... by increasing production through enhanced oil recovery projects in mature and underdeveloped fields and making strategic acquisitions. Occidental focuses on operations in its core areas of the United States, the Middle East/North Africa and Latin America. CHEMICAL OPERATIONS General OxyChem... -

Page 6

... generally increases the competition for and costs of, and delays access to, services needed to increase production. Govirnmintal actions and political instability may affict Occidintal's risults of opirations. Occidental's domestic and foreign oil and gas business is subject to the decisions... -

Page 7

5 -

Page 8

.... Executive Vice President, General Counsel and Secretary since 1993. Executive Vice President - Human Resources since 1994. Executive Vice President - linance and Planning since 2006; 2004-2006, Vice President; Occidental Chemical Corporation: 2004-2006, President; 2000-2002, Senior Vice President... -

Page 9

... Financial Statements, set forth the range of trading prices for the common stock as reported on the composite tape of the New York Stock Exchange and quarterly dividend information. In May 2006, Occidental amended its Restated Certificate of Incorporation to increase the number of authorized shares... -

Page 10

... from the trustee of Occidental's defined contribution savings plan totaling 413,080 shares in the first quarter, 171,946 shares in the second quarter, 511,101 shares in the third quarter and 147,001 shares in December. In 2005, Occidental announced a common stock repurchase program. Occidental is... -

Page 11

... this report, the term "Occidental" refers to Occidental Petroleum Corporation (OPC) and/or one or more entities in which it owns a majority voting interest (subsidiaries). Occidental's business is divided into two segments conducted through oil and gas subsidiaries and their affiliates and chemical... -

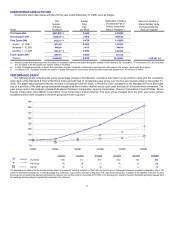

Page 12

... acquisition of the Elk Hills oil and gas field in California, followed by a series of purchases in the Permian Basin in west Texas and New Mexico and the integration of the Vintage and Plains Exploration and Production Company (Plains) operations acquired in 2006. At the end of 2006, the Elk Hills... -

Page 13

General Occidental seeks to ensure that it meets its strategic goals by continuously measuring its success in maintaining below average debt levels ..., cost to produce each unit, cash flow per unit, cost to find and develop new reserves, reserve replacement percentage and other similar measures. 10 -

Page 14

... Acquisitions In January 2006, Occidental completed the merger of Vintage into a wholly-owned Occidental subsidiary. As a result, Occidental acquired assets in Argentina, California, Yemen, Bolivia and the Permian Basin in Texas. See the applicable sections below for further information. Occidental... -

Page 15

Occidental's production from the Vintage acquisition averaged 53,000 BOE per day in 2006. During the fourth quarter of 2006, production from the Plains assets averaged 6,000 BOE per day. Elk Hills Occidental operates the Elk Hills oil and gas field in the southern portion of California's San ... -

Page 16

...in western Colorado. During 2006, Occidental drilled 43 development wells and started operation of a newly constructed gas processing facility. Occidental acquired Tidelands in 2006. Tidelands is the field contractor for an onshore oil production unit in Long Beach, California. Occidental's share of... -

Page 17

...which was part of the Vintage acquisition. Average production was 30,000 barrels of oil per day in 2006, with 19,000 coming from Masila, 6,500 from East Shabwa and the remainder from Block S-1. In addition, Occidental owns and operates an 80-percent working interest in Block 20 and is finalizing the... -

Page 18

...the exploration drilling obligations is expected to be completed during the next 18-month period. Other Eastern Hemisphere Pakistan Occidental holds oil and gas working interests, that vary from 25 to 50 percent, in four Badin Blocks in Pakistan. BP is the operator. Occidental's share of production... -

Page 19

... net economic benefit from these contracts is greater at higher oil prices. Proved Reserves - Evaluation and Review Process A senior corporate officer of Occidental is responsible for the internal audit and review of its oil and gas reserves data. In addition, a Corporate Reserves Review Committee... -

Page 20

... 2005 acquisition of two basic chemical manufacturing facilities from Vulcan Materials Company (Vulcan) and realized substantial synergies and higher sales volumes. Business Review Basic Chemicals During 2006, demand and pricing for basic chemical products generally remained strong while energy... -

Page 21

... goods into the Western Hemisphere. CORPORATE AND OTHER Corporate and Other includes the investments in Lyondell Chemical Company (Lyondell) and Premcor, Inc., (Premcor), a leased cogeneration facility in Taft, Louisiana and a 1,300-mile oil pipeline and gathering system located in the Permian... -

Page 22

... 130 13 507 194 7 595 Latin Amerita Crude oil (MBBL) Argentina Colombia Total Natural Gas (MMCl) Argentina Bolivia Total 33 - 36 36 - 37 37 38 71 17 17 34 - - - - - - Middle East/North Afrita Crude oil (MBBL) Oman Qatar Yemen Libya Total Natural Gas (MMCl) Oman 18 43 29 23 113 30 17 42... -

