Navy Federal Credit Union 2009 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2009 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

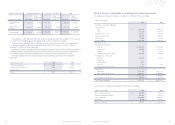

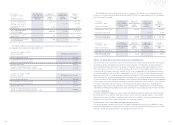

The table below presents the balance sheet items measured at fair value on a non-recurring basis when

certain assets are measured at the lower of cost or market (LOCOM) that were recognized at fair value below

cost at the end of the period.

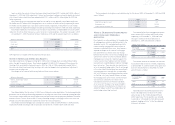

Note 16: Fair Values of Financial Instruments

ASC 825-10, Disclosures about Fair Value of Financial Instruments (formerly known as SFAS No. 107), requires

the disclosure of the estimated fair value of the financial instruments, including those financial instruments

Navy Federal did not elect to fair value. The financial instruments that are accounted for under ASC 820-10

(formerly known as SFAS No. 157) are disclosed separately in Note 15. Navy Federal discloses fair value

information for its financial instruments, whether the fair value is recognized in the Consolidated Statements

of Financial Condition or not, for which it is practicable to estimate that value. In cases where quoted market

prices are not available, fair values are based on estimates using present value or other valuation techniques.

Those techniques are significantly affected by the assumptions used, including the discount rate and estimates

of future cash flows. In that regard, the derived fair value cannot be substantiated by comparison to independent

markets and, in many cases, could not be realized in immediate settlement of the instrument. Certain financial

instruments and all non-financial instruments are excluded from disclosure requirements. Accordingly, the

aggregate fair value amounts presented do not necessarily represent the underlying fair value of Navy Federal.

The following methods and assumptions were used in estimating the fair value disclosures for financial instruments:

Loans to Members

For certain residential mortgages, fair value is estimated using the quoted market prices for securities backed

by similar loans. The fair value of other types of loans, such as consumer and equity loans, is estimated by

discounting the future cash flows using the current market rates at which similar loans would be made to

borrowers with similar credit ratings and for the same remaining maturities.

Investments, including Mortgage-Backed Securities

Fair value is based on a quoted market price, if available. If a quoted market price is not available, fair value is

estimated using quoted market prices for similar securities. For resale and repurchase agreements, due to their

short-term nature, the carrying amount is a reasonable estimate of fair value.

25

2009 Financial Section

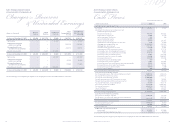

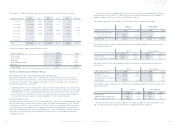

The following table summarizes the changes in fair value for items measured at fair value (Level 3) on a

recurring basis using significant unobservable inputs:

Navy Federal Credit Union

24

Fair Value at December 31, 2009

(dollars in thousands) Mortgage servicing assets

Balance, beginning of year $ 131,194

Net gains/(losses) included in earnings (14,540)

Purchases, issuances and settlements 52,045

Balance, end of year $ 168,699

Change in unrealized gains/(losses) related to

financial instruments still held at December 31, 2009 $ 17,545

Fair Value at December 31, 2008

(dollars in thousands) Mortgage servicing assets

Balance, beginning of year $ 169,306

Net gains/(losses) included in earnings (66,323)

Purchases, issuances and settlements 28,211

Balance, end of year $ 131,194

Change in unrealized gains/(losses) related to

financial instruments still held at December 31, 2008 $ (53,094)

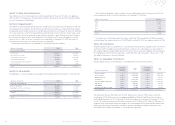

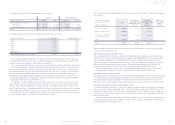

Fair Value at

December 31, 2008

(dollars in thousands)

Quoted prices

in Active Markets

for Identical Assets

(Level 1)

Significant

Other Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Balance

as of

December 31,

2008

Securities available-for-sale $—$ 2,631,256 $—$ 2,631,256

Mortgage servicing rights — — 131,194 131,194

Other assets—Derivative

commitments — 5,380 — 5,380

Total assets at fair value

on a recurring basis —2,636,636 131,194 2,767,830

Other liabilities—Derivative

commitments — 445 — 445

Total liabilities at fair value

on a recurring basis $—$ 445 $—$ 445

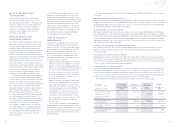

Fair Value at

December 31, 2009

(dollars in thousands)

Quoted prices

in Active Markets

for Identical Assets

(Level 1)

Significant

Other Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Balance

as of

December 31,

2009

Mortgage loans awaiting sale $—$ 264,625 $—$ 264,625

Other Real Estate Owned — — 17,793 17,793

Total assets at fair value

on a non-recurring basis $—$ 264,625 $ 17,793 $ 282,418

Fair Value at

December 31, 2008

(dollars in thousands)

Quoted prices

in Active Markets

for Identical Assets

(Level 1)

Significant

Other Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Balance

as of

December 31,

2008

Mortgage loans awaiting sale $—$ 68,731 $—$ 68,731

Total assets at fair value

on a non-recurring basis $—$ 68,731 $—$ 68,731

2009