Navy Federal Credit Union 2009 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2009 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

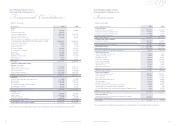

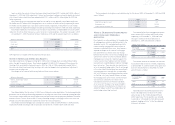

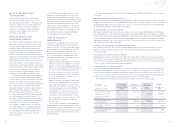

(dollars in thousands)

2009 2008

Consumer loans and credit cards

Consumer loans

Auto $ 5,596,484 $ 5,975,114

Other 2,213,193 2,110,468

NAVchek®lines of credit 265,526 264,724

Federal education loans 494,310 386,201

Vehicle leases 46,260 82,890

Credit card loans 4,617,978 4,159,310

Mortgage loans

Mortgage loan investments

Fixed rate 12,881,374 12,165,405

Variable rate 304,934 341,111

In process 599 2,779

Unamortized deferred income (76,230) (63,408)

Mortgage loans awaiting sale

Fixed rate 264,859 65,200

Variable rate ——

Unrealized losses (497) —

In process 1,371 1,323

Unamortized deferred income (1,532) (1)

Equity loans

Fixed equity 3,711,332 4,611,111

Home equity lines of credit 1,033,131 1,062,627

31,353,092 31,164,854

Less: Allowance for loan losses 588,278 512,479

Total loans to members $ 30,764,814 $ 30,652,375

Navy Federal Credit Union

12 13

2009 Financial Section

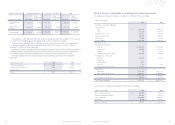

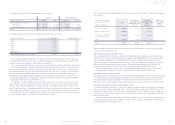

At December 31, 2009 and 2008, there was no decline considered “other-than-temporary” in the value of

U.S. Government and federal agency mortgage-backed securities owned by Navy Federal.

Other investments represent capital required to maintain partnerships with credit union organizations.

Investments pledged as collateral for borrowed funds were $357.6 million and $359.2 million at

December 31, 2009 and 2008, respectively.

Navy Federal’s certificates of deposits and share deposits in corporate credit unions are fully insured. However,

membership capital in the corporate credit unions is not insured and the value of the shares associated with

the membership capital declined, therefore the shares were permanently impaired by $20.5 million.

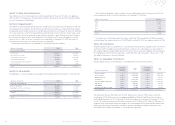

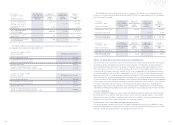

The following table shows Navy Federal’s deposits and membership capital shares in the corporate

credit unions:

(dollars in thousands) 2009 2008

Certificates of deposit $ 3,000 $ 2,000

Membership, capital shares 7,816 28,286

Share deposits —1

Total $ 10,816 $ 30,287

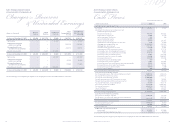

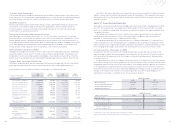

(dollars in thousands) 2009 2008

Balance, beginning of year $ 512,479 $ 256,277

Provision charged to operations 662,853 654,822

Loans charged off (623,488) (442,011)

Recoveries 36,434 43,391

Balance, end of year $ 588,278 $ 512,479

A summary of the changes in the allowance for loan losses is as follows:

Note 4: Loans to Members and Allowance for Loan Losses

The composition of loans to members at December 31, 2009 and 2008 was as follows:

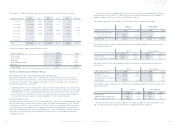

2009

(dollars in thousands) Less than 12 months 12 months or longer Total

December 31, 2009 Fair value

Gross

Unrealized

Losses Fair value

Gross

Unrealized

Losses Fair value

Gross

Unrealized

Losses

Available-for-sale

securities $ 253,278 $ (2,710) $ 837,190 $ (7,341) $1,090,468 $ (10,051)

Held-to-maturity

securities 528,144 (4,018) 125,710 (980) 653,854 (4,998)

Total securities $ 781,422 $ (6,728) $ 962,900 $ (8,321) $ 1,744,322 $ (15,049)