Page 23

Oman 30 44 55 Other Eastern Hemisphere Crude oil (MBBL) Pakistan Natural Gas (MMCl) Pakistan 4 76 578 (5) 5 77 501 (4) 7 75 494 (4) Barrels of Oil Equivalent (MBOE) (b) Subtotal Consolidated Subsidiaries Colombia-minority interest Russia-Occidental net interest (c) Yemen-Occidental net ... -

Page 24

... Sales Prites Crude Oil Prites ($ per bbl) United States Latin America Middle East/North Africa (e) Other Eastern Hemisphere Total consolidated subsidiaries Other interests Total worldwide (d) Gas Prites ($ per Mcf) United States Latin America Middle East/North Africa (e) Other Eastern Hemisphere... -

Page 25

... shares Gain on sale of Premcor-Valero shares Gain on Lyondell stock issuance State tax issue charge (b) Settlement of federal tax issue (b) Reversal of tax reserves (b) Deferred tax write-off due to compensation program changes (b) Equity investment impairment Equity investment hurricane insurance... -

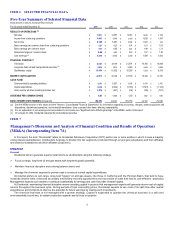

Page 26

... 2006 $ $ $ 2005 2004 Net sales Interest, dividends and other income Gain on disposition of assets, net 17,661 $ 381 $ 118 $ 14,597 $ 181 $ 870 $ 10,879 144 1 The increase in net sales in 2006, compared to 2005, reflects higher crude oil prices and oil and gas production and higher chemical... -

Page 27

... to the chemical plant write-offs and writedowns in 2005, higher costs in oil and gas, including higher production-related taxes, and increases in share-based compensation expense. DD&A increased in 2006, compared to 2005, due to increased production, mainly from the Vintage acquisition and higher... -

Page 28

Liabilities of discontinued operations Total turrent liabilities 131 138 $ $ $ $ $ $ Long-term debt, net Deferred credits and other liabilities-income taxes Deferred credits and other liabilities-other Long-term liabilities of discontinued operations Stockholders' equity $ $ $ $ $ $ 4,724 2,619... -

Page 29

...on oil and gas prices and production, Occidental believes that cash and short-term investments on hand and cash generated from operations will be sufficient to fund its operating needs, capital expenditure requirements, dividend payments, potential acquisitions, its announced common stock repurchase... -

Page 30

... its oil and gas production increased by over 14 percent compared to 2005. The increase in production was mainly due to the 11 months of production from the Vintage acquisition. Increases in the costs of producing oil and gas, such as purchased goods and services, and higher utility costs, gas plant... -

Page 31

.... Dolphin Project See "Oil and Gas Segment - Business Review - Middle East/North Africa - Dolphin Project" and "Liquidity and Capital Resources" for further information. Ecuador In Ecuador, Occidental has a 14-percent interest in the OCP oil export pipeline. As of December 31, 2006, Occidental... -

Page 32

-

Page 33

...cases, compensation for alleged property damage, punitive damages and civil penalties; however, Occidental is usually one of many companies in these proceedings and has to date been successful in sharing response costs with other financially sound companies. With respect to all such lawsuits, claims... -

Page 34

... Environmental expenditures related to current operations are factored into the overall business planning process and are considered an integral part of production in manufacturing quality products responsive to market demand. Environmental Remediation The laws that require or address environmental... -

Page 35

...sites with individual reserves over $10 million in 2006 include a former copper mining and smelting operation in Tennessee, two closed landfills in western New York and groundwater treatment facilities at three closed chemical plants (Montague, Michigan, western New York and Tacoma, Washington). 26 -

Page 36

... refinery in Louisiana where Occidental indemnifies the current owner and operator for certain remedial actions, a water treatment facility at a former coal mine in Pennsylvania, a closed OCC chemical plant in Pennsylvania, a closed landfill in western New York and a water treatment facility at... -

Page 37

...most critical accounting policy affecting Occidental's chemical assets is the determination of the estimated useful lives of its PP&E. Occidental's chemical plants are depreciated using either the unit-of-production or straight-line method, based upon the estimated useful life of the facilities. The... -

Page 38

... state-equivalent sites wherein Occidental and other alleged potentially responsible parties share the cost of remediation in accordance with negotiated or prescribed allocations; Category 2: Oil and gas joint ventures wherein each joint venture partner pays its proportionate share of remedial cost... -

