Navy Federal Credit Union 2009 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2009 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

!

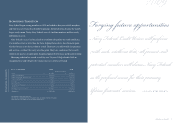

+".$ /$#",+2$+($+"$

•Opened 10 new branch offices,

most on or near military installations;

worldwide locations now exceed 180

•Provided the first ATM in the remote

desert location of Camp Lemonnier

in Djibouti, Africa

•Handled 17.2 million member calls,

1.2 million or almost 8% more than

in 2008, and further improved the

speed of calls answered

$3-.,#1"0/ +#

/-$"( ),%%$./

•Introduced the highly popular

cashRewards credit card that provides

cash back with every purchase,

no annual fee and no expiration

or limits on rewards

•Initiated three tiers on signature

loans, giving members more flexible

repayment terms

•Made limited-time certificate offers,

providing terms of 9 to 30 months

and annual percentage yields from

1.76% to 2.71%

$",&+(0(,+

•Once again rated Best in Class in the

latest American Customer Satisfaction

Index research. Overall satisfaction score

of 88 significantly surpassed others in

the banking industry

•Ranked #1 in Best Places to Work in

Hampton Roads by Inside Business

magazine

•Selected as one of Best Companies

to Work For by Florida Trend business

magazine

•Souda Bay branch in Crete, the only

U.S. financial institution in Greece,

named 2008 Department of the Navy

Credit Union of the Year

•Received LEED®(Leadership in Energy

and Environmental Design) Gold

certification for new Pensacola facilities

completed in 2009, in recognition of

green design and construction features

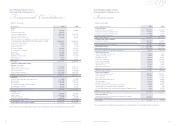

2009

$34.68

$36.40

$39.60

0

5

10

15

20

25

30

35

40

2007 2008 2009

3,004,352

3,408,432

3,194,292

0

500,000

1,000,000

1,500,000

2,000,000

2,500,000

3,000,000

3,500,000

2007 2008 2009

$31.4

$28.4

$31.2

$24.7

$28.2

$24.0

2008 2009

0

5

10

15

20

25

30

35

2007

Loans Savings

,0 )//$0/ ,0 ), +/ 2(+&/ $*!$./'(-

(Dollars in Billions) (Dollars in Billions)

Cutler Dawson

President & CEO

"#

John A. Lockard

Chairman

aimann he Psiden

We are pleased to report that 2009 was an excellent year for

Navy Federal. In an era when many financial institutions struggled, Navy Federal

thrived. Members of all ages and from all branches of service turned to their credit

union for help financing homes, buying cars, saving for retirement and for products

and services that make managing their finances easier and more convenient.

Over 214,000 new members joined Navy Federal in 2009, bringing total membership

to 3.4 million, a nearly 7% increase over the previous year. ey chose Navy Federal

because of the products we offer, the world-class service we provide and our reputation

for safety and soundness.

Members needing loans found credit readily available at Navy Federal. During a year

when many institutions were reluctant to lend, we originated $6.4 billion in mortgage

loans—the second best year on record—and surpassed our commitment of $6 billion.

We opened more than 116,000 new credit card accounts. Of those, our new cashRewards

card was a popular choice, with over 43,000 cards issued by year end. Total loans grew

by $188 million and ended the year at $31.4 billion.

2009 also saw members bolstering their efforts to save more. Deposits grew by almost

$4 billion, a 15% increase over 2008. Navy Federal’s checking accounts experienced

strong growth ending the year at 2.2 million accounts. is demonstrates the compet itive

strength of our checking accounts that earn dividends, provide access to over 40,000

free ATMs and many that feature ATM fee rebates.

Continuing to improve convenience for our members remains a top priority. In 2009,

we opened 10 new branch offices, developed a new mobile banking service and made

improvements to online Account Access, which saw enrolled subscribers increase by

13% to reach 2.7 million.

Navy Federal ended the year with assets of $39.6 billion, an increase of $3.2 billion.

Our success is measured by the service we provide and the trust our members have

in us. Looking ahead, we pledge to continue that tradition of service excellence and

unmatched trustworthiness. It has served our members well for over 76 years and

will continue to do so in the years ahead.

Report from the