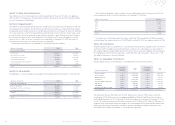

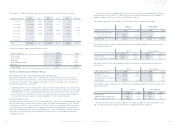

Navy Federal Credit Union 2009 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2009 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Ca Fos

Navy Federal Credit Union

4 5

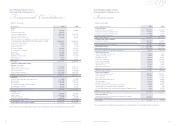

2009 Financial Section

2009

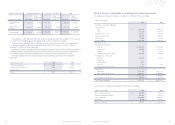

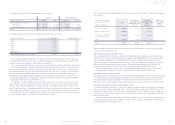

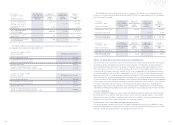

(dollars in thousands) Regular

Reserve

Capital

Reserve

Undivided

Earnings

Other

Comprehensive

Income

Total Reserves

and Undivided

Earnings

Balance at December 31, 2007 $ 349,808 $ 3,011,154 $ 50,000 $ (104,739) $ 3,306,223

Net income ——81,633 — 81,633

Adjustments related to

pension accounting ——— (198,289) (198,289)

Net unrealized loss on

available-for-sale securities ——— (48,537) (48,537)

Discretionary transfer — 81,633 (81,633) — —

Balance at December 31, 2008 $ 349,808 $ 3,092,787 $ 50,000 $ (351,565) $ 3,141,030

Net income ——245,483 — 245,483

Adjustments related to

pension accounting ———62,560 62,560

Net unrealized gain on

available-for-sale securities ———119,066 119,066

Discretionary transfer — 245,483 (245,483) — —

Balance at December 31, 2009 $ 349,808 $ 3,338,270 $ 50,000 $ (169,939) $ 3,568,139

Navy Federal Credit Union

Consolidated Statements of

Navy Federal Credit Union

Consolidated Statements of

The accompanying notes (beginning on page 6) are an integral part of these consolidated financial statements.

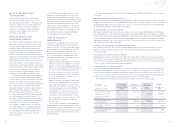

The accompanying notes (beginning on page 6) are an integral part of these consolidated financial statements.

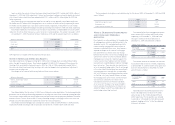

(dollars in thousands) 2009 2008

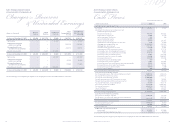

Cash flows from operating activities

Net income $ 245,483 $ 81,633

Adjustments to reconcile net income to net cash

provided by operating activities:

Provision for loan losses 662,853 654,822

Depreciation of fixed assets 87,040 77,185

Loss on disposal of fixed assets 566 566

Loss on membership capital 20,470 —

Gain on sale of investments (6,809) (20,797)

Amortization of loan origination fees and costs 7,290 21,956

Mortgage loans originated for sale (2,132,866) (145,203)

Mortgage loan sales proceeds 1,933,159 162,827

Accretion of AFS investment securities (9,599) (1,443)

Amortization of HTM investment securities 370 (11,112)

(Increase)/decrease in mortgage servicing assets (37,505) 60,612

(Increase)/decrease in accrued interest receivable (11,877) 4,951

Decrease/(increase) in prepaid expenses 52,037 (119,728)

Decrease/(increase) in accounts receivable 123,450 (206,047)

(Increase) in other assets (47,650) (10,720)

(Decrease)/increase in dividends payable (44) 47

Increase/(decrease) in drafts payable 6,563 (22,944)

Increase/(decrease) in accrued expenses and accounts payable 16,619 (30,093)

(Decrease)/increase in accrued interest payable (3,813) 10,142

(Decrease)/increase in deferred income (2,942) 5,590

Increase in other liabilities 929 48,990

Net cash provided by operating activities 903,724 561,234

Cash flows from investing activities

Net (increase)/decrease in short-term and other investments (500,965) 2,868,213

Purchase of AFS investment securities (2,226,640) (2,143,121)

Purchase of HTM investment securities (1,584,904) —

Proceeds from maturity of AFS investment securities 1,141,126 156,205

Proceeds from maturity of HTM investment securities 76,899 596,724

Purchase of FHLB Stock, net of redemptions (3,206) (152,117)

Net increase in loans to members (578,828) (5,039,421)

Purchase of fixed assets (413,679) (448,557)

Sale of fixed assets 313,914 203,355

Increase in deposit to NCUSIF (61,123) (11,847)

Net cash used in investing activities (3,837,406) (3,970,566)

Cash flows from financing activities

Net increase in members’ accounts 3,720,243 747,875

Net decrease in securities sold under repurchase agreements —(443,870)

Net (decrease)/increase in notes payable (965,987) 3,193,782

Net cash provided by financing activities 2,754,256 3,497,787

Net (decrease)/increase in cash (179,426) 88,455

Cash at beginning of year 534,400 445,945

Cash at end of year $ 354,974 $ 534,400

Additional cash flow information:

Interest paid $ 873,754 $ 974,098

Transfers from loans to other real estate 35,875 40,414

Years Ended December 31

anges Reserves

&Univided Eanings