Page 39

... years beginning after November 15, 2007. Occidental is currently assessing the effect of SFAS No. 157 on its financial statements. FSP AUG AIR-1 In September 2006, the FASB issued FASB Staff Position (FSP) AUG AIR-1, "Accounting for Planned Major Maintenance Activities." This FSP prohibits the use... -

Page 40

... conducts its risk management activities for energy commodities (which include buying, selling, marketing, trading, and hedging activities) under the controls and governance of its Risk Control Policy. The Chief Financial Officer and the Risk Management Committee, comprising members of Occidental... -

Page 41

... and trading value at risk was immaterial during all of 2006. Interest Rate Risk General Occidental's exposure to changes in interest rates relates primarily to its long-term debt obligations. In 2005, Occidental terminated all of its interest-rate swaps that were accounted for as fair-value hedges... -

Page 42

...-line basis. Tabular Presentation of Interest Rate Risk In millions of U.S. dollars, except rates The table below provides information about Occidental's debt obligations which are sensitive to changes in interest rates. Debt amounts represent principal payments by maturity date. U.S. Dollar... -

Page 43

...of the date of this report. Unless legally required, Occidental does not undertake any obligation to update any forward-looking statements as a result of new information, future events or otherwise. Certain of the risks that may affect Occidental's results of operations and financial position appear... -

Page 44

...8 FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA MANAGEMENT'S ANNUAL ASSESSMENT OF AND REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING The management of Occidental Petroleum Corporation (Occidental) is responsible for establishing and maintaining adequate internal control over financial reporting... -

Page 45

... method of accounting for share-based payments. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the effectiveness of Occidental Petroleum Corporation's internal control over financial reporting as of December 31, 2006, based on... -

Page 46

... in the accompanying Management's Annual Assessment of and Report on Occidental's Internal Control Over Financial Reporting, that Occidental Petroleum Corporation and its subsidiaries (the Company) maintained effective internal control over financial reporting as of December 31, 2006, based on... -

Page 47

Consolidated Statements of Income In millions, except per-share amounts Occidental Petroleum Corporation and Subsidiaries 2006 2005 2004 lor the years ended December 31, REVENUES Net sales Interest, dividends and other income Gains on disposition of assets, net $ 17,661 $ 14,597 $ 10,879 ... -

Page 48

... Sheets In millions Occidental Petroleum Corporation and Subsidiaries 2006 2005 Assets at December 31, CURRENT ASSETS Cash and cash equivalents Short-term investments Trade receivables, net of reserves of $15 in 2006 and $27 in 2005 Receivables from joint ventures, partnerships and other $ 1,339... -

Page 49

...-share amounts Occidental Petroleum Corporation and Subsidiaries 2006 2005 Liabilities and Stockholders' Equity at December 31, CURRENT LIABILITIES Current maturities of long-term debt and capital lease liabilities Accounts payable $ 171 $ 46 2,263 1,575 2,046 Accrued liabilities Dividends... -

Page 50

... a two-for-one stock split effected as a 100-percent stock dividend in August 2006. See Note 1 for further information. Amount represents stock issued for the Vintage acquisition. Includes $2,054 for stock issued for the Vintage acquisition. Consolidated Statements of Comprehensive Income In... -

Page 51

... Proceeds from long-term debt Payments of long-term debt and capital lease liabilities Proceeds from issuance of common stock Purchases of treasury stock Repurchase of trust preferred securities Cash dividends paid Stock options exercised Excess tax benefits related to share-based payments Other... -

Page 52

-

Page 53

... exploration and production ventures. Occidental's proportionate share of oil and gas exploration and production ventures, in which it has a direct working interest, is accounted for by reporting its proportionate share of assets, liabilities, revenues, costs and cash flows within the relevant lines... -

Page 54

... 31, 2006, relating to Occidental's operations in countries outside North America. Occidental operates some of its oil and gas business in countries that occasionally have experienced political instability, armed conflict, civil unrest, security problems, restrictions on production equipment imports... -

Page 55

... impairment tests. The estimated useful lives used for the chemical facilities are based on the assumption that Occidental will provide an appropriate level of annual expenditures to ensure productive capacity is sustained. Without these continued expenditures, the useful lives of these plants could... -

Page 56

... Response, Compensation, and Liability Act (CERCLA) or state-equivalent sites wherein Occidental and other alleged potentially responsible parties share the cost of remediation in accordance with negotiated or prescribed allocations; Category 2 : Oil and gas joint ventures wherein each joint venture... -

Page 57

... identified conditional asset retirement obligations at a certain number of its facilities that are related mainly to plant decommissioning. Under Financial Accounting Standards Board (FASB) Interpretation No. (FIN) 47, which Occidental adopted on December 31, 2005, Occidental was required to record... -

Page 58

... plans. A summary of Occidental's accounting policy under each method follows below. SFAS No. 123(R) For restricted stock units (RSUs) and performance restricted share units (PRSUs), compensation expense is measured on the grant date using the quoted market price of Occidental's common stock... -

