Navy Federal Credit Union 2009 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2009 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

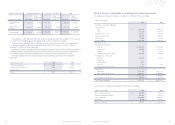

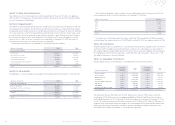

Navy Federal has obligations under a number of non-cancelable operating leases for premises. The future

minimum payments under the terms of the leases as of December 31, 2009 were:

Rent expense was $18.6 million and $18.2 million in 2009 and 2008, respectively. In 2009, Navy Federal

received income from sublease contracts of $75,000 while it received $73,000 from sublease contracts in 2008.

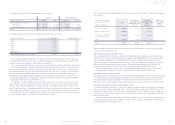

Note 10: Goodwill

Goodwill acquired in business combinations is tested for impairment quarterly in accordance with ASC 350-35,

Goodwill and Other Intangible Assets (formerly known as SFAS No. 142).Navy Federal uses the number of

new accounts opened at acquired office locations to estimate the fair value of the goodwill. The carrying value

of the goodwill was $14.9 million at December 31, 2009 and 2008, and is included in “Other assets” in the

Consolidated Statements of Financial Condition.

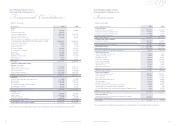

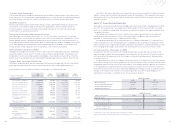

Note 11: Members’ Accounts

Member deposit accounts as of December 31, 2009 and 2008 were summarized as follows:

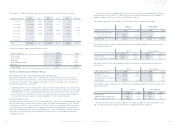

The Helping Families Save Their Homes Act of 2009, signed into law May 20, 2009, includes a provision

extending the $250,000 share insurance coverage provided by the National Credit Union Share Insurance

Fund through December 31, 2013. Previously, this level of coverage was set to expire on December 31, 2009.

As such, the total uninsured amount of members’ accounts was $1.6 billion and $1.3 billion at December 31,

2009 and 2008, respectively. Based on the original insurance coverage of $100,000 per non-IRA account and

$250,000 per IRA account, the amount of members’ accounts exceeding the original coverage limits was

$4.9 billion and $3.8 billion at December 31, 2009 and 2008, respectively.

17

2009 Financial Section

Note 7: Legal Contingencies

Navy Federal is a party to various legal actions normally associated with financial institutions, the aggregate

effect of which, in management’s and legal counsel’s opinion, would not be material to the financial condition

or results of operations of Navy Federal.

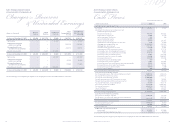

Note 8: Commitments

Navy Federal is a party to conditional commitments to lend funds in the normal course of business to meet the

financing needs of its members. Unused commitments for loans to members are amounts which Navy Federal

has agreed to lend a member as long as the member does not default on existing loans or violate any condition

of the loan agreement. Commitments generally have fixed expiration dates or other termination clauses. Since

many of the commitments are expected to expire without being drawn upon, the total commitment amounts

do not necessarily represent future cash requirements. Navy Federal uses the same credit policies in making

commitments as it does for all loans to members and, accordingly, at December 31, 2009, the credit risk

related to these commitments was similar to that on its existing loans.

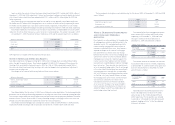

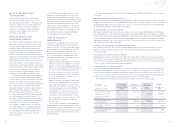

Unused commitment balances as of December 31, 2009 and 2008 were as follows:

Note 9: Fixed Assets

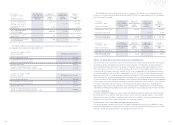

The following is a summary of property and equipment Navy Federal owned at December 31, 2009 and 2008:

Navy Federal Credit Union

16

(dollars in thousands) 2009 2008

Unused Commitments

Credit cards $ 5,707,412 $ 5,222,057

NAVchek lines of credit 577,302 564,354

Home equity lines of credit 1,113,517 1,247,390

Pre-approved auto loans 177,905 195,712

Utility deposit guarantee programs 3,281 3,146

Letter of credit 7,500 7,500

Total $ 7,586,917 $ 7,240,159

(dollars in thousands) 2009 2008

Property and Equipment

Land and buildings $ 607,387 $ 554,339

Equipment, furniture and fixtures 550,836 517,207

Leasehold improvements 107,850 107,200

Subtotal 1,266,073 1,178,746

Less: Accumulated depreciation (547,487) (472,319)

Total $ 718,586 $ 706,427

(dollars in thousands) Amount

2010 $ 14,945

2011 13,751

2012 11,695

2013 9,946

Thereafter 23,118

Total $ 73,455

2009

(dollars in thousands)

Weighted

Average Rate

for 2009

2009

Weighted

Average Rate

for 2008

2008

Money market 1.11% $ 5,179,419 2.32% $ 4,260,542

Share savings 0.44% 5,673,060 0.89% 4,826,346

Member escrow 0.23% 115,464 0.56% 109,582

Sharechek 0.26% 4,215,143 0.43% 3,579,195

Share and IRA certificates 3.61% 12,683,923 4.51% 11,470,990

IRA shares 0.56% 394,303 1.30% 364,409

IRA MMSA 0.94% 86,980 2.02% 52,422

Investor custodial accounts 0.00% 97,466 0.00% 62,029

Total deposits $ 28,445,758 $ 24,725,515