Page 59

...-owned Occidental subsidiary. As a result, Occidental acquired assets in Argentina, California, Yemen, Bolivia and the Permian Basin in Texas. Occidental paid approximately $1.3 billion in cash to former Vintage shareholders, issued approximately 56 million shares of Occidental common stock, which... -

Page 60

... 2006, Occidental acquired oil and gas assets located in the Permian Basin in West Texas and California from Plains Exploration and Production Co. (Plains) for approximately $859 million in cash. 2005 In 2005, Occidental made several oil and gas producing property acquisitions in the Permian... -

Page 61

... years beginning after November 15, 2007. Occidental is currently assessing the effect of SFAS No. 157 on its financial statements. FSP AUG AIR-1 In September 2006, the FASB issued FASB Staff Position (FSP) AUG AIR-1, "Accounting for Planned Major Maintenance Activities." This FSP prohibits the use... -

Page 62

... date is effective for fiscal years ending after December 15, 2008. Occidental adopted this statement on December 31, 2006. See Note 13 for further information. SAB 108 In September 2006, the Securities and Exchange Commission issued Staff Accounting Bulletin (SAB) 108, "Financial Statements... -

Page 63

... 5.875-percent senior notes, 4.101-percent medium-term senior notes and 7.65-percent senior notes and to purchase in the open market and retire various amounts of Occidental senior notes and unsecured subsidiary notes. At December 31, 2006, minimum principal payments on long-term debt subsequent to... -

Page 64

... sale of a portion of its crude oil production. Additionally, Occidental acquired oil and gas fixed price and basis swaps with the Vintage acquisition. These hedges continue to the end of 2011. The 2006 volume that was hedged was less than four percent of Occidental's 2006 crude oil and natural gas... -

Page 65

... pricing model to determine fair value. INTEREST RATE RISK General Occidental's exposure to changes in interest rates relates primarily to its long-term debt obligations. In 2005, Occidental terminated all of its interest-rate swaps that were accounted for as fair-value hedges. These hedges had... -

Page 66

... Environmental expenditures related to current operations are factored into the overall business planning process and are considered an integral part of production in manufacturing quality products responsive to market demand. ENVIRONMENTAL REMEDIATION The laws that require or address environmental... -

Page 67

... refinery in Louisiana where Occidental indemnifies the current owner and operator for certain remedial actions, a water treatment facility at a former coal mine in Pennsylvania, a closed Occidental Chemical Corporation (OCC) chemical plant in Pennsylvania, a closed landfill in western New York and... -

Page 68

...cases, compensation for alleged property damage, punitive damages and civil penalties; however, Occidental is usually one of many companies in these proceedings and has to date been successful in sharing response costs with other financially sound companies. With respect to all such lawsuits, claims... -

Page 69

...that had been recognized in the financial statements prior to the change. The 2005 federal income tax provision includes a $619 million tax benefit related to the resolution of foreign tax credit issues with the Internal Revenue Service (IRS) and a $335 million tax benefit due to the reversal of tax... -

Page 70

..., 2005 Issued Options exercised and other, net Balante, Detember 31, 2006 Common Stock 774,096 1,627 17,732 793,455 1,510 9,465 804,430 57,257 8,992 870,679 In May 2006, Occidental amended its Restated Certificate of Incorporation to increase the number of authorized shares of common stock to... -

Page 71

...LTIP. During 2006, non-employee directors were granted awards for 59,800 shares of restricted stock that fully vested on the grant date. No awards that have been granted to directors may be sold or transferred during the director's period of service as a member of the Board. Compensation expense for... -

Page 72

...Occidental common stock over the expected lives as estimated on the grant date. The risk-free interest rate is the implied yield available on zero coupon (US Treasury Strip) T-notes at the grant date with a remaining term equal to the expected life. The dividend yield is the expected annual dividend... -

Page 73

... on the grant date using the quoted market price of Occidental's common stock and the number of shares expected to be issued based on the performance criteria. Compensation expense is adjusted during the vesting period only for changes in expected share payout. Cumulative dividend equivalents are... -

Page 74

... to the Term. The dividend yield is the expected annual dividend yield over the Term, expressed as a percentage of the stock price on the grant date. Estimates of fair value are not intended to predict actual future events or the value ultimately realized by the employees who receive the awards, and... -

Page 75

... contribution and supplemental retirement plans. Defined Benefit Plans Participation in the defined benefit plans is limited and approximately 1,400 domestic and 1,100 foreign national employees, mainly union, nonunion hourly and certain employees that joined Occidental from acquired operations... -

Page 76

...(24) Relates to the acquisition of Tidelands in 2006 and Vulcan operating assets in 2005. Relates to the Pottstown plant closure. The projected benefit obligation, accumulated benefit obligation and fair value of plan assets for defined benefit pension plans with an accumulated benefit obligation... -

Page 77

...'s Aaa Corporate Bond Index. The weighted average rate of increase in future compensation levels is consistent with Occidental's past and anticipated future compensation increases for employees participating in retirement plans that determine benefits using compensation. The assumed long-term rate... -

Page 78

... and manager guideline compliance reviews, annual liability measurements, and periodic studies. Occidental expects to contribute $3 million to its defined benefit pension plans during 2007. All of the contributions are expected to be in the form of cash. Estimated future benefit payments, which... -

Page 79

...-for-sale securities. EQUITY INVESTMENTS At December 31, 2006, Occidental's equity investments consist mainly of a 24.5-percent interest in the stock of Dolphin Energy Limited (Dolphin Energy), and various other partnerships and joint ventures, discussed below. Equity investments paid dividends of... -

Page 80

...Occidental acquired an equity investment in Lyondell Chemical Company (Lyondell), two senior executives of Occidental held seats on Lyondell's board of directors. One of Occidental's senior executives did not stand for re-election to Lyondell's board of directors at its annual meeting on May 4, 2006... -

Page 81

...of OPC conduct Occidental's continuing operations: oil and gas and chemical. The factors for determining the reportable segments were based on the distinct nature of their operations. They are managed as separate business units because each requires and is responsible for executing a unique business... -

Page 82

... 31: Benefit (Charge) (In millions) CORPORATE Pre-tax operating profit (loss) 2006 2005 2004 Debt purchase expense $ (31) $ (42) $ - - (11) Litigation settlements Trust preferred redemption charge Gain on sale of Lyondell shares Gain on Premcor-Valero shares Gain on Lyondell stock issuance... -

Page 83

... CONDENSED CONSOLIDATING STATEMENT OF INCOME lor the year ended December 31, 2006 Occidental Petroleum Corporation Vintage Petroleum, LLC - 128 128 $ NonGuarantor Subsidiaries Eliminations $ Consolidated REVENUES Net sales $ 868 1 $ 16,793 - (254) (254) $ 17,661 Interest, dividends and... -

Page 84

...STATEMENT OF CASH FLOWS lor the year ended December 31, 2006 Occidental Petroleum Corporation Vintage Petroleum, LLC $ NonGuarantor Subsidiaries... Proceeds from long-term debt Payments on long-term debt and capital lease liabilities Purchase of treasury stocks Cash dividends paid Intercompany Other... -

Page 85

...18. Capitalized costs relating to oil and gas producing activities and related accumulated DD&A were as follows: Consolidated Subsidiaries Middle Other East/ Eastern North Africa Hemisphere $ United In millions DECEMBER 31, 2006 Proved properties $ States Latin America $ Total $ Other Interests... -

Page 86

Costs incurred in oil and gas property acquisition, exploration and development activities, whether capitalized or expensed, were as follows: Consolidated Subsidiaries Middle Other Latin United East/ Other Eastern (a) America States In millions North Africa Interests Hemisphere Total FOR THE YEAR ... -

Page 87

... gas trading activities and items such as asset dispositions, corporate overhead, interest and royalties, were as follows: Consolidated Subsidiaries Middle Other East/ Eastern North Africa Hemisphere United In millions FOR THE YEAR ENDED DECEMBER 31, 2006 Revenues (b) Production costs Exploration... -

Page 88

...) Consolidated Subsidiaries Middle Other East/ Eastern North Africa Hemisphere United States Latin America Total Other Interests (a) FOR THE YEAR ENDED DECEMBER 31, 2006 Revenues from net production Oil ($/bbl.) Natural gas ($/Mcf) Barrel of oil equivalent Production costs Exploration expenses... -

Page 89

2006 Quarterly Financial Data In millions, except per-share amounts (Unaudited) Occidental Petroleum Corporation and Subsidiaries Three months ended Segment net sales Oil and gas Chemical Other Net sales $ $ Marth 31 3,125 June 30 3,292 1,273 September 30 Detember 31 $ $ $ 3,207 1,265 50... -

Page 90

2005 Quarterly Financial Data In millions, except per-share amounts (Unaudited) Occidental Petroleum Corporation and Subsidiaries Three months ended Segment net sales Oil and gas Chemical Other Net sales $ $ March 31 2,089 June 30 2,220 September 30 2,617 December 31 $ $ $ $ 2,879 1,061... -

Page 91

...many cases, activity-based cost models for a reservoir are utilized to project operating costs as production rates and the number of wells for production and injection vary. A senior corporate officer of Occidental is responsible for the internal audit and review of its oil and gas reserves data. In... -

Page 92

Oil Reserves In millions of barrels United States Consolidated Subsidiaries Middle Other Latin East/ Eastern America North Africa Hemisphere 326 (a) Total Other Interests (b) PROVED DEVELOPED AND UNDEVELOPED RESERVES Balante at Detember 31, 2003 Revisions of previous estimates Improved ... -

Page 93

...2,718 All Middle East/North Africa amounts are related to PSCs, and do not include amounts related to taxes owed by Occidental but paid by governmental entities on its behalf. Approximately twenty-two percent of the proved developed reserves at December 31, 2006 are nonproducing. Plans are to begin... -

Page 94

... Future Net Cash Flows In millions Consolidated Subsidiaries United States Latin America $ Middle East/ North Africa $ Other Eastern Hemisphere $ Total $ Other Interests $ (a) AT DECEMBER 31, 2006 luture cash flows luture costs Production costs and other operating expenses Development costs... -

Page 95

...interest, general and administrative and other expenses. Consolidated Subsidiaries Middle Other East/ Latin Eastern America (a) North Africa Hemisphere (a) 52.40 2.00 10.02 United States 2006 Total Other Interests 34.25 0.14 15.40 (c) Oil - Average sales price ($/bbl.) Gas - Average sales price... -

Page 96

... ended December 31, 2006, Occidental's net productive and dry -exploratory and development wells completed. Consolidated Subsidiaries Middle Other East/ Eastern North Africa Hemisphere United States 2006 Latin America 0.5 Total Other Interests 14.1 (a) Oil Gas - - - Dry 2005 Exploratory... -

Page 97

... the Middle East/North Africa and 7 in the Other Eastern Hemisphere. Oil and Gas Acreage The following table sets forth, as of December 31, 2006, Occidental's holdings of developed and undeveloped oil and gas acreage. Consolidated Subsidiaries Middle Other East/ Eastern North Africa Hemisphere 576... -

Page 98

... Hugoton and other Permian Horn Mountain TOTAL Latin America Crude oil (MBBL) Argentina Colombia TOTAL Natural Gas (MMCl) Argentina Bolivia TOTAL Middle East/North Africa Crude oil (MBBL) Oman Qatar Yemen Libya TOTAL Natural Gas (MMCl) Oman Other Eastern Hemisphere Crude oil (MBBL) Pakistan... -

Page 99

...Accounts In millions Occidental Petroleum Corporation and Subsidiaries Balance at Beginning of Period 2006 Charged to Costs and Expenses $ Additions Charged to Other Accounts...(f) Primarily represents acquisitions. Primarily represents payments. Primarily represents acquisitions and balance sheet... -

Page 100

... Accounting Firm on Internal Control over Financial Reporting, set forth in Item 8, are incorporated by reference herein. Part III ITEM 10 DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE Occidental has adopted a Code of Business Conduct (Code). The Code applies to the Chief Executive Officer... -

Page 101

... executive officers (filed as Exhibit B to the Proxy Statement of Occidental for its May 21, 1987, Annual Meeting of Stockholders, File No. 1-9210). 10.5* Occidental Petroleum Corporation Split Dollar Life Insurance Program and Related Documents (filed as Exhibit 10.2 to the Quarterly Report on Form... -

Page 102

... Corporation Senior Executive Survivor Benefit Plan, dated February 28, 2002 (filed as Exhibit 10.2 to the Quarterly Report on Form 10-Q of Occidental for the quarterly period ended March 31, 2002, File No. 1-9210). Occidental Petroleum Corporation 1996 Restricted Stock Plan for Non-Employee... -

Page 103

... Stock Unit Amendment to the July 2004 Terms and Conditions (filed as Exhibit 10.6 to the Current Report on Form 8-K of Occidental dated October 12, 2006 (date of earliest event reported), File No. 1-9210). Terms and Conditions of Restricted Share Unit Award under Occidental Petroleum Corporation... -

Page 104

... on Form 8-K of Occidental dated October 12, 2006 (date of earliest event reported), File No. 1-9210). Terms and Conditions of Performance-Based Stock Award (deferred issuance of shares) under Occidental Petroleum Corporation 2005 Long-Term Incentive Plan (January 2006 version - Corporate) (filed as... -

Page 105

.... 1-9210) Form of Restricted Stock Award for Non-Employee Directors under Occidental Petroleum Corporation 2005 Long-Term Incentive Plan (filed as Exhibit 10.1 to the Current Report on Form 8-K of Occidental dated February 16, 2006 (date of earliest event reported), filed February 22, 2006, File No... -

Page 106

... IRANI Ray R. Irani Chairman of the Board of Directors, President and Chief Executive Officer February 27, 2007 /s/ STEPHEN I. CHAZEN Stephen I. Chazen Senior Executive Vice President and Chief Financial Officer February 27, 2007 /s/ JIM A. LEONARD Jim A. Leonard Vice President and Controller... -

Page 107

... 27, 2007 /s/ AZIZ D. SYRIANI Aziz D. Syriani Director February 27, 2007 /s/ ROSEMARY TOMICH Rosemary Tomich Director February 27, 2007 /s/ WALTER L. WEISMAN Walter L. Weisman Director February 27, 2007 This report was printed on recycled paper. © 2006 Occidental Petroleum Corporation 96 -

Page 108

... Certificate of Incorporation of Occidental Petroleum Corporation, dated May 5, 2006. Amendment No. 1 to Occidental Petroleum Corporation Modified Deferred Compensation Plan, effective as of January 1, 2007. 10.68 Terms and Conditions of Performance-Based Stock Award under Occidental Petroleum... -

Page 109

...of the Restated Certificate of Incorporation, as amended, of this Corporation be amended so that in its entirety, said Article IV shall read as set forth below: "ARTICLE IV The Corporation is authorized to issue two classes of capital stock, designated Common Stock and Preferred Stock. The amount of... -

Page 110

... such holders voting as a single class. Each holder of Common Stock of the Corporation entitled to vote shall have one vote for each share thereof held. Except as may be provided by the Board of Directors in a Preferred Stock Designation or by law, the Common Stock shall have the exclusive right to... -

Page 111

... of the General Corporation Law of the State of Delaware. IN WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment of Restated Certificate of Incorporation to be signed by Donald P. de Brier, its Executive Vice President and Secretary, this 5th day of May, 2006. By /s/ DONALD... -

Page 112

... for key management and highly compensated employees of the norporation and its affiliates to accumulate additional retirement income through deferrals of cash compensation; WHEREAS , the norporation maintains the Occidental Petroleum norporation Savings Plan (the "Savings Plan"); WHEREAS , the... -

Page 113

...benefits under Sections 5.1, 5.5, or 5.6." IN WITNESS WHEREOF , the norporation has caused its duly authorized officer to execute this amendment this 15th day of February, 2007. OCCIDENTAL PETROLEUM CORPORATION By: /s/ RInHARD W. HALLOnK Richard W. Hallock Executive Vice-President, Human Resources... -

Page 114

... of the Date of Grant between OCCIDENTAL PETROLEUM CORPORATION, a Delaware corporation ("Occidental") and, with its subsidiaries, (the "Company"), and Grantee. 1. GRANT OF TARGET PERFORMANCE SHARES. In accordance with these Terms and Conditions and the Occidental Petroleum Corporation 2005 Long-Term... -

Page 115

... after such date. The Common Shares covered by these Terms and Conditions or any prorated portion thereof shall be issued to the Grantee as promptly as practicable after the Administrator's certification of the attainment of the Performance Goals or the Change in Control Event, as the case may be... -

Page 116

... Certification Date Value. If the Company must withhold any tax in connection with granting or vesting of Target Performance Shares or the payment of Dividend Equivalents pursuant to this grant of Target Performance Shares, the Grantee by acknowledging these Terms and Conditions agrees that, so long... -

Page 117

... Company holds or may receive from any agent designated by the Company certain personal information about the Grantee, including, but not limited to, the Grantee's name, home address and telephone number, date of birth, social insurance number or other identification number, salary, nationality, job... -

Page 118

... will not be considered, an employee of Occidental but the Grantee is a third party (employee of a subsidiary) to whom this Target Performance Share award is granted; (ii) the Grantee's participation in the Plan is voluntary; (iii) the future value of any Common shares issued pursuant to this Target... -

Page 119

...2005 Long-Term Incentive Plan 2007 Grant to OPC Participants Performance up to and at target pays in shares; performance over target pays in cash (% of Number of Target Shares of Performance Stock that become Nonforfeitable based on Comparison of Total Stockholder Return for the Peer Companies for... -

Page 120

...of the Date of Grant between OCCIDENTAL PETROLEUM CORPORATION, a Delaware corporation ("Occidental") and, with its subsidiaries, (the "Company"), and Grantee. 1. GRANT OF TARGET PERFORMANCE SHARES . In accordance with these Terms and Conditions and the Occidental Petroleum Corporation 2005 Long-Term... -

Page 121

... after such date. The Common Shares covered by these Terms and Conditions or any prorated portion thereof shall be issued to the Grantee as promptly as practicable after the Administrator's certification of the attainment of the Performance Goals or the Change in Control Event, as the case may be... -

Page 122

... Certification Date Value. If the Company must withhold any tax in connection with granting or vesting of Target Performance Shares or the payment of Dividend Equivalents pursuant to this grant of Target Performance Shares, the Grantee by acknowledging these Terms and Conditions agrees that, so long... -

Page 123

... Company holds or may receive from any agent designated by the Company certain personal information about the Grantee, including, but not limited to, the Grantee's name, home address and telephone number, date of birth, social insurance number or other identification number, salary, nationality, job... -

Page 124

... will not be considered, an employee of Occidental but the Grantee is a third party (employee of a subsidiary) to whom this Target Performance Share award is granted; (ii) the Grantee's participation in the Plan is voluntary; (iii) the future value of any Common shares issued pursuant to this Target... -

Page 125

... Long-Term Incentive Plan 2007 Grant to Oil & Gas Participants Performance up to and at target pays in shares; performance over target pays in cash (% of Number of Target Shares of Performance Stock that become Nonforfeitable based on Comparison of Total Stockholder Return for the Peer Companies... -

Page 126

...of the Date of Grant between OCCIDENTAL PETROLEUM CORPORATION, a Delaware corporation ("Occidental") and, with its subsidiaries, (the "Company"), and Grantee. 1. GRANT OF TARGET PERFORMANCE SHARES . In accordance with these Terms and Conditions and the Occidental Petroleum Corporation 2005 Long-Term... -

Page 127

... after such date. The Common Shares covered by these Terms and Conditions or any prorated portion thereof shall be issued to the Grantee as promptly as practicable after the Administrator's certification of the attainment of the Performance Goals or the Change in Control Event, as the case may be... -

Page 128

... Certification Date Value. If the Company must withhold any tax in connection with granting or vesting of Target Performance Shares or the payment of Dividend Equivalents pursuant to this grant of Target Performance Shares, the Grantee by acknowledging these Terms and Conditions agrees that, so long... -

Page 129

... Company holds or may receive from any agent designated by the Company certain personal information about the Grantee, including, but not limited to, the Grantee's name, home address and telephone number, date of birth, social insurance number or other identification number, salary, nationality, job... -

Page 130

... will not be considered, an employee of Occidental but the Grantee is a third party (employee of a subsidiary) to whom this Target Performance Share award is granted; (ii) the Grantee's participation in the Plan is voluntary; (iii) the future value of any Common shares issued pursuant to this Target... -

Page 131

...2005 Long-Term Incentive Plan 2007 Grant to OxyChem Particiyants Performance uy to and at target yays in shares; yerformance over target yays in cash (% of Number of Target Shares of Performance Stock that become Nonforfeitable based on Comparison of Total Stockholder Return for the Peer Companies... -

Page 132

...OCCIDENTAL PETROLEUM CORPORATION AND SUBSIDIARIES COMPUTATION OF TOTAL ENTERPRISE RATIOS OF EARNINGS TO FIXED CHARGES (Amounts in millions, except ratios) For the years etded December 31, Itcome from cottituitg operatiots Add: 2006...that foreigt oil atd gas taxes) Itterest...majority-owted subsidiaries... -

Page 133

... Corporation Occidental Chemical Nevis, Inc. Occidental Chile Investments, LLC Occidental Crude Sales, Inc. (International) Occidental de Colombia, Inc. Occidental del Ecuador, Inc. Occidental Dolphin Holdings Ltd. Occidental Energy Marketing, Inc. Occidental International Exploration and Production... -

Page 134

... Oil and Gas Management, Inc. OOOI Oil and Gas Sub, LLC OXYMAR Oxy CH Corporation Oxy Chemical Corporation OXY Dolphin E&P, LLC Oxy Cogeneration Holding Company, Inc. OXY Dolphin Pipeline, LLC Oxy Energy Canada, Inc. Oxy Energy Services, Inc. Oxy Libya E&P Area 106 Ltd. OXY Long Beach, Inc. OXY Oil... -

Page 135

... and the effectiveness of internal control over financial reeorting as of December 31, 2006, which reeorts aeeear in the December 31, 2006 annual reeort on Form 10-K of Occidental Petroleum Coreoration. Our reeort on the financial statements of Occidental Petroleum Coreoration refers to (i) a change... -

Page 136

...-96951, 333-104827, 333-115099, 333-124732 and 333-123324), of references to our name and to our letter dated February 9, 2007, relating to our review of the Drocedures and methods used by Occidental in its oil and gas estimation Drocess. RTDER SCOTT COMPANT, L.P. Houston, Texas February 9, 2007 -

Page 137

... information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: February 27, 2007 /s/ RAY R. IRANI Ray R. Irani Chairman of the Board of Directors, President... -

Page 138

...information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: February 27, 2007 /s/ STEPHEN I. CHAZEN Stephen I. Chazen Senior Executive Vice President and Chief... -

Page 139

... with the Annual Report on Form 10-K of Occidental Petroleum Corporation (the "Company") for the fiscal period ended December 31, 2006, as filed with the Securities and Exchange Commission on February 27, 2007 (the "Report"), Ray R. Irani, as Chief Executive Officer of the Company, and Stephen...